Print

Clear

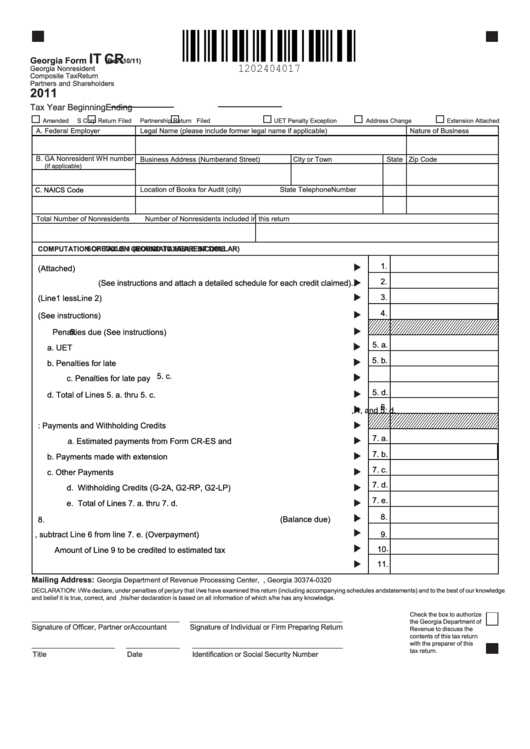

IT

CR

Georgia Form

(Rev. 10/11)

Georgia Nonresident

Composite Tax Return

Partners and Shareholders

2011

Tax Year Beginning

Ending

Amended

S Corp Return Filed

Partnership Return Filed

UET Penalty Exception

Address Change

Extension Attached

A. Federal Employer I.D. No.

Legal Name (please include former legal name if applicable)

Nature of Business

B. GA Nonresident WH number

Business Address (Number and Street)

City or Town

State Zip Code

(if applicable)

C. NAICS Code

Location of Books for Audit (city)

State

Telephone Number

Total Number of Nonresidents

Number of Nonresidents included in this return

COMPUTATION OF TAX ON GEORGIA TAXABLE INCOME

(ROUND TO NEAREST DOLLAR)

SCHEDULE 1

1.

1. Tax from your schedule (Attached) ...............................................................................

2.

(See instructions and attach a detailed schedule for each credit claimed)..

2. Best Credits

3.

3. Balance (Line 1 less Line 2) .........................................................................................

4.

4. Interest due (See instructions).......................................................................................

5.

Penalties due (See instructions)....................................................................................

5. a.

a. UET Penalty........................................................................................................

5. b.

b. Penalties for late file............................................................................................

5. c.

c. Penalties for late pay ..........................................................................................

5. d.

d. Total of Lines 5. a. thru 5. c. ...............................................................................

6.

. 6

Add lines 3, 4, and 5. d. .................................................

. .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

7. Less: Payments and Withholding Credits .....................................................................

7. a.

a. Estimated payments from Form CR-ES and returns...........................................

7. b.

b. Payments made with extension .........................................................................

7. c.

c. Other Payments ..................................................................................................

7. d.

d. Withholding Credits (G-2A, G2-RP, G2-LP).........................................................

7. e.

e. Total of Lines 7. a. thru 7. d. ..............................................................................

8.

If Line 6 is greater than Line 7. e. subtract Line 7. e. from Line 6

. .

. .

.

(Balance due) ........

8.

9.

9. If Line 7. e. is greater than Line 6, subtract Line 6 from line 7. e. (Overpayment) ........

10 .

10.

Amount of Line 9 to be credited to estimated tax .........................................................

11.

11. Amount of Line 9 to be refunded

................................................................................

Mailing Address:

Georgia Department of Revenue Processing Center, P.O.Box 740320 Atlanta, Georgia 30374-0320

DECLARATION: I/We declare, under penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the best of our knowledge

and belief it is true, correct, and complete. If prepared by a person other than taxpayer, his/her declaration is based on all information of which s/he has any knowledge.

Check the box to authorize

_________________________________

__________________________________

the Georgia Department of

Signature of Officer, Partner or Accountant

Signature of Individual or Firm Preparing Return

Revenue to discuss the

.

contents of this tax return

___________________

_________

_________________________________

with the preparer of this

tax return.

Title

Date

Identification or Social Security Number

1

1 2

2 3

3 4

4