Instructions For Underpayment Of Estimated Tax - Minnesota Department Of Revenue

ADVERTISEMENT

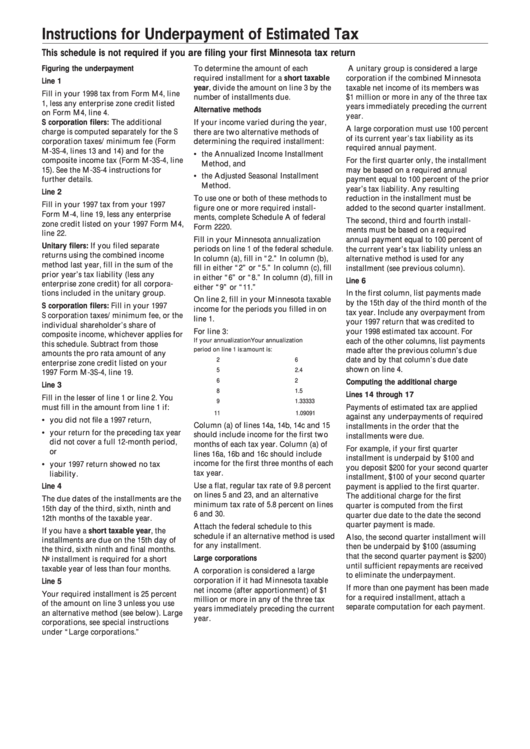

Instructions for Underpayment of Estimated Tax

This schedule is not required if you are filing your first Minnesota tax return

Figuring the underpayment

To determine the amount of each

A unitary group is considered a large

required installment for a short taxable

corporation if the combined Minnesota

Line 1

year, divide the amount on line 3 by the

taxable net income of its members was

Fill in your 1998 tax from Form M4, line

number of installments due.

$1 million or more in any of the three tax

1, less any enterprise zone credit listed

years immediately preceding the current

Alternative methods

on Form M4, line 4.

year.

S corporation filers: The additional

If your income varied during the year,

A large corporation must use 100 percent

charge is computed separately for the S

there are two alternative methods of

of its current year’s tax liability as its

corporation taxes/minimum fee (Form

determining the required installment:

required annual payment.

M-3S-4, lines 13 and 14) and for the

• the Annualized Income Installment

composite income tax (Form M-3S-4, line

For the first quarter only, the installment

Method, and

15). See the M-3S-4 instructions for

may be based on a required annual

• the Adjusted Seasonal Installment

further details.

payment equal to 100 percent of the prior

Method.

year’s tax liability. Any resulting

Line 2

To use one or both of these methods to

reduction in the installment must be

Fill in your 1997 tax from your 1997

figure one or more required install-

added to the second quarter installment.

Form M-4, line 19, less any enterprise

ments, complete Schedule A of federal

The second, third and fourth install-

zone credit listed on your 1997 Form M4,

Form 2220.

ments must be based on a required

line 22.

Fill in your Minnesota annualization

annual payment equal to 100 percent of

Unitary filers: If you filed separate

periods on line 1 of the federal schedule.

the current year’s tax liability unless an

returns using the combined income

In column (a), fill in “2.” In column (b),

alternative method is used for any

method last year, fill in the sum of the

fill in either “2” or “5.” In column (c), fill

installment (see previous column).

prior year’s tax liability (less any

in either “6” or “8.” In column (d), fill in

Line 6

enterprise zone credit) for all corpora-

either “9” or “11.”

tions included in the unitary group.

In the first column, list payments made

On line 2, fill in your Minnesota taxable

by the 15th day of the third month of the

S corporation filers: Fill in your 1997

income for the periods you filled in on

tax year. Include any overpayment from

S corporation taxes/minimum fee, or the

line 1.

your 1997 return that was credited to

individual shareholder’s share of

For line 3:

your 1998 estimated tax account. For

composite income, whichever applies for

If your annualization

Your annualization

each of the other columns, list payments

this schedule. Subtract from those

period on line 1 is:

amount is:

made after the previous column’s due

amounts the pro rata amount of any

date and by that column’s due date

2

6

enterprise zone credit listed on your

shown on line 4.

5

2.4

1997 Form M-3S-4, line 19.

6

2

Computing the additional charge

Line 3

8

1.5

Lines 14 through 17

Fill in the lesser of line 1 or line 2. You

9

1.33333

must fill in the amount from line 1 if:

Payments of estimated tax are applied

11

1.09091

against any underpayments of required

• you did not file a 1997 return,

Column (a) of lines 14a, 14b, 14c and 15

installments in the order that the

• your return for the preceding tax year

should include income for the first two

installments were due.

did not cover a full 12-month period,

months of each tax year. Column (a) of

For example, if your first quarter

or

lines 16a, 16b and 16c should include

installment is underpaid by $100 and

income for the first three months of each

• your 1997 return showed no tax

you deposit $200 for your second quarter

tax year.

liability.

installment, $100 of your second quarter

Line 4

Use a flat, regular tax rate of 9.8 percent

payment is applied to the first quarter.

on lines 5 and 23, and an alternative

The additional charge for the first

The due dates of the installments are the

minimum tax rate of 5.8 percent on lines

quarter is computed from the first

15th day of the third, sixth, ninth and

6 and 30.

quarter due date to the date the second

12th months of the taxable year.

quarter payment is made.

Attach the federal schedule to this

If you have a short taxable year, the

schedule if an alternative method is used

Also, the second quarter installment will

installments are due on the 15th day of

for any installment.

then be underpaid by $100 (assuming

the third, sixth ninth and final months.

that the second quarter payment is $200)

Large corporations

No installment is required for a short

until sufficient repayments are received

taxable year of less than four months.

A corporation is considered a large

to eliminate the underpayment.

Line 5

corporation if it had Minnesota taxable

If more than one payment has been made

net income (after apportionment) of $1

Your required installment is 25 percent

for a required installment, attach a

million or more in any of the three tax

of the amount on line 3 unless you use

separate computation for each payment.

years immediately preceding the current

an alternative method (see below). Large

year.

corporations, see special instructions

under “Large corporations.”

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1