Form Ct-1120at - Connecticut Department Of Revenue Services Apprenticeship Training Tax Credit 2015

ADVERTISEMENT

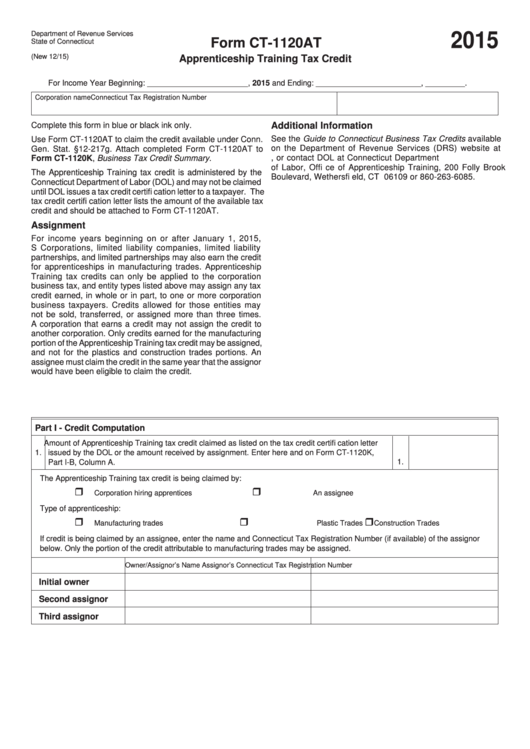

Department of Revenue Services

2015

Form CT-1120AT

State of Connecticut

(New 12/15)

Apprenticeship Training Tax Credit

For Income Year Beginning: _______________________ , 2015 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Complete this form in blue or black ink only.

Additional Information

See the Guide to Connecticut Business Tax Credits available

Use Form CT-1120AT to claim the credit available under Conn.

on the Department of Revenue Services (DRS) website at

Gen. Stat. §12-217g. Attach completed Form CT-1120AT to

, or contact DOL at Connecticut Department

Form CT-1120K, Business Tax Credit Summary.

of Labor, Offi ce of Apprenticeship Training, 200 Folly Brook

The Apprenticeship Training tax credit is administered by the

Boulevard, Wethersfi eld, CT 06109 or 860-263-6085.

Connecticut Department of Labor (DOL) and may not be claimed

until DOL issues a tax credit certifi cation letter to a taxpayer. The

tax credit certifi cation letter lists the amount of the available tax

credit and should be attached to Form CT-1120AT.

Assignment

For income years beginning on or after January 1, 2015,

S Corporations, limited liability companies, limited liability

partnerships, and limited partnerships may also earn the credit

for apprenticeships in manufacturing trades. Apprenticeship

Training tax credits can only be applied to the corporation

business tax, and entity types listed above may assign any tax

credit earned, in whole or in part, to one or more corporation

business taxpayers. Credits allowed for those entities may

not be sold, transferred, or assigned more than three times.

A corporation that earns a credit may not assign the credit to

another corporation. Only credits earned for the manufacturing

portion of the Apprenticeship Training tax credit may be assigned,

and not for the plastics and construction trades portions. An

assignee must claim the credit in the same year that the assignor

would have been eligible to claim the credit.

Part I - Credit Computation

Amount of Apprenticeship Training tax credit claimed as listed on the tax credit certifi cation letter

1.

issued by the DOL or the amount received by assignment. Enter here and on Form CT-1120K,

1.

Part I-B, Column A.

The Apprenticeship Training tax credit is being claimed by:

Corporation hiring apprentices

An assignee

Type of apprenticeship:

Manufacturing trades

Plastic Trades

Construction Trades

If credit is being claimed by an assignee, enter the name and Connecticut Tax Registration Number (if available) of the assignor

below. Only the portion of the credit attributable to manufacturing trades may be assigned.

Owner/Assignor’s Name

Assignor’s Connecticut Tax Registration Number

Initial owner

Second assignor

Third assignor

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1