Instructions For Form N-318 - Hawaii Department Of Taxation - 1999

ADVERTISEMENT

payer, no repayment except for dividends or inter-

companies, attach a schedule to Form N-318.

Form N-318

est shall be made for at least three years from the

Instructions

Line 2.—Enter the total amount of the investment made

date the investment is made.

in the QHTB listed in the same column. Do not enter

(1999)

The annual amount of any dividend and inter-

any amounts from investments made before July 1,

General Instructions for Part I

est payment to the taxpayer shall not exceed

1999.

Purpose of Form. Act 178, Session Laws of

twelve per cent of the amount of the investment.

Line 3.—Multiply the amount on line 2, column a, by

Hawaii 1999, created tax credits to assist in the

(b) For the purposes of this section:

10% (0.1) and enter the result on line 3, column a. Cal-

creation of opportunities for high technology com-

culate each column the same way. These are the total

“Qualified high technology business” means:

panies. Use this form to calculate the allowed

maximum credits allowed per QHTB per tax year.

high-technology tax credits. Part I is used to claim

(1) A business, employing or owning capital

Line 4.—Add line 3, column(s) a through c and any ad-

the High-Technology Business Investment Tax

or property, or maintaining an office, in

ditional maximum credit allowed per QHTB from an at-

Credit created under the Income Tax Law. The

this State; and which

tached schedule. Enter the total here.

Franchise and Insurance Premium Tax Laws also

(2) (A) Conducts one hundred per cent of

provide those companies filing under those tax

Line 5.—Enter the name and federal employer identifi-

its activities in performing qualified

laws to also claim the tax credit.

cation number of any flow-through entity who has

research in this State; or

passed the high-technology business investment tax

For more information, contact the Department

(B) Receives one hundred per cent of

credit through to the taxpayer. If additional space is

of Taxation, Technical Section at (808) 587-1577.

its gross income derived from quali-

needed, include the information on an attached sched-

Statutory Reference. § 235-( uncodified) ,

fied research; provided that the in-

ule.

Hawaii Revised Statutes (HRS).

come is received from products sold

Line 6.—For 1999, this space is reserved for the carry-

from, manufactured, or produced in

High-technology business investment tax

over of unused high technology business investment

the State; or services performed in

credit. (a) There shall be allowed to each tax-

tax credits from prior years.

this State.

payer, subject to the taxes imposed by this chap-

Line 7.—Add lines 5 and 6. This is your tentative cur-

ter, a high technology investment tax credit that

The term “ qualified high technology business ”

rent year high-technology business investment tax

shall be deductible from the taxpayer’s net income

does not include:

credit. Form N-20, N-35 and 314 filers, stop here and

tax liability, if any, imposed by this chapter for the

(1) Any trade or business involving the per-

enter the amount on line 7 on the appropriate lines of

taxable year in which the credit is properly

formance of services in the field of law,

your tax return. All others, continue to line 8.

claimed. The tax credit shall be an amount equal

architecture, accounting, actuarial sci-

to ten per cent of the investment made by the tax-

Tax Liability Limitations

ence, performing arts, consulting, athlet-

payer in each qualified high technology business,

ics, financial services, or brokerage

NOTE: If you are also claiming the Low-Income

up to a maximum allowed credit of $500,000 for

services;

Housing Tax Credit (Form N-586), complete Form N-586

the taxable year for the investment made by the

before completing this form. If you have any carryover of

(2) Any banking, insurance, financing, leas-

taxpayer in a qualified high technology business.

unused credit from Form N-586, do not complete lines 8

ing, rental, investing, or similar business;

(b) The credit allowed under this section shall

and 9 of this form. Enter zero on line 10 and continue to

any farming business, including the busi-

be claimed against the net income tax liabil-

line 12. Your total high-technology business investment

ness of raising or harvesting trees; any

ity for the taxable year. For the purpose of

tax credit cannot be used this year and must be carried

business involving the production or ex-

this section, “net income tax liability” means

over to next year.

traction of products of a character with

net income tax liability reduced by all other

respect to which a deduction is allow-

Line 8.—Enter the tax liability before any credits from

credits allowed under this chapter.

able under section 611 (with respect to

the appropriate line of your tax return.

(c) If the tax credit under this section exceeds

allowance of deduction for depletion),

Line 9.—The law requires that ALL other credits offset

the taxpayer’s income tax liability, the excess

613 (with respect to basis for percentage

a taxpayer's tax liability BEFORE allowing a credit for

of the tax credit over liability may be used as

depletion), or 613A (with respect to limi-

investment in a qualified high technology business.

a credit against the taxpayer’s income tax li-

tation on percentage depleting in cases

Complete this worksheet and enter the result on line 9.

ability in subsequent years until exhausted.

of oil and gas wells) of the Internal Rev-

enue Code;

