Instructions For Form 80-170 Mississippi Amended Individual Income Tax Return

ADVERTISEMENT

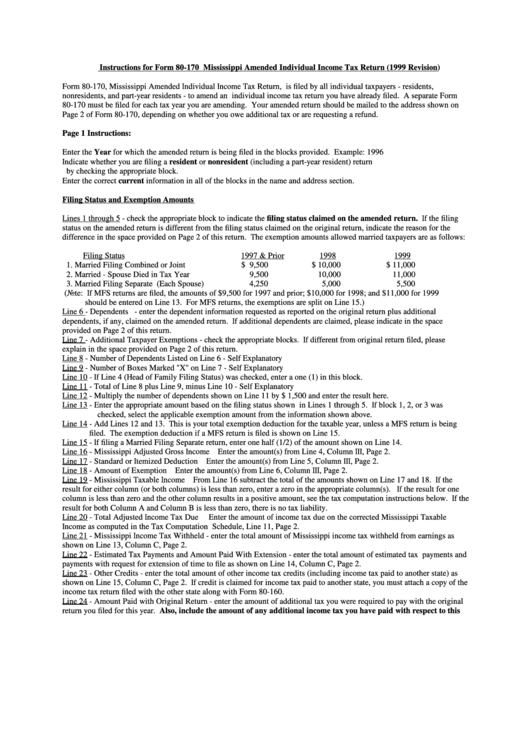

Instructions for Form 80-170 Mississippi Amended Individual Income Tax Return (1999 Revision)

Form 80-170, Mississippi Amended Individual Income Tax Return, is filed by all individual taxpayers - residents,

nonresidents, and part-year residents - to amend an individual income tax return you have already filed. A separate Form

80-170 must be filed for each tax year you are amending. Your amended return should be mailed to the address shown on

Page 2 of Form 80-170, depending on whether you owe additional tax or are requesting a refund.

Page 1 Instructions:

Enter the Year for which the amended return is being filed in the blocks provided. Example: 1996

Indicate whether you are filing a resident or nonresident (including a part-year resident) return

by checking the appropriate block.

Enter the correct current information in all of the blocks in the name and address section.

Filing Status and Exemption Amounts

Lines 1 through 5 - check the appropriate block to indicate the filing status claimed on the amended return. If the filing

status on the amended return is different from the filing status claimed on the original return, indicate the reason for the

difference in the space provided on Page 2 of this return. The exemption amounts allowed married taxpayers are as follows:

Filing Status

1997 & Prior

1998

1999

1. Married Filing Combined or Joint

$ 9,500

$ 10,000

$ 11,000

2. Married - Spouse Died in Tax Year

9,500

10,000

11,000

3. Married Filing Separate (Each Spouse)

4,250

5,000

5,500

(Note: If MFS returns are filed, the amounts of $9,500 for 1997 and prior; $10,000 for 1998; and $11,000 for 1999

should be entered on Line 13. For MFS returns, the exemptions are split on Line 15.)

Line 6 - Dependents - enter the dependent information requested as reported on the original return plus additional

dependents, if any, claimed on the amended return. If additional dependents are claimed, please indicate in the space

provided on Page 2 of this return.

Line 7 - Additional Taxpayer Exemptions - check the appropriate blocks. If different from original return filed, please

explain in the space provided on Page 2 of this return.

Line 8 - Number of Dependents Listed on Line 6 - Self Explanatory

Line 9 - Number of Boxes Marked "X" on Line 7 - Self Explanatory

Line 10 - If Line 4 (Head of Family Filing Status) was checked, enter a one (1) in this block.

Line 11 - Total of Line 8 plus Line 9, minus Line 10 - Self Explanatory

Line 12 - Multiply the number of dependents shown on Line 11 by $ 1,500 and enter the result here.

Line 13 - Enter the appropriate amount based on the filing status shown in Lines 1 through 5. If block 1, 2, or 3 was

checked, select the applicable exemption amount from the information shown above.

Line 14 - Add Lines 12 and 13. This is your total exemption deduction for the taxable year, unless a MFS return is being

filed. The exemption deduction if a MFS return is filed is shown on Line 15.

Line 15 - If filing a Married Filing Separate return, enter one half (1/2) of the amount shown on Line 14.

Line 16 - Mississippi Adjusted Gross Income Enter the amount(s) from Line 4, Column III, Page 2.

Line 17 - Standard or Itemized Deduction Enter the amount(s) from Line 5, Column III, Page 2.

Line 18 - Amount of Exemption Enter the amount(s) from Line 6, Column III, Page 2.

Line 19 - Mississippi Taxable Income From Line 16 subtract the total of the amounts shown on Line 17 and 18. If the

result for either column (or both columns) is less than zero, enter a zero in the appropriate column(s). If the result for one

column is less than zero and the other column results in a positive amount, see the tax computation instructions below. If the

result for both Column A and Column B is less than zero, there is no tax liability.

Line 20 - Total Adjusted Income Tax Due

Enter the amount of income tax due on the corrected Mississippi Taxable

Income as computed in the Tax Computation Schedule, Line 11, Page 2.

Line 21 - Mississippi Income Tax Withheld - enter the total amount of Mississippi income tax withheld from earnings as

shown on Line 13, Column C, Page 2.

Line 22 - Estimated Tax Payments and Amount Paid With Extension - enter the total amount of estimated tax payments and

payments with request for extension of time to file as shown on Line 14, Column C, Page 2.

Line 23 - Other Credits - enter the total amount of other income tax credits (including income tax paid to another state) as

shown on Line 15, Column C, Page 2. If credit is claimed for income tax paid to another state, you must attach a copy of the

income tax return filed with the other state along with Form 80-160.

Line 24 - Amount Paid with Original Return - enter the amount of additional tax you were required to pay with the original

return you filed for this year. Also, include the amount of any additional income tax you have paid with respect to this

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3