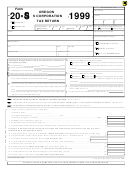

Form 355s-A - Domestic S Corporation Excise Return - 1999 Page 4

ADVERTISEMENT

Schedule D. Intangible Property Corporation —

Value of Net Worth Allocated to Massachusetts

1999 355S-A — Page 4

(Complete this schedule only if Schedule B, line 19 is less than 10%). Note: Enter all values as net book values from Schedule A, column C

31. Total assets (Schedule A, line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 $

32. Total liabilities (Schedule A, line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 $

33. Mass. tangible property subject to local taxation (Schedule B, line 6) . . . . . . 3 $

34. Less any mortgages thereon (Schedule A, line 19a). Enter result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 $

35. Investments in and advances to subsidiaries which are 80% or more owned . . . . . . . . . . . . . . . . . . . . . . . . . 5 $

36. Deductions from total assets. Add lines 2, 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 $

37. Allocable net worth, domestic corporation. Subtract line 6 from line 1. Do not enter less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 $

38. Income apportionment percentage (Schedule F, line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

%

39. Taxable net worth, domestic calculation. Multiply line 7 by line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 $

10. Total tangible assets (Schedule A, line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 $

11. Total intangible assets. Subtract line 10 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 $

12. Investments in and advances to subsidiaries which are 80% or more owned. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13. Subtract line 12 from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 $

14. Income apportionment percentage (Schedule F, line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

%

15. Intangible assets allocable to Massachusetts. Multiply line 13 by line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 $

16. Massachusetts tangible property not subject to local taxation (Schedule B, line 7). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17. Add line 15 and line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 $

18. Net worth ratio. Divide line 17 by line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

%

19. Total assets (line 1 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 $

20. Total liabilities (line 2 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21. Net worth. Subtract line 20 from line 19. Do not enter less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22. Taxable net worth, foreign calculation. Multiply line 18 by line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 $

23. Enter the smaller of line 9 or line 22. Enter line 23 as line 2 and enter “0” on page 1, line 1 of the Computation of Excise . . . . . . . . . . . . . . . 23 $

Schedule E-1. Dividends Deduction

31. Total dividends (U.S. Form 1120, Schedule C, line 19). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 $

22. Dividends from Massachusetts corporate trusts (attach schedule). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 $

23. Dividends from non-wholly-owned DISCs (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

24. Dividends, if less than 15% of voting stock owned:

a On common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4a

b On preferred stock. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b

35. Total taxable dividends. Add lines 2 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

36. Dividends eligible for deduction. Subtract line 5 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

37. Dividends deduction.* Multiply line 6 by .95. Enter here and in Schedule E, line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 $

*Attach schedule showing payers, amounts and % of voting stock owned by class of stock.

Schedule E. Taxable Income

Note: see instructions.

31. Gross receipts or sales (from U.S. Form 1120, line 1c or U.S. Form 1120-A, line 1c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 1

$

32. Gross profit (from U.S. Form 1120, line 3, or U.S. Form 1120-A, line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 2

33. Other deductions (from U.S. Form 1120, line 26, or U.S. Form 1120-A, line 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 3

34. Net income as shown on line 28, U.S. Form 1120. See instructions for DISCs . . . . . . . . . . . . . . . . . . . . . . ¨ 4

$

35. Subtract from line 4 any allowable U.S. wage credit; enter result here (see Schedule E instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 5

$

36. State and municipal bond interest not included in U.S. net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 6

37. Foreign, state or local income, franchise, excise or capital stock taxes deducted from U.S. net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 7

38. Other adjustments (include expenses relating to research and development; attach schedule; see instructions). . . . . . . . . . . . . . . . . . . . . . ¨ 8

39. Combine lines 5, 6, 7 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 $

x .10 = . . . . . . . . . . . . . ¨ 10 $

10. Abandoned Building Renovation deduction. Total cost $

11. Dividends deduction (Schedule E-1, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 11

12. Subtotal. Subtract lines 10 and 11 from line 9. If a loss,skip to line 19 and enter “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13. Loss carryover (Schedule E-2, line 8 or line 13, whichever applies) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 13

14. Income subject to apportionment. Subtract line 13 from line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 $

15. Income apportionment percentage. (Schedule F, line 5 or 100%, whichever applies) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

%

16. Multiply line 14 (even if loss) by line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 $

17. Certified Massachusetts solar or wind power deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 17 $

18. 25% of wages paid to eligible poverty area employees (from Schedule I-1, line 3) . . . . . . . . . . . . . . . . . . ¨ 18 $

19. Income taxable in Massachusetts. Subtract total of lines 17 and 18 from line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 $

(Enter line 19 as line 4b in Computation of Excise. If loss, enter zero.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4