Schedule K-1 (Forms Clt-4s And Pr-1) - Partner'S/shareholder'S Share Of Income (Loss), Deductions, Credits, Etc. - 2009

ADVERTISEMENT

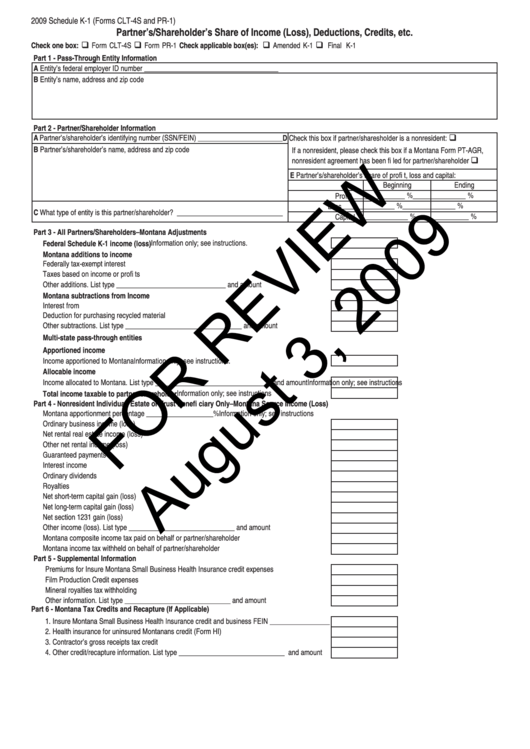

2009 Schedule K-1 (Forms CLT-4S and PR-1)

Partner’s/Shareholder’s Share of Income (Loss), Deductions, Credits, etc.

Check one box:

Form CLT-4S

Form PR-1

Check applicable box(es):

Amended K-1

Final K-1

Part 1 - Pass-Through Entity Information

A Entity’s federal employer ID number ______________________________________

B Entity’s name, address and zip code

Part 2 - Partner/Shareholder Information

A Partner’s/shareholder’s identifying number (SSN/FEIN) ________________________

D Check this box if partner/sharesholder is a nonresident:

B Partner’s/shareholder’s name, address and zip code

If a nonresident, please check this box if a Montana Form PT-AGR,

nonresident agreement has been fi led for partner/shareholder

E Partner’s/shareholder’s share of profi t, loss and capital:

Beginning

Ending

_______________ % _______________ %

Profi t

_______________ % _______________ %

Loss

C What type of entity is this partner/shareholder? ______________________________

_______________ % _______________ %

Capital

Part 3 - All Partners/Shareholders–Montana Adjustments

Information only; see instructions.

Federal Schedule K-1 income (loss)

Montana additions to income

Federally tax-exempt interest

Taxes based on income or profi ts

Other additions. List type _______________________________ and amount

Montana subtractions from Income

Interest from U.S. Treasury obligations

Deduction for purchasing recycled material

Other subtractions. List type _________________________________ and amount

Multi-state pass-through entities

Apportioned income

Income apportioned to Montana

Information only; see instructions.

Allocable income

Income allocated to Montana. List type _________________________________ and amount

Information only; see instructions

Information only; see instructions

Total income taxable to partner/shareholder

Part 4 - Nonresident Individual, Estate or Trust Benefi ciary Only–Montana Source Income (Loss)

Montana apportionment percentage ___________________ %

Information only; see instructions

Ordinary business income (loss)

Net rental real estate income (loss)

Other net rental income (loss)

Guaranteed payments

Interest income

Ordinary dividends

Royalties

Net short-term capital gain (loss)

Net long-term capital gain (loss)

Net section 1231 gain (loss)

Other income (loss). List type ______________________________ and amount

Montana composite income tax paid on behalf or partner/shareholder

Montana income tax withheld on behalf of partner/shareholder

Part 5 - Supplemental Information

Premiums for Insure Montana Small Business Health Insurance credit expenses

Film Production Credit expenses

Mineral royalties tax withholding

Other information. List type ______________________________ and amount

Part 6 - Montana Tax Credits and Recapture (If Applicable)

1. Insure Montana Small Business Health Insurance credit and business FEIN _________________

2. Health insurance for uninsured Montanans credit (Form HI)

3. Contractor’s gross receipts tax credit

4. Other credit/recapture information. List type ______________________________ and amount

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1