Print

Clear

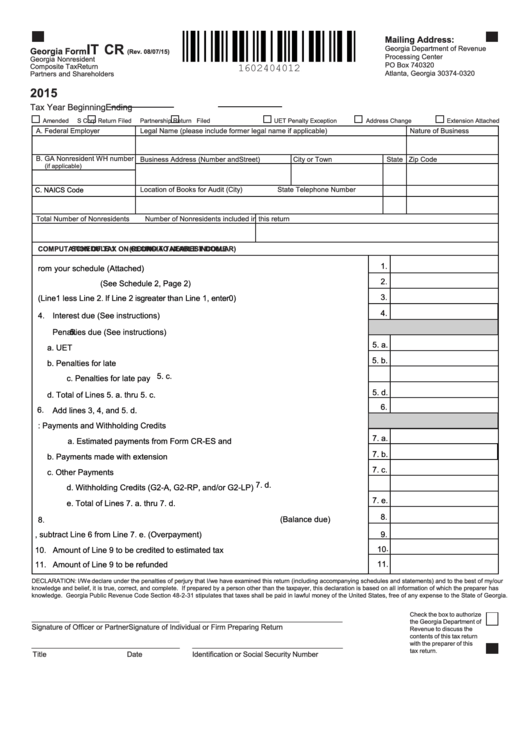

Mailing Address:

IT

CR

Georgia Department of Revenue

Georgia Form

(Rev. 08/07/15)

Processing Center

Georgia Nonresident

PO Box 740320

Composite Tax Return

Atlanta, Georgia 30374-0320

Partners and Shareholders

2015

Tax Year Beginning

Ending

Amended

S Corp Return Filed

Partnership Return Filed

UET Penalty Exception

Address Change

Extension Attached

A. Federal Employer I.D. No.

Legal Name (please include former legal name if applicable)

Nature of Business

B. GA Nonresident WH number

Business Address (Number and Street)

City or Town

State Zip Code

(if applicable)

C. NAICS Code

Location of Books for Audit (City)

State

Telephone Number

Total Number of Nonresidents

Number of Nonresidents included in this return

COMPUTATION OF TAX ON GEORGIA TAXABLE INCOME

(ROUND TO NEAREST DOLLAR)

SCHEDULE 1

1.

1. Tax from your schedule (Attached) ...............................................................................

2.

2. Credits used (See Schedule 2, Page 2)...........................................................................

3.

3. Balance (Line 1 less Line 2. If Line 2 is greater than Line 1, enter 0) ...............................

4.

4. Interest due (See instructions).......................................................................................

5.

Penalties due (See instructions)....................................................................................

5. a.

a. UET Penalty........................................................................................................

5. b.

b. Penalties for late file............................................................................................

5. c.

c. Penalties for late pay ..........................................................................................

5. d.

d. Total of Lines 5. a. thru 5. c. ...............................................................................

6.

6.

Add lines 3, 4, and 5. d. ................................................................................................

7. Less: Payments and Withholding Credits .....................................................................

7. a.

a. Estimated payments from Form CR-ES and returns...........................................

7. b.

b. Payments made with extension .........................................................................

7. c.

c. Other Payments ..................................................................................................

7. d.

d. Withholding Credits (G2-A, G2-RP, and/or G2-LP).............................................

7. e.

e. Total of Lines 7. a. thru 7. d. ..............................................................................

8.

If Line 6 is greater than Line 7. e. subtract Line 7. e. from Line 6

.

(Balance due) ........

. .

8.

9.

9. If Line 7. e. is greater than Line 6, subtract Line 6 from Line 7. e. (Overpayment) ........

10 .

10. Amount of Line 9 to be credited to estimated tax .........................................................

11.

11. Amount of Line 9 to be refunded ..................................................................................

DECLARATION: I/We declare under the penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the best of my/our

knowledge and belief, it is true, correct, and complete. If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has

knowledge. Georgia Public Revenue Code Section 48-2-31 stipulates that taxes shall be paid in lawful money of the United States, free of any expense to the State of Georgia.

Check the box to authorize

_________________________________

__________________________________

the Georgia Department of

Signature of Officer or Partner

Signature of Individual or Firm Preparing Return

Revenue to discuss the

contents of this tax return

___________________

_________________________________

with the preparer of this

tax return.

Title

Date

Identification or Social Security Number

1

1 2

2