Instructions For Form 1045-K - Kentucky Department Of Revenue

ADVERTISEMENT

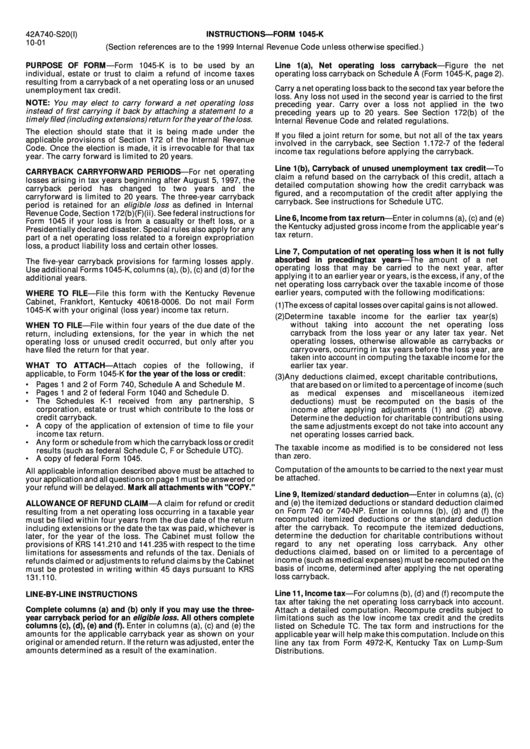

INSTRUCTIONS—FORM 1045-K

42A740-S20(I)

10-01

(Section references are to the 1999 Internal Revenue Code unless otherwise specified.)

PURPOSE OF FORM—Form 1045-K is to be used by an

Line 1(a), Net operating loss carryback—Figure the net

individual, estate or trust to claim a refund of income taxes

operating loss carryback on Schedule A (Form 1045-K, page 2).

resulting from a carryback of a net operating loss or an unused

Carry a net operating loss back to the second tax year before the

unemployment tax credit.

loss. Any loss not used in the second year is carried to the first

NOTE: You may elect to carry forward a net operating loss

preceding year. Carry over a loss not applied in the two

instead of first carrying it back by attaching a statement to a

preceding years up to 20 years. See Section 172(b) of the

timely filed (including extensions) return for the year of the loss.

Internal Revenue Code and related regulations.

The election should state that it is being made under the

If you filed a joint return for some, but not all of the tax years

applicable provisions of Section 172 of the Internal Revenue

involved in the carryback, see Section 1.172-7 of the federal

Code. Once the election is made, it is irrevocable for that tax

income tax regulations before applying the carryback.

year. The carry forward is limited to 20 years.

Line 1(b), Carryback of unused unemployment tax credit—To

CARRYBACK CARRYFORWARD PERIODS—For net operating

claim a refund based on the carryback of this credit, attach a

losses arising in tax years beginning after August 5, 1997, the

detailed computation showing how the credit carryback was

carryback period has changed to two years and the

figured, and a recomputation of the credit after applying the

carryforward is limited to 20 years. The three-year carryback

carryback. See instructions for Schedule UTC.

period is retained for an eligible loss as defined in Internal

Revenue Code, Section 172(b)(F)(ii). See federal instructions for

Line 6, Income from tax return—Enter in columns (a), (c) and (e)

Form 1045 if your loss is from a casualty or theft loss, or a

the Kentucky adjusted gross income from the applicable year's

Presidentially declared disaster. Special rules also apply for any

tax return.

part of a net operating loss related to a foreign expropriation

loss, a product liability loss and certain other losses.

Line 7, Computation of net operating loss when it is not fully

absorbed in preceding tax years—The amount of a net

The five-year carryback provisions for farming losses apply.

operating loss that may be carried to the next year, after

Use additional Forms 1045-K, columns (a), (b), (c) and (d) for the

applying it to an earlier year or years, is the excess, if any, of the

additional years.

net operating loss carryback over the taxable income of those

earlier years, computed with the following modifications:

WHERE TO FILE—File this form with the Kentucky Revenue

Cabinet, Frankfort, Kentucky 40618-0006. Do not mail Form

(1) The excess of capital losses over capital gains is not allowed.

1045-K with your original (loss year) income tax return.

(2) Determine taxable income for the earlier tax year(s)

without taking into account the net operating loss

WHEN TO FILE—File within four years of the due date of the

carryback from the loss year or any later tax year. Net

return, including extensions, for the year in which the net

operating losses, otherwise allowable as carrybacks or

operating loss or unused credit occurred, but only after you

carryovers, occurring in tax years before the loss year, are

have filed the return for that year.

taken into account in computing the taxable income for the

WHAT TO ATTACH—Attach copies of the following, if

earlier tax year.

applicable, to Form 1045-K for the year of the loss or credit:

(3) Any deductions claimed, except charitable contributions,

• Pages 1 and 2 of Form 740, Schedule A and Schedule M.

that are based on or limited to a percentage of income (such

• Pages 1 and 2 of federal Form 1040 and Schedule D.

as

medical

expenses

and

miscellaneous

itemized

• The Schedules K-1 received from any partnership, S

deductions) must be recomputed on the basis of the

corporation, estate or trust which contribute to the loss or

income after applying adjustments (1) and (2) above.

credit carryback.

Determine the deduction for charitable contributions using

• A copy of the application of extension of time to file your

the same adjustments except do not take into account any

income tax return.

net operating losses carried back.

• Any form or schedule from which the carryback loss or credit

The taxable income as modified is to be considered not less

results (such as federal Schedule C, F or Schedule UTC).

than zero.

• A copy of federal Form 1045.

Computation of the amounts to be carried to the next year must

All applicable information described above must be attached to

be attached.

your application and all questions on page 1 must be answered or

your refund will be delayed. Mark all attachments with "COPY."

Line 9, Itemized/standard deduction—Enter in columns (a), (c)

and (e) the itemized deductions or standard deduction claimed

ALLOWANCE OF REFUND CLAIM—A claim for refund or credit

on Form 740 or 740-NP. Enter in columns (b), (d) and (f) the

resulting from a net operating loss occurring in a taxable year

recomputed itemized deductions or the standard deduction

must be filed within four years from the due date of the return

after the carryback. To recompute the itemized deductions,

including extensions or the date the tax was paid, whichever is

determine the deduction for charitable contributions without

later, for the year of the loss. The Cabinet must follow the

regard to any net operating loss carryback. Any other

provisions of KRS 141.210 and 141.235 with respect to the time

deductions claimed, based on or limited to a percentage of

limitations for assessments and refunds of the tax. Denials of

income (such as medical expenses) must be recomputed on the

refunds claimed or adjustments to refund claims by the Cabinet

basis of income, determined after applying the net operating

must be protested in writing within 45 days pursuant to KRS

loss carryback.

131.110.

Line 11, Income tax—For columns (b), (d) and (f) recompute the

LINE-BY-LINE INSTRUCTIONS

tax after taking the net operating loss carryback into account.

Complete columns (a) and (b) only if you may use the three-

Attach a detailed computation. Recompute credits subject to

year carryback period for an eligible loss . All others complete

limitations such as the low income tax credit and the credits

columns (c), (d), (e) and (f). Enter in columns (a), (c) and (e) the

listed on Schedule TC. The tax form and instructions for the

amounts for the applicable carryback year as shown on your

applicable year will help make this computation. Include on this

original or amended return. If the return was adjusted, enter the

line any tax from Form 4972-K, Kentucky Tax on Lump-Sum

amounts determined as a result of the examination.

Distributions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1