Form N-40 - Schedule J - Trust Allocation Ofhawaii Form N-40 Schedule J An Accumulation Distribution - 2006

ADVERTISEMENT

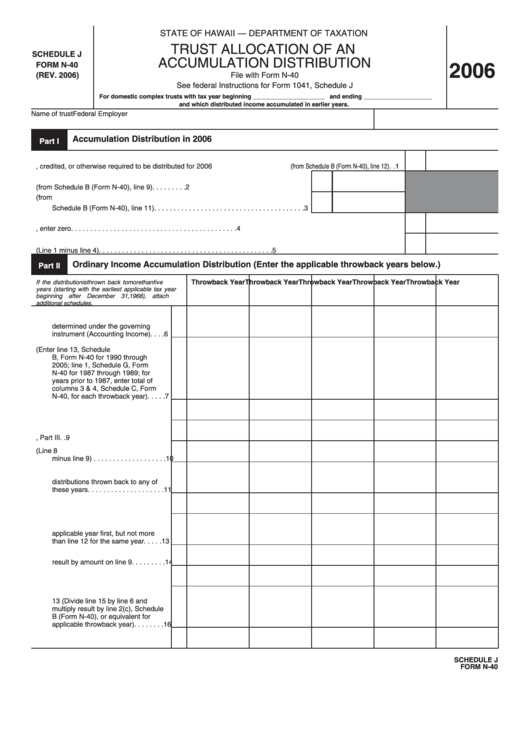

STATE OF HAWAII — DEPARTMENT OF TAXATION

TRUST ALLOCATION OF AN

SCHEDULE J

ACCUMULATION DISTRIBUTION

FORM N-40

2006

(REV. 2006)

File with Form N-40

See federal Instructions for Form 1041, Schedule J

For domestic complex trusts with tax year beginning _____________________ and ending ____________________

and which distributed income accumulated in earlier years.

Name of trust

Federal Employer I.D. No.

Accumulation Distribution in 2006

Part I

1.

Other amounts paid, credited, or otherwise required to be distributed for 2006 (from Schedule B (Form N-40), line 12) . .

1

2.

Distributable net income for 2006 (from Schedule B (Form N-40), line 9). . . . . . . . .

2

3.

Income required to be distributed currently for 2006 (from

Schedule B (Form N-40), line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4.

Line 2 minus line 3. If line 3 is more than line 2, enter zero. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5.

Accumulation distribution for 2006 (Line 1 minus line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Ordinary Income Accumulation Distribution (Enter the applicable throwback years below.)

Part II

Throwback Year

Throwback Year

Throwback Year

Throwback Year

Throwback Year

If the distribution is thrown back to more than five

years (starting with the earliest applicable tax year

beginning after December 31, 1968), attach

additional schedules.

6.

Enter Distributable Net Income as

determined under the governing

instrument (Accounting Income) . . . .

6

7.

Distributions (Enter line 13, Schedule

B, Form N-40 for 1990 through

2005; line 1, Schedule G, Form

N-40 for 1987 through 1989; for

years prior to 1987, enter total of

columns 3 & 4, Schedule C, Form

N-40, for each throwback year). . . . .

7

8.

Line 6 minus line 7 . . . . . . . . . . . . . .

8

9.

Enter amount from line 25, Part III . .

9

10. Undistributed net income (Line 8

minus line 9) . . . . . . . . . . . . . . . . . . .

10

11. Enter amount of prior accumulation

distributions thrown back to any of

these years . . . . . . . . . . . . . . . . . . . .

11

12. Line 10 minus line 11 . . . . . . . . . . . .

12

13. Allocate amount on line 5 to earliest

applicable year first, but not more

than line 12 for the same year . . . . .

13

14. Divide line 13 by line 10 and multiply

result by amount on line 9. . . . . . . . .

14

15. Add lines 13 and 14 . . . . . . . . . . . . .

15

16. Tax-exempt interest included on line

13 (Divide line 15 by line 6 and

multiply result by line 2(c), Schedule

B (Form N-40), or equivalent for

applicable throwback year) . . . . . . . .

16

17. Line 15 minus line 16 . . . . . . . . . . . .

17

SCHEDULE J

FORM N-40

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2