Form Sd Rev Spt 303 - In-State Cigarette Distributors' Monthly Report 2003

ADVERTISEMENT

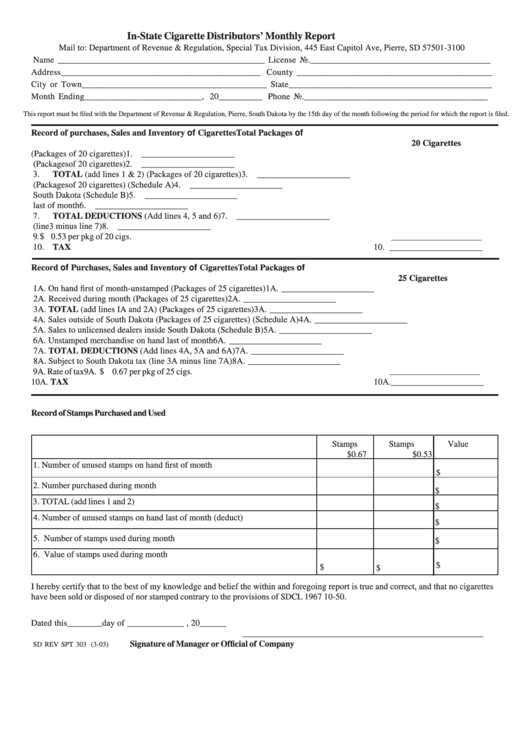

In-State Cigarette Distributors’ Monthly Report

Mail to: Department of Revenue & Regulation, Special Tax Division, 445 East Capitol Ave, Pierre, SD 57501-3100

Name ______________________________________________ License No.________________________________________

Address____________________________________________ County ___________________________________________

City or Town_________________________________________ State_____________________________________________

Month Ending__________________________, 20__________ Phone No._________________________________________

This report must be filed with the Department of Revenue & Regulation, Pierre, South Dakota by the 15th day of the month following the period for which the report is filed.

Record of purchases, Sales and Inventory of Cigarettes

Total Packages of

20 Cigarettes

1.

On hand first of month-unstamped (Packages of 20 cigarettes)

1. _____________________

2.

Received during month (Packages of 20 cigarettes)

2. _____________________

3.

TOTAL (add lines 1 & 2) (Packages of 20 cigarettes)

3. _____________________

4.

Sales outside of South Dakota (Packages of 20 cigarettes) (Schedule A)

4. _____________________

5.

Sales to licensed dealers inside South Dakota (Schedule B)

5. _____________________

6.

Unstamped merchandise on hand last of month

6. _____________________

7.

TOTAL DEDUCTIONS (Add lines 4, 5 and 6)

7. _____________________

8.

Subject to South Dakota tax (line 3 minus line 7)

8. _____________________

9.

Rate of tax

9.

$ 0.53 per pkg of 20 cigs.

10. TAX

10. _____________________

Record of Purchases, Sales and Inventory of Cigarettes

Total Packages of

25 Cigarettes

1A. On hand first of month-unstamped (Packages of 25 cigarettes)

1A. _____________________

2A. Received during month (Packages of 25 cigarettes)

2A. _____________________

3A. TOTAL (add lines IA and 2A) (Packages of 25 cigarettes)

3A. _____________________

4A. Sales outside of South Dakota (Packages of 25 cigarettes) (Schedule A)

4A. _____________________

5A. Sales to unlicensed dealers inside South Dakota (Schedule B)

5A. _____________________

6A. Unstamped merchandise on hand last of month

6A. _____________________

7A. TOTAL DEDUCTIONS (Add lines 4A, 5A and 6A)

7A. _____________________

8A. Subject to South Dakota tax (line 3A minus line 7A)

8A. _____________________

9A. Rate of tax

9A. $ 0.67 per pkg of 25 cigs.

10A. TAX

10A._____________________

Record of Stamps Purchased and Used

Stamps

Stamps

Value

$0.67

$0.53

1. Number of unused stamps on hand first of month

$

2. Number purchased during month

$

3. TOTAL (add lines 1 and 2)

$

4. Number of unused stamps on hand last of month (deduct)

$

5. Number of stamps used during month

$

6. Value of stamps used during month

$

$

$

I hereby certify that to the best of my knowledge and belief the within and foregoing report is true and correct, and that no cigarettes

have been sold or disposed of nor stamped contrary to the provisions of SDCL 1967 10-50.

Dated this________day of _____________ , 20______

_______________________________________________________

Signature of Manager or Official of Company

SD REV SPT 303 (3-03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1