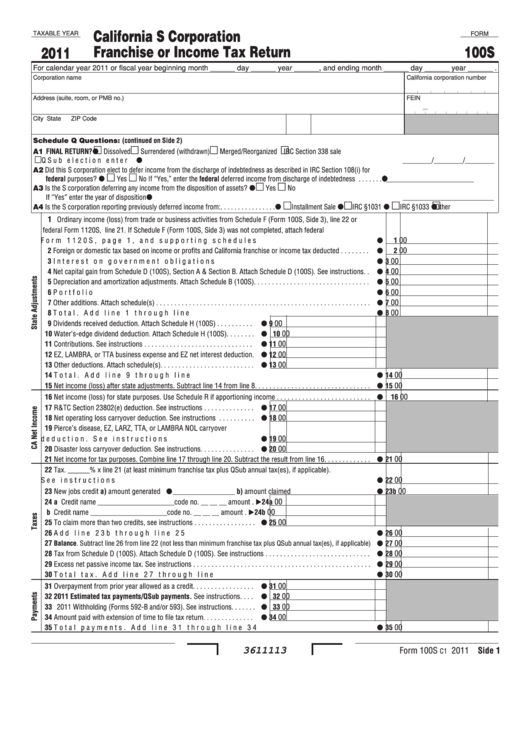

Form 100s - California S Corporation Franchise Or Income Tax Return - 2011

ADVERTISEMENT

California S Corporation

TAXABLE YEAR

FORM

Franchise or Income Tax Return

100S

2011

For calendar year 2011 or fiscal year beginning month ______ day ______ year ______, and ending month ______ day ______ year ______ .

Corporation name

California corporation number

Address (suite, room, or PMB no.)

FEIN

City

State

ZIP Code

Schedule Q Questions: (continued on Side 2)

A1 FINAL RETURN?

Dissolved

Surrendered (withdrawn)

Merged/Reorganized

IRC Section 338 sale

QSub election enter date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

________/________/________

A2 Did this S corporation elect to defer income from the discharge of indebtedness as described in IRC Section 108(i) for

federal purposes?

Yes

No If “Yes,” enter the federal deferred income from discharge of indebtedness . . . . . . .

$_________________________

A3 Is the S corporation deferring any income from the disposition of assets?

Yes

No

If “Yes” enter the year of disposition . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

_________________________

A4 Is the S corporation reporting previously deferred income from: . . . . . . . . . . . . . . . .

Installment Sale

IRC §1031

IRC §1033

Other

Ordinary income (loss) from trade or business activities from Schedule F (Form 100S, Side 3), line 22 or

federal Form 1120S, line 21 . If Schedule F (Form 100S, Side 3) was not completed, attach federal

00

Form 1120S, page 1, and supporting schedules . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

2 Foreign or domestic tax based on income or profits and California franchise or income tax deducted . . . . . . . .

2

3 Interest on government obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

00

4 Net capital gain from Schedule D (100S), Section A & Section B . Attach Schedule D (100S) . See instructions . .

4

00

5 Depreciation and amortization adjustments . Attach Schedule B (100S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Portfolio income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Other additions . Attach schedule(s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Total . Add line 1 through line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9 Dividends received deduction . Attach Schedule H (100S) . . . . . . . . . .

9

00

0 Water’s-edge dividend deduction . Attach Schedule H (100S) . . . . . . . .

0

00

Contributions . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

2 EZ, LAMBRA, or TTA business expense and EZ net interest deduction .

2

3 Other deductions . Attach schedule(s) . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

00

4 Total . Add line 9 through line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5 Net income (loss) after state adjustments . Subtract line 14 from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Net income (loss) for state purposes . Use Schedule R if apportioning income . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 R&TC Section 23802(e) deduction . See instructions . . . . . . . . . . . . . .

7

00

8 Net operating loss carryover deduction . See instructions . . . . . . . . . .

8

9 Pierce’s disease, EZ, LARZ, TTA, or LAMBRA NOL carryover

00

deduction . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

20 Disaster loss carryover deduction . See instructions . . . . . . . . . . . . . . .

20

00

00

2 Net income for tax purposes . Combine line 17 through line 20 . Subtract the result from line 16 . . . . . . . . . . . . .

2

22 Tax . ______% x line 21 (at least minimum franchise tax plus QSub annual tax(es), if applicable) .

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

00

23 New jobs credit a) amount generated

_________________ b) amount claimed . . . . . . . . . . . . . . . . . . . . .

23b

24 a Credit name _____________________code no . __ __ __ amount . 24a

00

00

b Credit name _____________________code no . __ __ __ amount . 24b

00

25 To claim more than two credits, see instructions . . . . . . . . . . . . . . . . .

25

00

26 Add line 23b through line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

00

27

27

Balance . Subtract line 26 from line 22 (not less than minimum franchise tax plus QSub annual tax(es), if applicable)

00

28 Tax from Schedule D (100S) . Attach Schedule D (100S) . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

00

29 Excess net passive income tax . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

30 Total tax . Add line 27 through line 29 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

00

00

3 Overpayment from prior year allowed as a credit . . . . . . . . . . . . . . . . .

3

00

32 20 Estimated tax payments/QSub payments. See instructions . . . .

32

00

33 2011 Withholding (Forms 592-B and/or 593) . See instructions . . . . . . .

33

00

34 Amount paid with extension of time to file tax return . . . . . . . . . . . . . .

34

00

35 Total payments . Add line 31 through line 34 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35

Form 100S

2011 Side

3611113

C1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5