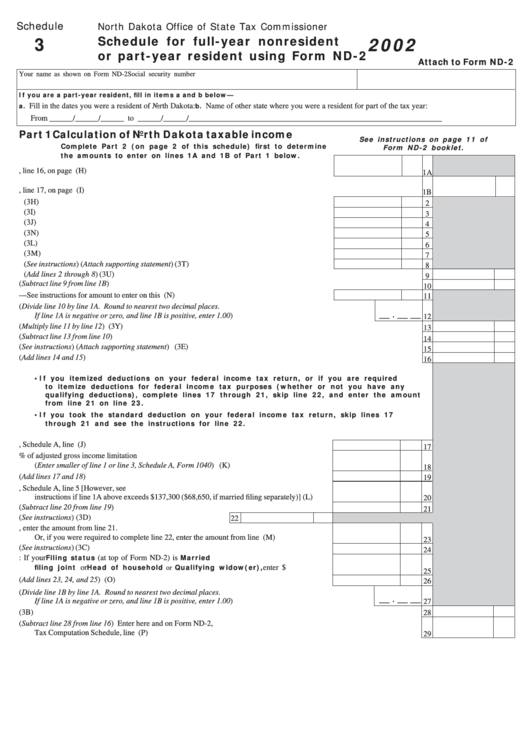

Schedule 3 - Schedule For Full-Year Nonresident Or Part Year Resident Using Form Nd-2 - 2002

ADVERTISEMENT

Schedule

North Dakota Office of State Tax Commissioner

3

Schedule for full-year nonresident

2002

or part-year resident using Form ND-2

Attach to Form ND-2

Your name as shown on Form ND-2

Social security number

If you are a part-year resident, fill in items a and b below—

a.

b.

Fill in the dates you were a resident of North Dakota:

Name of other state where you were a resident for part of the tax year:

From ______/______/______ to ______/______/______

___________________________________________________________

Part 1 Calculation of North Dakota taxable income

See instructions on page 11 of

Complete Part 2 (on page 2 of this schedule) first to determine

Form ND-2 booklet.

the amounts to enter on lines 1A and 1B of Part 1 below.

1A. Federal adjusted gross income from Part 2, line 16, on page 2 ............................................... (H)

1A

1B. North Dakota adjusted gross income from Part 2, line 17, on page 2 ................................................................................... (I)

1B

2. Interest income from sale of land to a qualifying beginning farmer ...................................... (3H)

2

3. Rental income from leasing of land to a qualifying beginning farmer ...................................... (3I)

3

4. Gain from sale of land to a qualifying beginning farmer ......................................................... (3J)

4

5. Interest income from sale of a business to a qualifying beginning entrepreneur ................... (3N)

5

6. Rental income from leasing a business to a qualifying beginning entrepreneur ..................... (3L)

6

7. Gain from sale of a business to a qualifying beginning entrepreneur ................................... (3M)

7

8. Other (See instructions) (Attach supporting statement) ......................................................... (3T)

8

9. Total North Dakota subtractions (Add lines 2 through 8) ................................................................................................. (3U)

9

10. Balance (Subtract line 9 from line 1B) .......................................................................................................................................

10

11. Federal income tax—See instructions for amount to enter on this line .................................. (N)

11

12. North Dakota income ratio (Divide line 10 by line 1A. Round to nearest two decimal places.

__ . __ __

If line 1A is negative or zero, and line 1B is positive, enter 1.00) ......................................................................

12

13. Federal income tax deduction (Multiply line 11 by line 12) ................................................................................................. (3Y)

13

14. Balance (Subtract line 13 from line 10) ......................................................................................................................................

14

15. North Dakota additions (See instructions) (Attach supporting statement) ......................................................................... (3E)

15

16. Balance (Add lines 14 and 15) ...................................................................................................................................................

16

• If you itemized deductions on your federal income tax return, or if you are required

to itemize deductions for federal income tax purposes (whether or not you have any

qualifying deductions), complete lines 17 through 21, skip line 22, and enter the amount

from line 21 on line 23.

• If you took the standard deduction on your federal income tax return, skip lines 17

through 21 and see the instructions for line 22.

17. Federal itemized deductions from Form 1040, Schedule A, line 28 ......................................... (J)

17

18. Medical expenses not allowed due to 7.5% of adjusted gross income limitation

(Enter smaller of line 1 or line 3, Schedule A, Form 1040) .................................................... (K)

18

19. Balance (Add lines 17 and 18) ......................................................................................................

19

20. State and local income taxes from Form 1040, Schedule A, line 5 [However, see

instructions if line 1A above exceeds $137,300 ($68,650, if married filing separately)] ......... (L)

20

21. Net itemized deductions (Subtract line 20 from line 19) ..............................................................

21

22. Federal standard deduction (See instructions) ................. (3D)

22

23. If you were required to complete lines 17 through 21, enter the amount from line 21.

Or, if you were required to complete line 22, enter the amount from line 22 ....................... (M)

23

24. Federal exemption amount (See instructions) ....................................................................... (3C)

24

Filing status

Married

25. Additional exemption amount: If your

(at top of Form ND-2) is

filing joint

Head of household or Qualifying widow(er),

or

enter $300 ...........

25

26. Total (Add lines 23, 24, and 25) ............................................................................................. (O)

26

27. North Dakota income ratio (Divide line 1B by line 1A. Round to nearest two decimal places.

__ . __ __

If line 1A is negative or zero, and line 1B is positive, enter 1.00) ......................................................................

27

28. Multiply line 26 by line 27 ................................................................................................................................................ (3B)

28

29. North Dakota taxable income (Subtract line 28 from line 16) Enter here and on Form ND-2,

Tax Computation Schedule, line 1 ........................................................................................................................................ (P)

29

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2