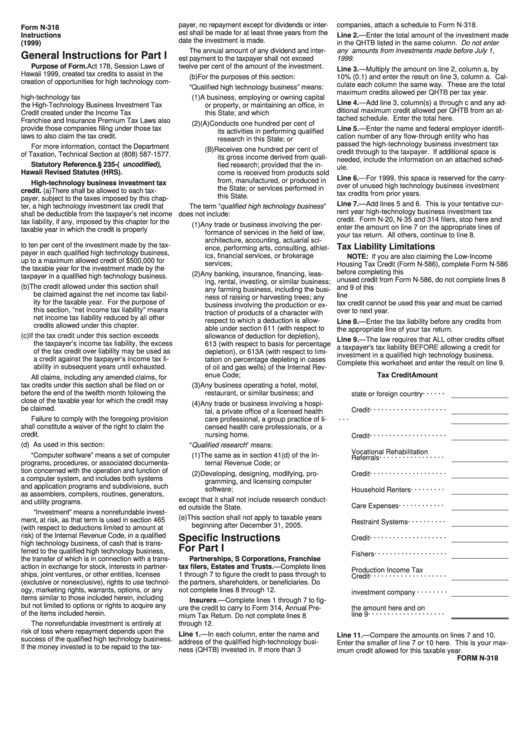

Tax Credit

Amount

All claims, including any amended claims, for

tax credits under this section shall be filed on or

(3) Any business operating a hotel, motel,

a. Income Taxes Paid to another

before the end of the twelfth month following the

restaurant, or similar business; and

state or foreign country · · · · · ·

close of the taxable year for which the credit may

(4) Any trade or business involving a hospi-

b. Energy Conservation Tax

be claimed.

Credit· · · · · · · · · · · · · · · · · · · ·

tal, a private office of a licensed health

Failure to comply with the foregoing provision

care professional, a group practice of li-

c.

Enterprise Zone Tax Credit · · ·

shall constitute a waiver of the right to claim the

censed health care professionals, or a

d. Low-Income Housing Tax

credit.

nursing home.

Credit· · · · · · · · · · · · · · · · · · · ·

(d) As used in this section:

“ Qualified research ” means:

e. Credit for Employment of

Vocational Rehabilitation

“Computer software” means a set of computer

(1) The same as in section 41(d) of the In-

Referrals · · · · · · · · · · · · · · · · ·

programs, procedures, or associated documenta-

ternal Revenue Code; or

f.

Low-Income Refundable Tax

tion concerned with the operation and function of

(2) Developing, designing, modifying, pro-

Credit· · · · · · · · · · · · · · · · · · · ·

a computer system, and includes both systems

gramming, and licensing computer

g. Credit for Low-Income

and application programs and subdivisions, such

software;

Household Renters · · · · · · · · ·

as assemblers, compilers, routines, generators,

except that it shall not include research conduct-

h. Credit for Child and Dependent

and utility programs.

Care Expenses · · · · · · · · · · · ·

ed outside the State.

“Investment” means a nonrefundable invest-

I.

Credit for Child Passenger

(e) This section shall not apply to taxable years

ment, at risk, as that term is used in section 465

Restraint Systems · · · · · · · · · ·

beginning after December 31, 2005.

(with respect to deductions limited to amount at

j.

Capital Goods Excise Tax

risk) of the Internal Revenue Code, in a qualified

Specific Instructions

Credit· · · · · · · · · · · · · · · · · · · ·

high technology business, of cash that is trans-

For Part I

k.

Fuel Tax Credit for Commercial

ferred to the qualified high technology business,

Fishers· · · · · · · · · · · · · · · · · · ·

the transfer of which is in connection with a trans-

Partnerships, S Corporations, Franchise

l.

Motion Picture and Film

action in exchange for stock, interests in partner-

tax filers, Estates and Trusts.—Complete lines

Production Income Tax

ships, joint ventures, or other entities, licenses

1 through 7 to figure the credit to pass through to

Credit· · · · · · · · · · · · · · · · · · · ·

(exclusive or nonexclusive), rights to use technol-

the partners, shareholders, or beneficiaries. Do

m. Credit from a regulated

ogy, marketing rights, warrants, options, or any

not complete lines 8 through 12.

investment company · · · · · · · ·

items similar to those included herein, including

Insurers.—Complete lines 1 through 7 to fig-

n. Add lines a through m. Enter

but not limited to options or rights to acquire any

ure the credit to carry to Form 314, Annual Pre-

the amount here and on

of the items included herein.

line 9 · · · · · · · · · · · · · · · · · · · ·

mium Tax Return. Do not complete lines 8

The nonrefundable investment is entirely at

through 12.

risk of loss where repayment depends upon the

Line 1.—In each column, enter the name and

Line 11.—Compare the amounts on lines 7 and 10.

success of the qualified high technology business.

address of the qualified high-technology busi-

Enter the smaller of line 7 or 10 here. This is your max-

If the money invested is to be repaid to the tax-

ness (QHTB) invested in. If more than 3

imum credit allowed for this taxable year.

FORM N-318

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1