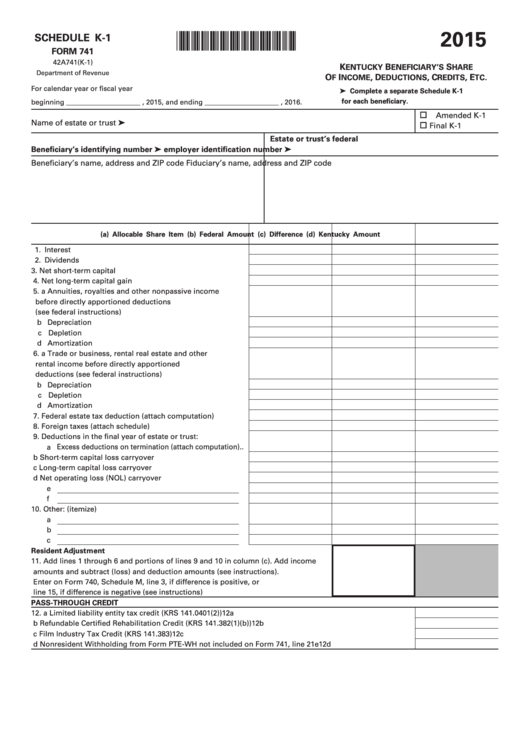

Schedule K-1 (Form 741) - Kentucky Beneficiary'S Share Of Income, Deductions, Credits, Etc. - 2015

ADVERTISEMENT

2015

*1500010033*

SCHEDULE K-1

FORM 741

42A741(K-1)

K

B

S

ENTUCKY

ENEFICIARY’S

HARE

Department of Revenue

O

I

, D

, C

, E

.

F

NCOME

EDUCTIONS

REDITS

TC

For calendar year or fiscal year

➤ Complete a separate Schedule K-1

for each beneficiary.

beginning _____________________ , 2015, and ending _____________________ , 2016.

Amended K-1

Name of estate or trust ➤

Final K-1

Estate or trust’s federal

Beneficiary’s identifying number ➤

employer identification number ➤

Beneficiary’s name, address and ZIP code

Fiduciary’s name, address and ZIP code

(a) Allocable Share Item

(b) Federal Amount

(c) Difference

(d) Kentucky Amount

1. Interest ...................................................................................

2. Dividends ...............................................................................

3. Net short-term capital gain...................................................

4. Net long-term capital gain ....................................................

5. a Annuities, royalties and other nonpassive income

before directly apportioned deductions

(see federal instructions) .................................................

b Depreciation .....................................................................

c Depletion ..........................................................................

d Amortization .....................................................................

6. a Trade or business, rental real estate and other

rental income before directly apportioned

deductions (see federal instructions) .............................

b Depreciation .....................................................................

c Depletion ..........................................................................

d Amortization .....................................................................

7. Federal estate tax deduction (attach computation) ............

8. Foreign taxes (attach schedule) ...........................................

9. Deductions in the final year of estate or trust:

a Excess deductions on termination (attach computation) ..

b Short-term capital loss carryover ...................................

c Long-term capital loss carryover ....................................

d Net operating loss (NOL) carryover ................................

e

f

10. Other: (itemize)

a

b

c

Resident Adjustment

11. Add lines 1 through 6 and portions of lines 9 and 10 in column (c). Add income

amounts and subtract (loss) and deduction amounts (see instructions).

Enter on Form 740, Schedule M, line 3, if difference is positive, or

line 15, if difference is negative (see instructions) .....................................................

PASS-THROUGH CREDIT

12. a Limited liability entity tax credit (KRS 141.0401(2)) .................................................................................. 12a

b Refundable Certified Rehabilitation Credit (KRS 141.382(1)(b)) ..............................................................12b

c Film Industry Tax Credit (KRS 141.383) ...................................................................................................... 12c

d Nonresident Withholding from Form PTE-WH not included on Form 741, line 21e ..............................12d

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2