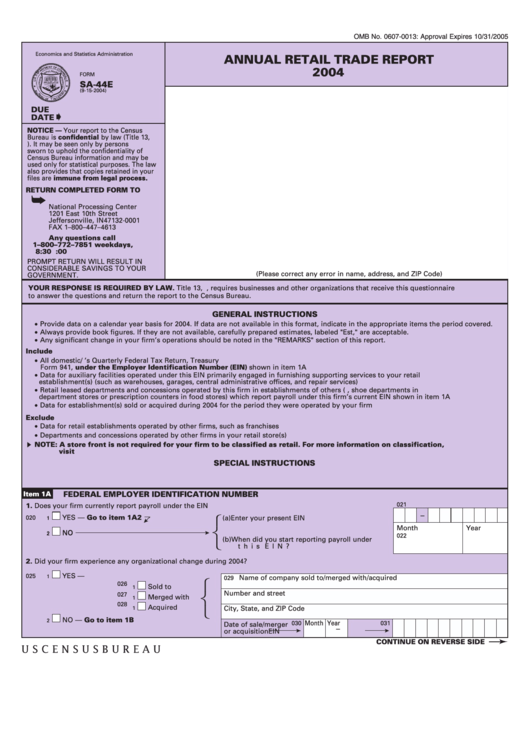

Form Sa-44e - Annual Retail Trade Report 2004 - U.s. Census Bureau

ADVERTISEMENT

OMB No. 0607-0013: Approval Expires 10/31/2005

U.S. DEPARTMENT OF COMMERCE

Economics and Statistics Administration

ANNUAL RETAIL TRADE REPORT

U.S. CENSUS BUREAU

2004

FORM

SA-44E

(9-15-2004)

DUE

DATE

NOTICE — Your report to the Census

Bureau is confidential by law (Title 13,

U.S. Code). It may be seen only by persons

sworn to uphold the confidentiality of

Census Bureau information and may be

used only for statistical purposes. The law

also provides that copies retained in your

files are immune from legal process.

RETURN COMPLETED FORM TO

➥

U.S. CENSUS BUREAU

National Processing Center

1201 East 10th Street

Jeffersonville, IN 47132-0001

FAX 1–800–447–4613

Any questions call

1–800–772–7851 weekdays,

8:30 a.m. to 5:00 p.m. EST

PROMPT RETURN WILL RESULT IN

CONSIDERABLE SAVINGS TO YOUR

(Please correct any error in name, address, and ZIP Code)

GOVERNMENT.

YOUR RESPONSE IS REQUIRED BY LAW. Title 13, U.S. Code, requires businesses and other organizations that receive this questionnaire

to answer the questions and return the report to the Census Bureau.

GENERAL INSTRUCTIONS

• Provide data on a calendar year basis for 2004. If data are not available in this format, indicate in the appropriate items the period covered.

• Always provide book figures. If they are not available, carefully prepared estimates, labeled "Est," are acceptable.

• Any significant change in your firm’s operations should be noted in the "REMARKS" section of this report.

Include

• All domestic/U.S. retail establishments whose payroll was reported on the Employer’s Quarterly Federal Tax Return, Treasury

Form 941, under the Employer Identification Number (EIN) shown in item 1A

• Data for auxiliary facilities operated under this EIN primarily engaged in furnishing supporting services to your retail

establishment(s) (such as warehouses, garages, central administrative offices, and repair services)

• Retail leased departments and concessions operated by this firm in establishments of others (e.g., shoe departments in

department stores or prescription counters in food stores) which report payroll under this firm’s current EIN shown in item 1A

• Data for establishment(s) sold or acquired during 2004 for the period they were operated by your firm

Exclude

• Data for retail establishments operated by other firms, such as franchises

• Departments and concessions operated by other firms in your retail store(s)

NOTE: A store front is not required for your firm to be classified as retail. For more information on classification,

visit

SPECIAL INSTRUCTIONS

Item 1A

FEDERAL EMPLOYER IDENTIFICATION NUMBER

021

1. Does your firm currently report payroll under the EIN

–

⎧

YES — Go to item 1A2

020

(a) Enter your present EIN. . . . . . . . . . . . . . .

1

1

Month

Year

⎨

NO

NO

2

2

022

(b) When did you start reporting payroll under

⎩

this EIN? . . . . . . . . . . . . . . . . . . . . . . .

2. Did your firm experience any organizational change during 2004?

YES —

025

1

Name of company sold to/merged with/acquired

029

⎧

026

Sold to

1

Number and street

⎨

027

Merged with

1

028

Acquired

⎩

City, State, and ZIP Code

1

NO — Go to item 1B

2

Month Year

030

031

Date of sale/merger

–

or acquisition

EIN

CONTINUE ON REVERSE SIDE

U S C E N S U S B U R E A U

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5