Form 105 Draft - Colorado Fiduciary Income Tax Return - 2010 Page 5

ADVERTISEMENT

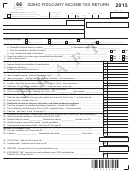

Fiduciary’s coPy oF Page one, Form 105, lines 1–23

2010

Name of estate or trust

Colorado account number

•

.00

1. Federal taxable income, line 22, federal Form 1041 .....................................................................................................

1

2. Additions to federal taxable income, explain

•

.00

round all

__________________________________________________________________

2

3. Subtractions from federal taxable income, explain

amounTs

•

.00

__________________________________________________________________

3

To The

.00

4. Net modifications, line 2 minus line 3 ......................................................................... 4

nearesT dollar.

•

.00

5. Net modifications allocated to beneficiaries ..............................................................

5

.00

6. Net modifications allocated to the estate or trust, line 4 minus line 5 ........................................................................... 6

.00

7. Colorado taxable income of the estate or trust, line 1 plus or minus line 6 ................................................................... 7

•

.00

8. Normal Tax, 4.63% of the amount on line 7. Nonresident estates or trusts enter tax from line 8, schedule E .............

8

•

.00

9. Alternative minimum tax from line 8, schedule F ............................................................................................................

9

.00

10. Total of lines 8 and 9 ................................................................................................................................................... 10

•

.00

11. Credits from line 7, schedule G ...................................................................................................................................

11

•

.00

12. Gross conservation easement credit ...........................................................................................................................

12

.00

13. Total of lines 11 and 12—Total credits may not exceed line 10 ................................................................................. 13

.00

14. Net tax, line 10 minus line 13 .................................................................................................................................... 14

•

.00

15. Estimated tax payments and credits ............................................................................................................................

15

•

.00

16. Colorado income tax withheld from wages ..................................................................................................................

16

•

.00

17. Refundable alternative fuel vehicle credit ....................................................................................................................

17

.00

18. Total of lines 15 through 17 ......................................................................................................................................... 18

•

.00

19. penalty, also include on line 21 if applicable ..............................................................................................................

19

•

.00

20. Interest, also include on line 21 if applicable ..............................................................................................................

20

21. If amount on line 14 exceeds amount on line 18, enter amount owed.

•

.00

(Make checks payable to Colorado Department of Revenue) or pay online: .....................

21

.00

22. If line 18 is larger that line 14, enter overpayment . ................................................................................................... 22

•

.00

23. overpayment to be credited to 2011 estimated tax .....................................................................................................

23

•

.00

24. overpayment to be refunded .......................................................................................................................................

24

Be sure to round your payment to the nearest dollar. The amount on the check and the amount entered on

DETACH FORM

ON THIS LINE

the payment voucher must be the same. This will help maintain accuracy in your tax account.

reTurn only The lower PorTion oF This Page wiTh your PaymenT

(0068)

2010 Colorado Nonresident Beneficiary

Vendor id

Form 104BEP ( 09/21/10)

70

estimated income Tax Payment Voucher

colorado deParTmenT oF reVenue

Payment for Nonresident Beneficiary—See Instructions on Page 3

For tax period ______________________, ending _________________________ .

Return this voucher with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-0008. Write the beneficiary’s social security number

and “ 2010 Form 104BEp” on the check or money order. Do not send cash. File only if you are making a payment. submit a separate check or money order for each document.

Payment is due at the time the income is distributed.

Beneficiary’s last Name

First Name and middle Initial

Address

social security Number

City

State

ZIP

IF No pAymENT Is DuE, Do NoT FIlE ThIs FoRm.

Amount of Payment

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day

received by the state. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department

of Revenue may collect the payment amount directly from your bank account electronically.

(08)

$

.00

(Do not write in space below)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5