Instructions For Form Ct-990t - Connecticut Department Of Revenue Services

ADVERTISEMENT

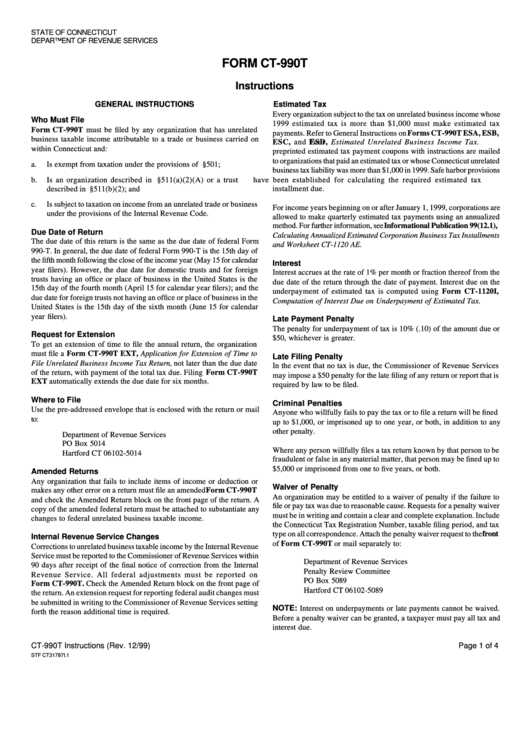

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

FORM CT-990T

Instructions

GENERAL INSTRUCTIONS

Estimated Tax

Every organization subject to the tax on unrelated business income whose

Who Must File

1999 estimated tax is more than $1,000 must make estimated tax

Form CT-990T

must be filed by any organization that has unrelated

payments. Refer to General Instructions on

Forms CT-990T ESA, ESB,

business taxable income attributable to a trade or business carried on

ESC,

and

ESD,

Estimated Unrelated Business Income Tax.

Four

within Connecticut and:

preprinted estimated tax payment coupons with instructions are mailed

to organizations that paid an estimated tax or whose Connecticut unrelated

a.

Is exempt from taxation under the provisions of I.R.C. §501;

business tax liability was more than $1,000 in 1999. Safe harbor provisions

b.

Is an organization described in I.R.C. §511(a)(2)(A) or a trust

have been established for calculating the required estimated tax

described in I.R.C. §511(b)(2); and

installment due.

c.

Is subject to taxation on income from an unrelated trade or business

For income years beginning on or after January 1, 1999, corporations are

under the provisions of the Internal Revenue Code.

allowed to make quarterly estimated tax payments using an annualized

method. For further information, see

Informational Publication 99(12.1),

Due Date of Return

Calculating Annualized Estimated Corporation Business Tax Installments

The due date of this return is the same as the due date of federal Form

and Worksheet CT-1120 AE.

990-T. In general, the due date of federal Form 990-T is the 15th day of

the fifth month following the close of the income year (May 15 for calendar

Interest

year filers). However, the due date for domestic trusts and for foreign

Interest accrues at the rate of 1% per month or fraction thereof from the

trusts having an office or place of business in the United States is the

due date of the return through the date of payment. Interest due on the

15th day of the fourth month (April 15 for calendar year filers); and the

underpayment of estimated tax is computed using

Form CT-1120I,

due date for foreign trusts not having an office or place of business in the

Computation of Interest Due on Underpayment of Estimated Tax.

United States is the 15th day of the sixth month (June 15 for calendar

year filers).

Late Payment Penalty

The penalty for underpayment of tax is 10% (.10) of the amount due or

Request for Extension

$50, whichever is greater.

To get an extension of time to file the annual return, the organization

must file a

Form CT-990T EXT,

Application for Extension of Time to

Late Filing Penalty

File Unrelated Business Income Tax Return,

not later than the due date

In the event that no tax is due, the Commissioner of Revenue Services

of the return, with payment of the total tax due. Filing

Form CT-990T

may impose a $50 penalty for the late filing of any return or report that is

EXT

automatically extends the due date for six months.

required by law to be filed.

Where to File

Criminal Penalties

Use the pre-addressed envelope that is enclosed with the return or mail

Anyone who willfully fails to pay the tax or to file a return will be fined

to:

up to $1,000, or imprisoned up to one year, or both, in addition to any

other penalty.

Department of Revenue Services

PO Box 5014

Where any person willfully files a tax return known by that person to be

Hartford CT 06102-5014

fraudulent or false in any material matter, that person may be fined up to

$5,000 or imprisoned from one to five years, or both.

Amended Returns

Any organization that fails to include items of income or deduction or

Waiver of Penalty

makes any other error on a return must file an amended

Form CT-990T

An organization may be entitled to a waiver of penalty if the failure to

and check the Amended Return block on the front page of the return. A

file or pay tax was due to reasonable cause. Requests for a penalty waiver

copy of the amended federal return must be attached to substantiate any

must be in writing and contain a clear and complete explanation. Include

changes to federal unrelated business taxable income.

the Connecticut Tax Registration Number, taxable filing period, and tax

type on all correspondence. Attach the penalty waiver request to the

front

Internal Revenue Service Changes

of

Form CT-990T

or mail separately to:

Corrections to unrelated business taxable income by the Internal Revenue

Service must be reported to the Commissioner of Revenue Services within

Department of Revenue Services

90 days after receipt of the final notice of correction from the Internal

Penalty Review Committee

Revenue Service. All federal adjustments must be reported on

PO Box 5089

Form CT-990T.

Check the Amended Return block on the front page of

Hartford CT 06102-5089

the return. An extension request for reporting federal audit changes must

be submitted in writing to the Commissioner of Revenue Services setting

NOTE:

Interest on underpayments or late payments cannot be waived.

forth the reason additional time is required.

Before a penalty waiver can be granted, a taxpayer must pay all tax and

interest due.

CT-990T Instructions (Rev. 12/99)

Page 1 of 4

STF CT31787I.1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4