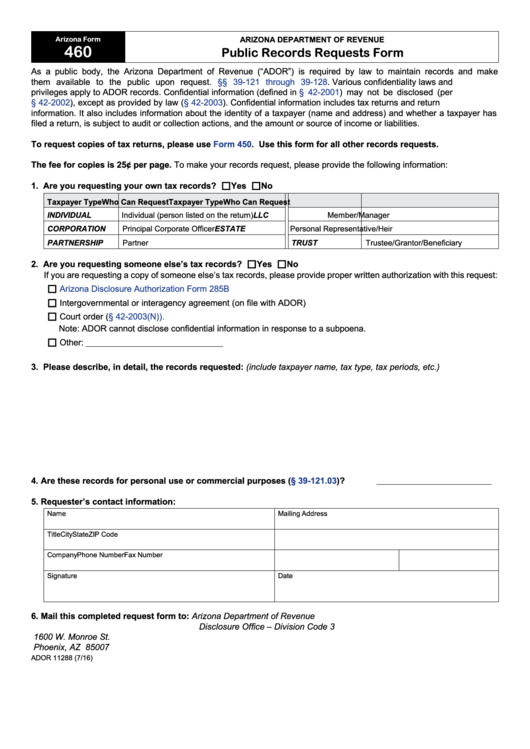

ARIZONA DEPARTMENT OF REVENUE

Arizona Form

460

Public Records Requests Form

As a public body, the Arizona Department of Revenue (“ADOR”) is required by law to maintain records and make

them available to the public upon request.

A.R.S. §§ 39-121 through

39-128. Various confidentiality laws and

privileges apply to ADOR records. Confidential information (defined in

A.R.S. §

42-2001) may not be disclosed (per

A.R.S. §

42-2002), except as provided by law

(A.R.S. §

42-2003). Confidential information includes tax returns and return

information. It also includes information about the identity of a taxpayer (name and address) and whether a taxpayer has

filed a return, is subject to audit or collection actions, and the amount or source of income or liabilities.

To request copies of tax returns, please use

Form

450. Use this form for all other records requests.

The fee for copies is 25¢ per page. To make your records request, please provide the following information:

1. Are you requesting your own tax records?

Yes

No

Taxpayer Type

Who Can Request

Taxpayer Type

Who Can Request

INDIVIDUAL

Individual (person listed on the return)

LLC

Member/Manager

CORPORATION

Principal Corporate Officer

ESTATE

Personal Representative/Heir

PARTNERSHIP

Partner

TRUST

Trustee/Grantor/Beneficiary

2. Are you requesting someone else’s tax records?

Yes

No

If you are requesting a copy of someone else’s tax records, please provide proper written authorization with this request:

Arizona Disclosure Authorization Form 285B

Intergovernmental or interagency agreement (on file with ADOR)

Court order

(A.R.S. § 42-2003(N)).

Note: ADOR cannot disclose confidential information in response to a subpoena.

Other:

3. Please describe, in detail, the records requested: (include taxpayer name, tax type, tax periods, etc.)

4. Are these records for personal use or commercial purposes

(A.R.S. §

39-121.03)?

5. Requester’s contact information:

Name

Mailing Address

Title

City

State

ZIP Code

Company

Phone Number

Fax Number

Signature

Date

6. Mail this completed request form to:

Arizona Department of Revenue

Disclosure Office – Division Code 3

1600 W. Monroe St.

Phoenix, AZ 85007

ADOR 11288 (7/16)

1

1