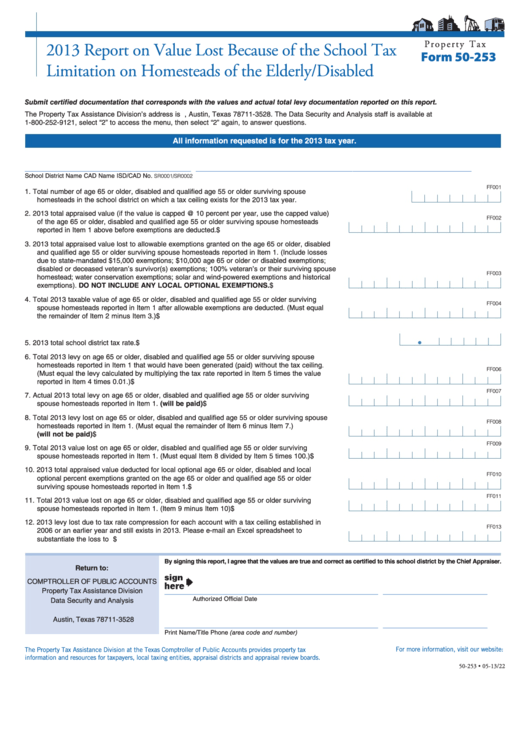

P r o p e r t y T a x

2013 Report on Value Lost Because of the School Tax

Form 50-253

Limitation on Homesteads of the Elderly/Disabled

Submit certified documentation that corresponds with the values and actual total levy documentation reported on this report.

The Property Tax Assistance Division’s address is P.O. Box 13528, Austin, Texas 78711-3528. The Data Security and Analysis staff is available at

1-800-252-9121, select “2” to access the menu, then select “2” again, to answer questions.

All information requested is for the 2013 tax year.

___________________________________

_________________________________

_________________________

School District Name

CAD Name

ISD/CAD No.

SR0001/SR0002

FF001

1.

Total number of age 65 or older, disabled and qualified age 55 or older surviving spouse

homesteads in the school district on which a tax ceiling exists for the 2013 tax year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. 2013 total appraised value (if the value is capped @ 10 percent per year, use the capped value)

FF002

of the age 65 or older, disabled and qualified age 55 or older surviving spouse homesteads

reported in Item 1 above before exemptions are deducted.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

3. 2013 total appraised value lost to allowable exemptions granted on the age 65 or older, disabled

and qualified age 55 or older surviving spouse homesteads reported in Item 1. (Include losses

due to state-mandated $15,000 exemptions; $10,000 age 65 or older or disabled exemptions;

disabled or deceased veteran’s survivor(s) exemptions; 100% veteran’s or their surviving spouse

FF003

homestead; water conservation exemptions; solar and wind-powered exemptions and historical

exemptions). DO NOT INCLUDE ANY LOCAL OPTIONAL EXEMPTIONS. . . . . . . . . . . . . . . . . . . . $

4. Total 2013 taxable value of age 65 or older, disabled and qualified age 55 or older surviving

FF004

spouse homesteads reported in Item 1 after allowable exemptions are deducted. (Must equal

the remainder of Item 2 minus Item 3.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

5. 2013 total school district tax rate.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

6. Total 2013 levy on age 65 or older, disabled and qualified age 55 or older surviving spouse

homesteads reported in Item 1 that would have been generated (paid) without the tax ceiling.

FF006

(Must equal the levy calculated by multiplying the tax rate reported in Item 5 times the value

reported in Item 4 times 0.01.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

FF007

7.

Actual 2013 total levy on age 65 or older, disabled and qualified age 55 or older surviving

spouse homesteads reported in Item 1. (will be paid) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

8. Total 2013 levy lost on age 65 or older, disabled and qualified age 55 or older surviving spouse

FF008

homesteads reported in Item 1. (Must equal the remainder of Item 6 minus Item 7.)

(will not be paid). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

FF009

9. Total 2013 value lost on age 65 or older, disabled and qualified age 55 or older surviving

spouse homesteads reported in Item 1. (Must equal Item 8 divided by Item 5 times 100.). . . . . . . . . $

10. 2013 total appraised value deducted for local optional age 65 or older, disabled and local

FF010

optional percent exemptions granted on the age 65 or older and qualified age 55 or older

surviving spouse homesteads reported in Item 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

FF011

11. Total 2013 value lost on age 65 or older, disabled and qualified age 55 or older surviving

spouse homesteads reported in Item 1. (Item 9 minus Item 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

12. 2013 levy lost due to tax rate compression for each account with a tax ceiling established in

FF013

2006 or an earlier year and still exists in 2013. Please e-mail an Excel spreadsheet to

substantiate the loss to ptad.ears@cpa.state.tx.us.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

By signing this report, I agree that the values are true and correct as certified to this school district by the Chief Appraiser.

Return to:

COMPTROLLER OF PUBLIC ACCOUNTS

_____________________________________________

______________________

Property Tax Assistance Division

Authorized Official

Date

Data Security and Analysis

P.O. Box 13528

Austin, Texas 78711-3528

_____________________________________________

______________________

Print Name/Title

Phone (area code and number)

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-253 • 05-13/22

true

1

1