PRINT FORM

CLEAR FORM

CTRC161

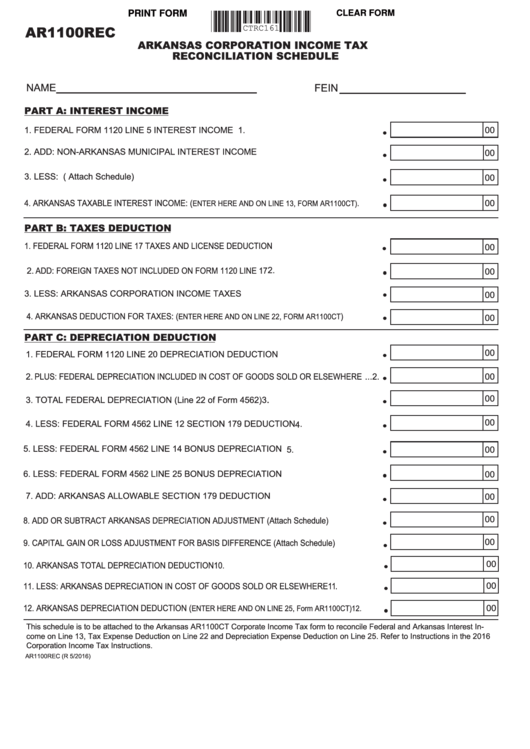

AR1100REC

ARKANSAS CORPORATION INCOME TAX

RECONCILIATION SCHEDULE

NAME___________________________________

___________________________________

FEIN______________________

______________________

PART A: INTEREST INCOME

1. FEDERAL FORM 1120 LINE 5 INTEREST INCOME ......................................................... 1.

00

2. ADD: NON-ARKANSAS MUNICIPAL INTEREST INCOME ............................................... 2.

00

3. LESS: U.S. OBLIGATION INTEREST INCOME ( Attach Schedule) .................................. 3.

00

4. ARKANSAS TAXABLE INTEREST INCOME: (

. ...... 4.

00

ENTER HERE AND ON LINE 13, FORM AR1100CT)

PART B: TAXES DEDUCTION

1. FEDERAL FORM 1120 LINE 17 TAXES AND LICENSE DEDUCTION ..............................................1.

00

........................................

2. ADD: FOREIGN TAXES NOT INCLUDED ON FORM 1120 LINE 17

2.

00

3. LESS: ARKANSAS CORPORATION INCOME TAXES ...................................................... 3.

00

4. ARKANSAS DEDUCTION FOR TAXES: (

) ..............4.

ENTER HERE AND ON LINE 22, FORM AR1100CT

00

PART C: DEPRECIATION DEDUCTION

1. FEDERAL FORM 1120 LINE 20 DEPRECIATION DEDUCTION ....................................... 1.

00

2. PLUS: FEDERAL DEPRECIATION INCLUDED IN COST OF GOODS SOLD OR ELSEWHERE ... 2.

00

......................................

.

00

3. TOTAL FEDERAL DEPRECIATION (Line 22 of Form 4562)

3

00

4. LESS: FEDERAL FORM 4562 LINE 12 SECTION 179 DEDUCTION

4 .

............................

5. LESS: FEDERAL FORM 4562 LINE 14 BONUS DEPRECIATION .................................... 5.

00

6. LESS: FEDERAL FORM 4562 LINE 25 BONUS DEPRECIATION .................................... 6.

00

7. ADD: ARKANSAS ALLOWABLE SECTION 179 DEDUCTION .......................................... 7.

00

00

8. ADD OR SUBTRACT ARKANSAS DEPRECIATION ADJUSTMENT (Attach Schedule) ...................8.

00

9. CAPITAL GAIN OR LOSS ADJUSTMENT FOR BASIS DIFFERENCE (Attach Schedule) ................9.

00

10. ARKANSAS TOTAL DEPRECIATION DEDUCTION ......................................................................... 10.

11. LESS: ARKANSAS DEPRECIATION IN COST OF GOODS SOLD OR ELSEWHERE ................... 11.

00

ENTER HERE AND ON LINE 25, Form AR1100CT) ......... 12.

12. ARKANSAS DEPRECIATION DEDUCTION (

00

This schedule is to be attached to the Arkansas AR1100CT Corporate Income Tax form to reconcile Federal and Arkansas Interest In-

come on Line 13, Tax Expense Deduction on Line 22 and Depreciation Expense Deduction on Line 25. Refer to Instructions in the 2016

Corporation Income Tax Instructions.

AR1100REC (R 5/2016)

1

1