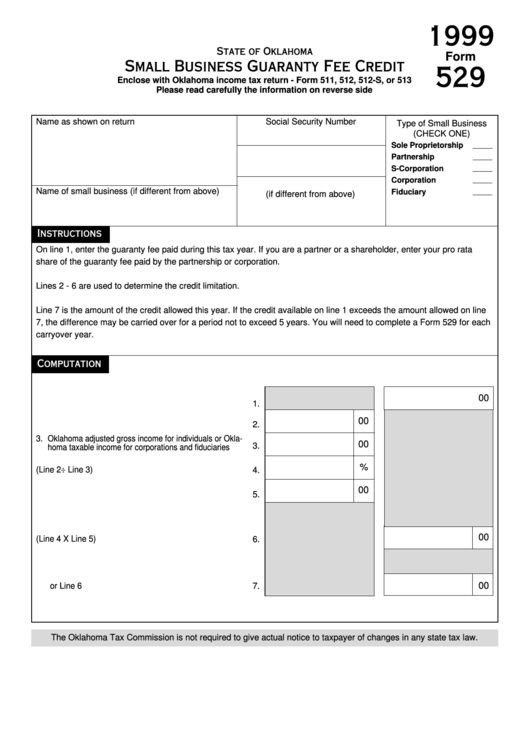

Form 529 - Small Business Guaranty Fee Credit - 1999

ADVERTISEMENT

1999

State of Oklahoma

Form

Small Business Guaranty Fee Credit

529

Enclose with Oklahoma income tax return - Form 511, 512, 512-S, or 513

Please read carefully the information on reverse side

Name as shown on return

Social Security Number

Type of Small Business

(CHECK ONE)

Sole Proprietorship

F.E.I. Number

Partnership

S-Corporation

Corporation

F.E.I. Number of small business

Name of small business (if different from above)

Fiduciary

(if different from above)

Instructions

On line 1, enter the guaranty fee paid during this tax year. If you are a partner or a shareholder, enter your pro rata

share of the guaranty fee paid by the partnership or corporation.

Lines 2 - 6 are used to determine the credit limitation.

Line 7 is the amount of the credit allowed this year. If the credit available on line 1 exceeds the amount allowed on line

7, the difference may be carried over for a period not to exceed 5 years. You will need to complete a Form 529 for each

carryover year.

Computation

00

1. Loan guaranty fee paid during this tax year

............

1.

00

2.

2. Net Income from the Small Business ........................

3. Oklahoma adjusted gross income for individuals or Okla-

00

3.

......

homa taxable income for corporations and fiduciaries

%

4. Percentage (Line 2 ÷ Line 3)

4.

.......................................

00

.............................................................

5. Tax per return

5.

00

6. Credit limitation (Line 4 X Line 5)

................................

6.

7. Credit allowed this year enter the smaller of Line 1

00

or Line 6

7.

....................................................................

The Oklahoma Tax Commission is not required to give actual notice to taxpayer of changes in any state tax law.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1