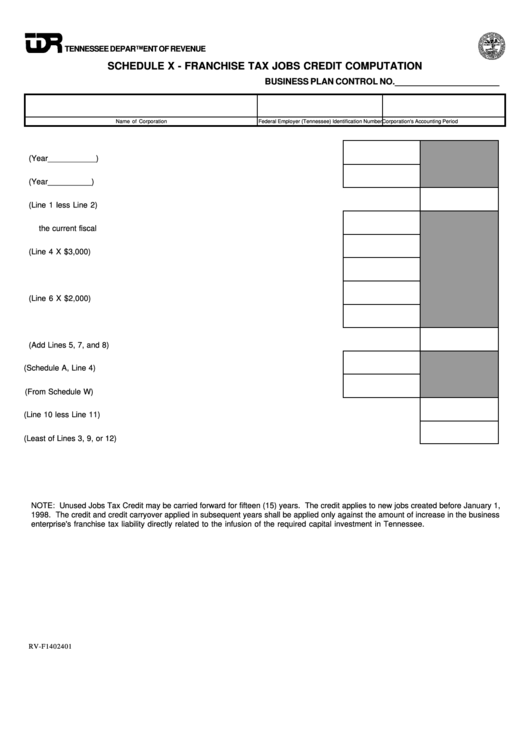

TENNESSEE DEPARTMENT OF REVENUE

SCHEDULE X - FRANCHISE TAX JOBS CREDIT COMPUTATION

BUSINESS PLAN CONTROL NO. ______________________

Name of Corporation

Federal Employer (Tennessee) Identification Number

Corporation's Accounting Period

1. Franchise Tax Liability on return first reflecting increase (Year ___________ ) .........

2. Franchise Tax from year immediately prior to investment (Year __________ ) .........

3. Franchise Tax Jobs Credit Limitation (Line 1 less Line 2) ............................................................................

4. New Tennessee jobs created and filled in economically distressed counties during

the current fiscal year ....................................................................................................

5. Jobs Tax Credit from jobs created in distressed counties (Line 4 X $3,000) ..............

6. Other new Tennessee jobs created and filled during the current fiscal year ..............

7. Jobs Tax Credit from jobs created in non-distressed counties (Line 6 X $2,000) ......

8. Jobs Tax Credit carryover from prior years ...................................................................

9. Total Jobs Tax Credit (Add Lines 5, 7, and 8) ................................................................................................

10. Franchise Tax (Schedule A, Line 4) ..............................................................................

11. Franchise Tax Day Care Credit (From Schedule W) ....................................................

12. Franchise Tax after Day Care Credit (Line 10 less Line 11) .........................................................................

13. Total Jobs Tax Credit available in current year (Least of Lines 3, 9, or 12) ...................................................

NOTE: Unused Jobs Tax Credit may be carried forward for fifteen (15) years. The credit applies to new jobs created before January 1,

1998. The credit and credit carryover applied in subsequent years shall be applied only against the amount of increase in the business

enterprise's franchise tax liability directly related to the infusion of the required capital investment in Tennessee.

RV-F1402401

1

1 2

2