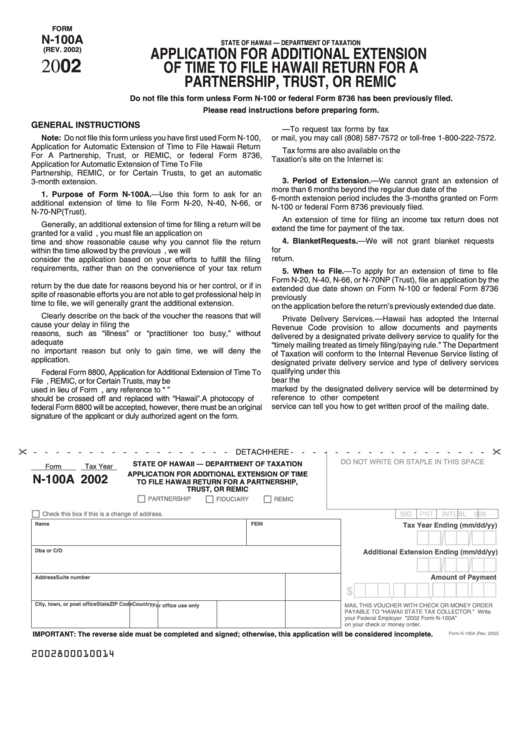

Form N-100a - Application For Additional Extension Of Time To File Hawaii Return For A Partnership, Trust, Or Remic - 2002

ADVERTISEMENT

FORM

N-100A

STATE OF HAWAII –– DEPARTMENT OF TAXATION

(REV. 2002)

APPLICATION FOR ADDITIONAL EXTENSION

2002

OF TIME TO FILE HAWAII RETURN FOR A

PARTNERSHIP, TRUST, OR REMIC

Do not file this form unless Form N-100 or federal Form 8736 has been previously filed.

Please read instructions before preparing form.

GENERAL INSTRUCTIONS

2. How to Obtain Tax Forms.—To request tax forms by fax

Note: Do not file this form unless you have first used Form N-100,

or mail, you may call (808) 587-7572 or toll-free 1-800-222-7572.

Application for Automatic Extension of Time to File Hawaii Return

Tax forms are also available on the Internet. The Department of

For A Partnership, Trust, or REMIC, or federal Form 8736,

Taxation’s site on the Internet is:

Application for Automatic Extension of Time To File U.S. Return for a

Partnership, REMIC, or for Certain Trusts, to get an automatic

3. Period of Extension.—We cannot grant an extension of

3-month extension.

more than 6 months beyond the regular due date of the return. The

1. Purpose of Form N-100A.—Use this form to ask for an

6-month extension period includes the 3-months granted on Form

additional extension of time to file Form N-20, N-40, N-66, or

N-100 or federal Form 8736 previously filed.

N-70-NP(Trust).

An extension of time for filing an income tax return does not

Generally, an additional extension of time for filing a return will be

extend the time for payment of the tax.

granted for a valid reason. However, you must file an application on

4. Blanket Requests.—We will not grant blanket requests

time and show reasonable cause why you cannot file the return

for extensions. You must file a separate extension form for each

within the time allowed by the previous extension. Generally, we will

return.

consider the application based on your efforts to fulfill the filing

requirements, rather than on the convenience of your tax return

5. When to File.—To apply for an extension of time to file

preparer. But if your tax return preparer is not able to complete the

Form N-20, N-40, N-66, or N-70NP (Trust), file an application by the

return by the due date for reasons beyond his or her control, or if in

extended due date shown on Form N-100 or federal Form 8736

spite of reasonable efforts you are not able to get professional help in

previously filed. Do so early enough so that we will have time to act

time to file, we will generally grant the additional extension.

on the application before the return’s previously extended due date.

Clearly describe on the back of the voucher the reasons that will

Private Delivery Services.—Hawaii has adopted the Internal

cause your delay in filing the return. We cannot accept incomplete

Revenue Code provision to allow documents and payments

reasons, such as “illness” or “practitioner too busy,” without

delivered by a designated private delivery service to qualify for the

adequate explanations. If it is clear that an application was made for

“timely mailing treated as timely filing/paying rule.” The Department

no important reason but only to gain time, we will deny the

of Taxation will conform to the Internal Revenue Service listing of

application.

designated private delivery service and type of delivery services

qualifying under this provision. Timely filing of mail which does not

Federal Form 8800, Application for Additional Extension of Time To

bear the U.S. Post Office cancellation mark or the date recorded or

File U.S. Return for a Partnership, REMIC, or for Certain Trusts, may be

marked by the designated delivery service will be determined by

used in lieu of Form N-100A. In the title area, any reference to “U.S.”

reference to other competent evidence.

The private delivery

should be crossed off and replaced with “Hawaii”. A photocopy of

service can tell you how to get written proof of the mailing date.

federal Form 8800 will be accepted, however, there must be an original

signature of the applicant or duly authorized agent on the form.

" -

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

DETACH HERE -

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

"

DO NOT WRITE OR STAPLE IN THIS SPACE

STATE OF HAWAII — DEPARTMENT OF TAXATION

Tax Year

Form

APPLICATION FOR ADDITIONAL EXTENSION OF TIME

N-100A

2002

TO FILE HAWAII RETURN FOR A PARTNERSHIP,

TRUST, OR REMIC

¨

¨

¨

PARTNERSHIP

FIDUCIARY

REMIC

¨

Check this box if this is a change of address.

SIG

PNT

INT

LBL

008

Name

FEIN

Tax Year Ending (mm/dd/yy)

Dba or C/O

Additional Extension Ending (mm/dd/yy)

Amount of Payment

Address

Suite number

$

,

,

.

City, town, or post office

State

ZIP Code

Country

MAIL THIS VOUCHER WITH CHECK OR MONEY ORDER

For office use only

PAYABLE TO “HAWAII STATE TAX COLLECTOR.” Write

your Federal Employer I.D. Number and “2002 Form N-100A”

on your check or money order.

IMPORTANT: The reverse side must be completed and signed; otherwise, this application will be considered incomplete.

Form N-100A (Rev. 2002)

2002800010014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2