Form Fr-128 - Extension Of Time To File D.c. Franchise Or Partnership Return - 2002

ADVERTISEMENT

*021280110000*

Extension of Time

2002

FR-128

Government of the

District of Columbia

to File D.C. Franchise

or Partnership Return

FEDERAL EMPLOYER I.D. NUMBER

SOC. SEC. NO. (IF SELF-EMPLOYED)

OFFICIAL USE:

BUSINESS NAME

TAXABLE YEAR ENDING MM/DD/YYYY

BUSINESS MAILING ADDRESS LINE #1

Fill in

if your address is different from last year’s return.

BUSINESS MAILING ADDRESS LINE #2

CITY

STATE

ZIP + 4

-

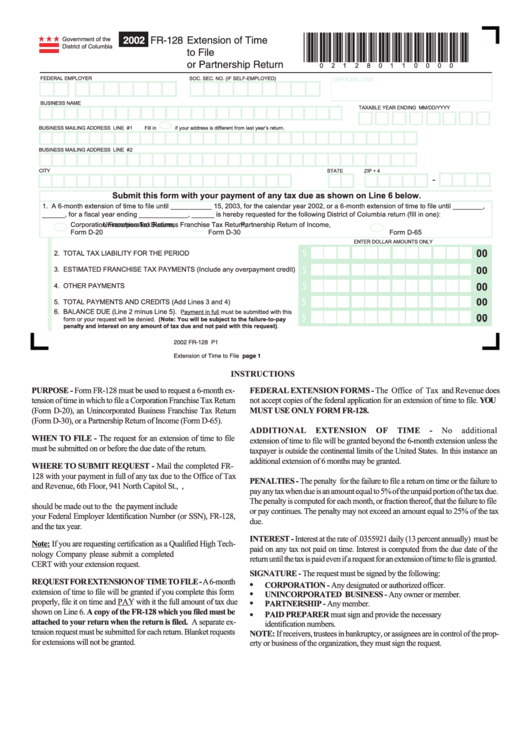

Submit this form with your payment of any tax due as shown on Line 6 below.

1. A 6-month extension of time to file until ___________ 15, 2003, for the calendar year 2002, or a 6-month extension of time to file until ________,

______, for a fiscal year ending _____________, ______ is hereby requested for the following District of Columbia return (fill in one):

Corporation Franchise Tax Return,

Unincorporated Business Franchise Tax Return,

Partnership Return of Income,

Form D-20

Form D-30

Form D-65

ENTER DOLLAR AMOUNTS ONLY

2. TOTAL TAX LIABILITY FOR THE PERIOD ......................................................

3. ESTIMATED FRANCHISE TAX PAYMENTS (Include any overpayment credit)

4. OTHER PAYMENTS .........................................................................................

5. TOTAL PAYMENTS AND CREDITS (Add Lines 3 and 4) .................................

6. BALANCE DUE (Line 2 minus Line 5).

Payment in full must be submitted with this

form or your request will be denied. (Note: You will be subject to the failure-to-pay

penalty and interest on any amount of tax due and not paid with this request).

2002 FR-128 P1

Extension of Time to File D.C. Franchise or Partnership Return page 1

INSTRUCTIONS

PURPOSE - Form FR-128 must be used to request a 6-month ex-

FEDERAL EXTENSION FORMS - The Office of Tax and Revenue does

not accept copies of the federal application for an extension of time to file. YOU

tension of time in which to file a Corporation Franchise Tax Return

(Form D-20), an Unincorporated Business Franchise Tax Return

MUST USE ONLY FORM FR-128.

(Form D-30), or a Partnership Return of Income (Form D-65).

ADDITIONAL

EXTENSION

OF

TIME

-

No

additional

WHEN TO FILE - The request for an extension of time to file

extension of time to file will be granted beyond the 6-month extension unless the

must be submitted on or before the due date of the return.

taxpayer is outside the continental limits of the United States. In this instance an

additional extension of 6 months may be granted.

WHERE TO SUBMIT REQUEST - Mail the completed FR-

128 with your payment in full of any tax due to the Office of Tax

PENALTIES - The penalty for the failure to file a return on time or the failure to

and Revenue, 6th Floor, 941 North Capitol St., N.E. Washington,

pay any tax when due is an amount equal to 5% of the unpaid portion of the tax due.

D.C. 20002. Be sure to sign and date the FR-128. Your payment

The penalty is computed for each month, or fraction thereof, that the failure to file

should be made out to the D.C. Treasurer. On the payment include

or pay continues. The penalty may not exceed an amount equal to 25% of the tax

your Federal Employer Identification Number (or SSN), FR-128,

due.

and the tax year.

INTEREST - Interest at the rate of .0355921 daily (13 percent annually) must be

Note: If you are requesting certification as a Qualified High Tech-

paid on any tax not paid on time. Interest is computed from the due date of the

nology Company please submit a completed D.C. form QHTC-

return until the tax is paid even if a request for an extension of time to file is granted.

CERT with your extension request.

SIGNATURE - The request must be signed by the following:

REQUEST FOR EXTENSION OF TIME TO FILE - A 6-month

•

CORPORATION - Any designated or authorized officer.

extension of time to file will be granted if you complete this form

•

UNINCORPORATED BUSINESS - Any owner or member.

properly, file it on time and PAY with it the full amount of tax due

•

PARTNERSHIP - Any member.

shown on Line 6. A copy of the FR-128 which you filed must be

•

PAID PREPARER must sign and provide the necessary

attached to your return when the return is filed. A separate ex-

identification numbers.

tension request must be submitted for each return. Blanket requests

NOTE: If receivers, trustees in bankruptcy, or assignees are in control of the prop-

for extensions will not be granted.

erty or business of the organization, they must sign the request.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2