Form 21d - Employer'S Annual Contribution, Investment Fee And Wage Report - 2007

ADVERTISEMENT

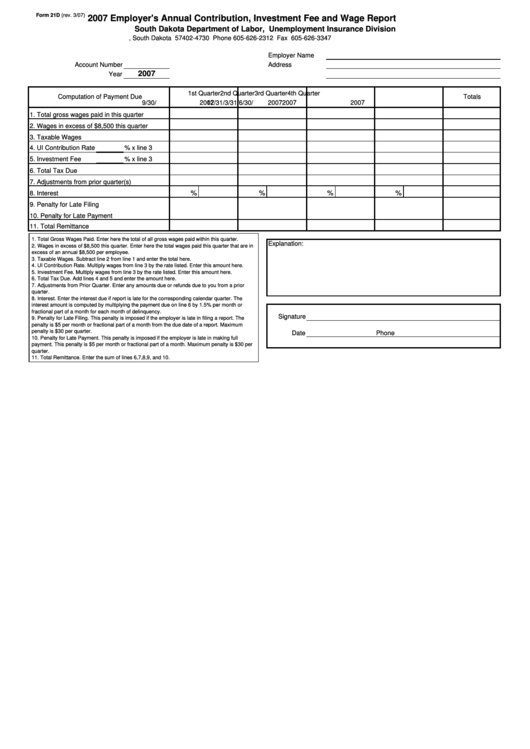

Form 21D (rev. 3/07)

2007 Employer's Annual Contribution, Investment Fee and Wage Report

South Dakota Department of Labor, Unemployment Insurance Division

P.O. Box 4730 Aberdeen, South Dakota 57402-4730 Phone 605-626-2312 Fax 605-626-3347

Employer Name

Account Number

Address

2007

Year

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

Computation of Payment Due

Totals

3/31/

2007

6/30/

2007

9/30/

2007

12/31/

2007

1. Total gross wages paid in this quarter

2. Wages in excess of $8,500 this quarter

3. Taxable Wages

4. UI Contribution Rate

% x line 3

5. Investment Fee

% x line 3

6. Total Tax Due

7. Adjustments from prior quarter(s)

8. Interest

%

%

%

%

9. Penalty for Late Filing

10. Penalty for Late Payment

11. Total Remittance

1. Total Gross Wages Paid. Enter here the total of all gross wages paid within this quarter.

Explanation:

2. Wages in excess of $8,500 this quarter. Enter here the total wages paid this quarter that are in

excess of an annual $8,500 per employee.

3. Taxable Wages. Subtract line 2 from line 1 and enter the total here.

4. UI Contribution Rate. Multiply wages from line 3 by the rate listed. Enter this amount here.

5. Investment Fee. Multiply wages from line 3 by the rate listed. Enter this amount here.

6. Total Tax Due. Add lines 4 and 5 and enter the amount here.

7. Adjustments from Prior Quarter. Enter any amounts due or refunds due to you from a prior

quarter.

8. Interest. Enter the interest due if report is late for the corresponding calendar quarter. The

interest amount is computed by multiplying the payment due on line 6 by 1.5% per month or

fractional part of a month for each month of delinquency.

Signature

9. Penalty for Late Filing. This penalty is imposed if the employer is late in filing a report. The

penalty is $5 per month or fractional part of a month from the due date of a report. Maximum

penalty is $30 per quarter.

Date

Phone

10. Penalty for Late Payment. This penalty is imposed if the employer is late in making full

payment. This penalty is $5 per month or fractional part of a month. Maximum penalty is $30 per

quarter.

11. Total Remittance. Enter the sum of lines 6,7,8,9, and 10.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1