Instructions For Form 5461 Draft - City Of Detroit Partnership Income Tax Quarterly Estimated Payment Voucher - 2017

ADVERTISEMENT

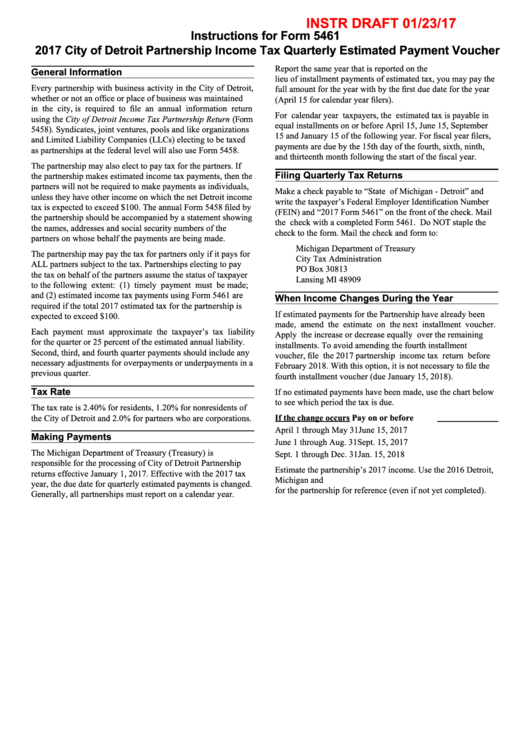

INSTR DRAFT 01/23/17

Instructions for Form 5461

2017 City of Detroit Partnership Income Tax Quarterly Estimated Payment Voucher

Report the same year that is reported on the U.S. Form 1065. In

General Information

lieu of installment payments of estimated tax, you may pay the

Every partnership with business activity in the City of Detroit,

full amount for the year with by the first due date for the year

whether or not an office or place of business was maintained

(April 15 for calendar year filers).

in the city, is required to file an annual information return

For calendar year taxpayers, the estimated tax is payable in

using the City of Detroit Income Tax Partnership Return (Form

equal installments on or before April 15, June 15, September

5458). Syndicates, joint ventures, pools and like organizations

15 and January 15 of the following year. For fiscal year filers,

and Limited Liability Companies (LLCs) electing to be taxed

payments are due by the 15th day of the fourth, sixth, ninth,

as partnerships at the federal level will also use Form 5458.

and thirteenth month following the start of the fiscal year.

The partnership may also elect to pay tax for the partners. If

Filing Quarterly Tax Returns

the partnership makes estimated income tax payments, then the

partners will not be required to make payments as individuals,

Make a check payable to “State of Michigan - Detroit” and

unless they have other income on which the net Detroit income

write the taxpayer’s Federal Employer Identification Number

tax is expected to exceed $100. The annual Form 5458 filed by

(FEIN) and “2017 Form 5461” on the front of the check. Mail

the partnership should be accompanied by a statement showing

the check with a completed Form 5461. Do NOT staple the

the names, addresses and social security numbers of the

check to the form. Mail the check and form to:

partners on whose behalf the payments are being made.

Michigan Department of Treasury

The partnership may pay the tax for partners only if it pays for

City Tax Administration

ALL partners subject to the tax. Partnerships electing to pay

PO Box 30813

the tax on behalf of the partners assume the status of taxpayer

Lansing MI 48909

to the following extent: (1) timely payment must be made;

and (2) estimated income tax payments using Form 5461 are

When Income Changes During the Year

required if the total 2017 estimated tax for the partnership is

If estimated payments for the Partnership have already been

expected to exceed $100.

made, amend the estimate on the next installment voucher.

Each payment must approximate the taxpayer’s tax liability

Apply the increase or decrease equally over the remaining

for the quarter or 25 percent of the estimated annual liability.

installments. To avoid amending the fourth installment

Second, third, and fourth quarter payments should include any

voucher, file the 2017 partnership income tax return before

necessary adjustments for overpayments or underpayments in a

February 2018. With this option, it is not necessary to file the

previous quarter.

fourth installment voucher (due January 15, 2018).

Tax Rate

If no estimated payments have been made, use the chart below

to see which period the tax is due.

The tax rate is 2.40% for residents, 1.20% for nonresidents of

If the change occurs

Pay on or before

the City of Detroit and 2.0% for partners who are corporations.

April 1 through May 31 .......................................... June 15, 2017

Making Payments

June 1 through Aug. 31 .......................................... Sept. 15, 2017

The Michigan Department of Treasury (Treasury) is

Sept. 1 through Dec. 31 ........................................... Jan. 15, 2018

responsible for the processing of City of Detroit Partnership

Estimate the partnership’s 2017 income. Use the 2016 Detroit,

returns effective January 1, 2017. Effective with the 2017 tax

Michigan and U.S. composite/partnership income tax returns

year, the due date for quarterly estimated payments is changed.

for the partnership for reference (even if not yet completed).

Generally, all partnerships must report on a calendar year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1