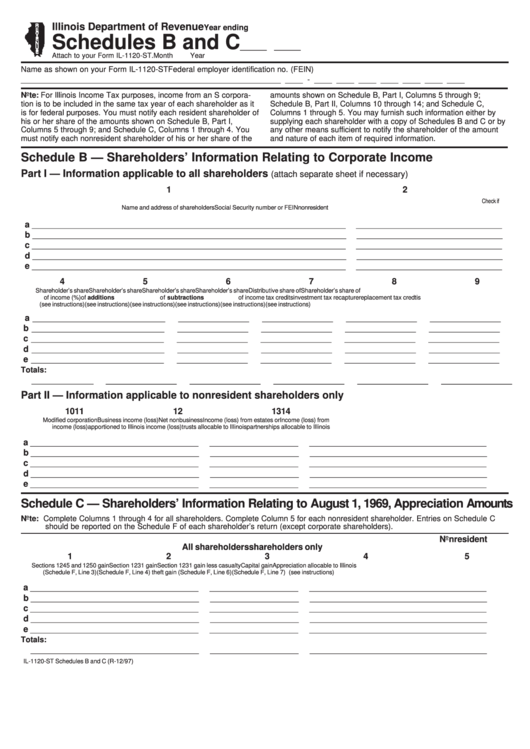

Illinois Department of Revenue

Year ending

Schedules B and C

______ ______

Attach to your Form IL-1120-ST.

Month

Year

Name as shown on your Form IL-1120-ST

Federal employer identification no. (FEIN)

_______________________________________________________

____ ____ - ____ ____ ____ ____ ____ ____ ____

Note: For Illinois Income Tax purposes, income from an S corpora-

amounts shown on Schedule B, Part I, Columns 5 through 9;

tion is to be included in the same tax year of each shareholder as it

Schedule B, Part II, Columns 10 through 14; and Schedule C,

is for federal purposes. You must notify each resident shareholder of

Columns 1 through 5. You may furnish such information either by

his or her share of the amounts shown on Schedule B, Part I,

supplying each shareholder with a copy of Schedules B and C or by

Columns 5 through 9; and Schedule C, Columns 1 through 4. You

any other means sufficient to notify the shareholder of the amount

must notify each nonresident shareholder of his or her share of the

and nature of each item of required information.

Schedule B — Shareholders’ Information Relating to Corporate Income

Part I — Information applicable to all shareholders

(attach separate sheet if necessary)

1

2

3

Check if

Name and address of shareholders

Social Security number or FEIN

nonresident

a

_______________________________________________________________________

________________________

_________

b

_______________________________________________________________________

________________________

_________

c

_______________________________________________________________________

________________________

_________

d

_______________________________________________________________________

________________________

_________

e

_______________________________________________________________________

________________________

_________

4

5

6

7

8

9

Shareholder’s share

Shareholder’s share

Shareholder’s share

Shareholder’s share

Distributive share of

Shareholder’s share of

of income (%)

of additions

of subtractions

of income tax credits

investment tax recapture

replacement tax credtis

(see instructions)

(see instructions)

(see instructions)

(see instructions)

(see instructions)

(see instructions)

a

______________

________________

________________

________________

________________

________________

b

______________

________________

________________

________________

________________

________________

c

______________

________________

________________

________________

________________

________________

d

______________

________________

________________

________________

________________

________________

e

______________

________________

________________

________________

________________

________________

Totals:

______________

________________

________________

________________

________________

________________

Part II — Information applicable to nonresident shareholders only

10

11

12

13

14

Modified corporation

Business income (loss)

Net nonbusiness

Income (loss) from estates or

Income (loss) from

income (loss)

apportioned to Illinois

income (loss)

trusts allocable to Illinois

partnerships allocable to Illinois

a

__________________

____________________

____________________

____________________

____________________

b

__________________

____________________

____________________

____________________

____________________

c

__________________

____________________

____________________

____________________

____________________

d

__________________

____________________

____________________

____________________

____________________

e

__________________

____________________

____________________

____________________

____________________

Schedule C — Shareholders’ Information Relating to August 1, 1969, Appreciation Amounts

Note: Complete Columns 1 through 4 for all shareholders. Complete Column 5 for each nonresident shareholder. Entries on Schedule C

should be reported on the Schedule F of each shareholder’s return (except corporate shareholders).

Nonresident

All shareholders

shareholders only

1

2

3

4

5

Sections 1245 and 1250 gain

Section 1231 gain

Section 1231 gain less casualty

Capital gain

Appreciation allocable to Illinois

(Schedule F, Line 3)

(Schedule F, Line 4)

theft gain (Schedule F, Line 6)

(Schedule F, Line 7)

(see instructions)

a

__________________

____________________

____________________

____________________

____________________

b

__________________

____________________

____________________

____________________

____________________

c

__________________

____________________

____________________

____________________

____________________

d

__________________

____________________

____________________

____________________

____________________

e

__________________

____________________

____________________

____________________

____________________

Totals:

__________________

____________________

____________________

____________________

____________________

IL-1120-ST Schedules B and C (R-12/97)

1

1