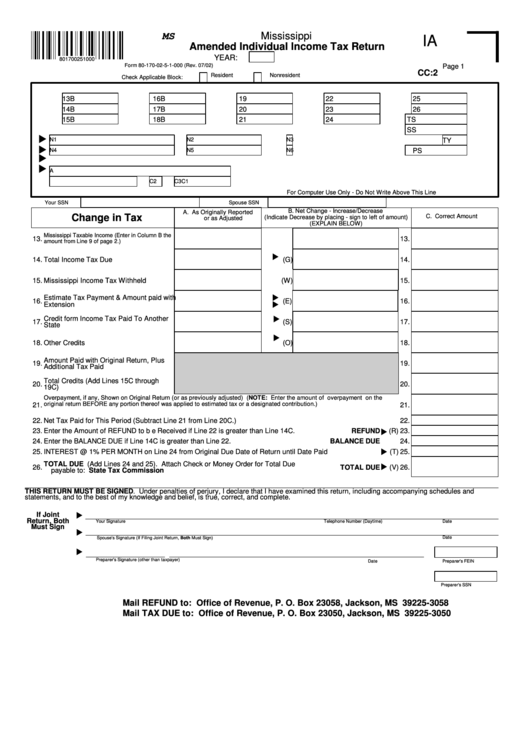

Mississippi Amended Individual Income Tax Return

ADVERTISEMENT

Mississippi

MS

IA

Amended Individual Income Tax Return

YEAR:

801700251000

Form 80-170-02-5-1-000 (Rev. 07/02)

Page 1

CC:2

Resident

Nonresident

Check Applicable Block:

13B

16B

19

22

25

14B

17B

20

23

26

15B

18B

21

24

TS

SS

N1

N2

N3

TY

N4

N5

N6

PS

A

C1

C2

C3

For Computer Use Only - Do Not Write Above This Line

Your SSN

Spouse SSN

B. Net Change - Increase/Decrease

A. As Originally Reported

Change in Tax

C. Correct Amount

(Indicate Decrease by placing - sign to left of amount)

or as Adjusted

(EXPLAIN BELOW)

Mississippi Taxable Income (Enter in Column B the

13.

13.

amount from Line 9 of page 2.)

14.

Total Income Tax Due

(G)

14.

15.

Mississippi Income Tax Withheld

(W)

15.

Estimate Tax Payment & Amount paid with

16.

(E)

16.

Extension

Credit form Income Tax Paid To Another

17.

(S)

17.

State

18.

Other Credits

(O)

18.

Amount Paid with Original Return, Plus

19.

19.

Additional Tax Paid

Total Credits (Add Lines 15C through

20.

20.

19C)

Overpayment, if any, Shown on Original Return (or as previously adjusted) (NOTE: Enter the amount of overpayment on the

original return BEFORE any portion thereof was applied to estimated tax or a designated contribution.)

21.

21.

22.

Net Tax Paid for This Period (Subtract Line 21 from Line 20C.)

22.

23.

Enter the Amount of REFUND to be Received if Line 22 is greater than Line 14C.

REFUND

(R)

23.

24.

Enter the BALANCE DUE if Line 14C is greater than Line 22.

BALANCE DUE

24.

25.

INTEREST @ 1% PER MONTH on Line 24 from Original Due Date of Return until Date Paid

(T)

25.

TOTAL DUE (Add Lines 24 and 25). Attach Check or Money Order for Total Due

26.

TOTAL DUE

(V)

26.

payable to: State Tax Commission

THIS RETURN MUST BE SIGNED. Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and

statements, and to the best of my knowledge and belief, is true, correct, and complete.

If Joint

Return, Both

Your Signature

Telephone Number (Daytime)

Date

Must Sign

Date

Spouse's Signature (If Filing Joint Return, Both Must Sign)

Preparer's Signature (other than taxpayer)

Date

Preparer's FEIN

Preparer's SSN

Mail REFUND to: Office of Revenue, P. O. Box 23058, Jackson, MS 39225-3058

Mail TAX DUE to: Office of Revenue, P. O. Box 23050, Jackson, MS 39225-3050

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2