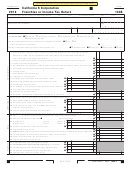

Form 100s - California S Corporation Franchise Or Income Tax Return - 2011 Page 5

ADVERTISEMENT

Schedule K S Corporation Shareholder’s Shares of Income, Deductions, Credits, etc.

(a)

(b)

(c)

(d)

Pro-rata share items

Amount from

California

Total amounts using

federal Schedule K

Adjustment

California law

(2OS)

Combine (b) and (c)

where applicable

Ordinary business income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Net rental real estate income (loss) . Attach federal Form 8825 . . . . . . . . . . . . . . 2

3 a Other gross rental income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3a

b Expenses from other rental activities . Attach schedule . . . . . . . . . . . . . . . . 3b

c Other net rental income (loss) . Subtract line 3b from line 3a . . . . . . . . . . . 3c

4 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Dividends . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Net short-term capital gain (loss) . Attach Schedule D (100S) . . . . . . . . . . . . . 7

8 Net long-term capital gain (loss) . Attach Schedule D (100S) . . . . . . . . . . . . . 8

9 Net Section 1231 gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

0 a Other portfolio income (loss) . Attach schedule . . . . . . . . . . . . . . . . . . . . . 0a

b Other income (loss) . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0b

Expense deduction for recovery property (IRC Section 179 and

R&TC Sections 17267 .2, 17267 .6 and 17268) Attach Schedule B (100S) . . . .

2 a Charitable contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

b Investment interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b

c Section 59(e)(2) expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c

2 Type of expenditures ______________________________________ 2c2

d Deductions-portfolio . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d

e Other deductions . Attach schedule

2e

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 a Low-income housing credit . See instructions . . . . . . . . . . . . . . . . . . . . . . 3a

b Credits related to rental real estate activities other than on line 13a

Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3b

c Credits related to other rental activities . See instructions . Attach schedule 3c

d Other credits . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3d

e New jobs credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3e

4 Total withholding allocated to all shareholders . . . . . . . . . . . . . . . . . . . . . . . . 4

5 a Depreciation adjustment on property placed in service after 12/31/86 . . . . 5a

b Adjusted gain or loss . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . 5b

c Depletion (other than oil and gas) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5c

d Gross income from oil, gas, and geothermal properties . . . . . . . . . . . . . 5d

2 Deductions allocable to oil, gas, and geothermal properties . . . . . . . . . . 5d2

e Other AMT items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5e

6 a Tax-exempt interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6a

b Other tax-exempt income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6b

c Nondeductible expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6c

d Total property distributions (including cash) other than dividends

distribution reported on line 17c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6d

7 a Investment income . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7a

b Investment expenses . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b

c Total dividend distributions paid from accumulated earnings and profits . . 7c

d Other items and amounts not included in lines 1 - 17b and lines 18a-e

that are required to be reported separately to shareholders . Attach schedule . . 7d

8 a Type of income __________________________________________ . . . 8a

b Name of state ___________________________________________ . . . 8b

c Total gross income from sources outside California . Attach schedule . . . . 8c

d Total applicable deductions and losses . Attach schedule . . . . . . . . . . . . . . 8d

e Total other state taxes . Check one:

Paid

Accrued . . . . . . . 8e

9 Income (loss) (required only if Schedule M-1 must be completed) .

Combine line 1, line 2, and line 3c through line 10b . From the result,

subtract the sum of lines 11, 12a, 12b, 12c1, 12d and 12e . . . . . . . . . . . . . . . 9

Form 100S

2011 Side 5

3615113

C1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5