Form Ind Cr - Individual Credit Form - State Of Georgia Page 3

ADVERTISEMENT

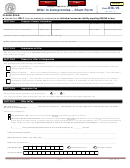

IND CR

Page 3

(Rev. 10/06)

Part 5 - Rural Physicians Credit

O.C.G.A.

48-7-29 provides for a $5,000 tax credit for rural physicians. The tax credit may be claimed for not more than five

§

years. There is no carryover or carry-back available. The credit cannot exceed the taxpayer’s income tax liability. In order to

qualify, the physician must meet the following conditions:

1. The physician must have started working in a rural county after July 1, 1995. If the physician worked in a rural county prior to

that date, a period of at least three years must have elapsed before the physician returns to work in a rural county.

2. The physician must practice and reside in a rural county. For taxable years beginning on or after January 1, 2003, a physician

qualifies for the credit if they practice in a rural county and reside in a county contiguous to a rural county. A rural county is

defined as one with 65 or fewer persons per square mile according to the United States Decennial Census of 1990 or any

future such census. For taxable years beginning on or after January 1, 2002, the United States Decennial Census of 2000 is

used.

3. The physician must be licensed to practice medicine in Georgia, primarily admit patients to a rural hospital, and practice in

the fields of family practice, obstetrics and gynecology, pediatrics, internal medicine, or general surgery. A rural hospital is

defined as an acute-care hospital located in a rural county that contains 80 or fewer beds. For taxable years beginning on or

after January 1, 2003, a rural hospital is defined as an acute-care hospital located in a rural county that contains 100 or fewer

beds.

For more information, see Regulation 560-7-8-.20, which is located on our website at

1. County of residence.

1

2. County of practice.

2

3. Type of practice.

3

4. Date started working as a rural physician.

4

5. Number of hospital beds in the rural hospital.

5

6. Rural physicians credit, enter $5,000 and include in Part 9.

6

Part 6 - Disaster Assistance Credit

O.C.G.A.

48-7-29.4 provides for a disaster assistance credit. This is a credit for a taxpayer who receives disaster assistance

§

during a taxable year from the Georgia Emergency Management Agency or the Federal Emergency Management Agency. The

amount of the credit is equal to $500 or the actual amount of the disaster assistance, whichever is less. The credit cannot

exceed the taxpayer’s income tax liability. Any unused tax credit can be carried forward to the succeeding years’ tax liability

but cannot be carried back to the prior years’ tax liability. The approval letter from the disaster assistance agency must be

enclosed with the return.

The following types of assistance qualify:

1. Grants received from the Department of Human Resources’ Individual and Family Grant Program.

2. Grants received from FEMA.

3. Loans received from the Small Business Administration that are due to disasters declared by the President or

Governor.

1. Name of the disaster assistance agency.

1

2. Date the disaster assistance was received.

2

3. Amount of the disaster assistance received.

3

$500

4. Maximum credit.

4

5. Enter the lesser of Line 3 or Line 4 and include in Part 9.

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4