Form 69-101 - Instructions For Completing The Texas Distributor Monthly Report Of Cigar And Tobacco Products

ADVERTISEMENT

Form 69-101 (Back) (Rev.10-99/7)

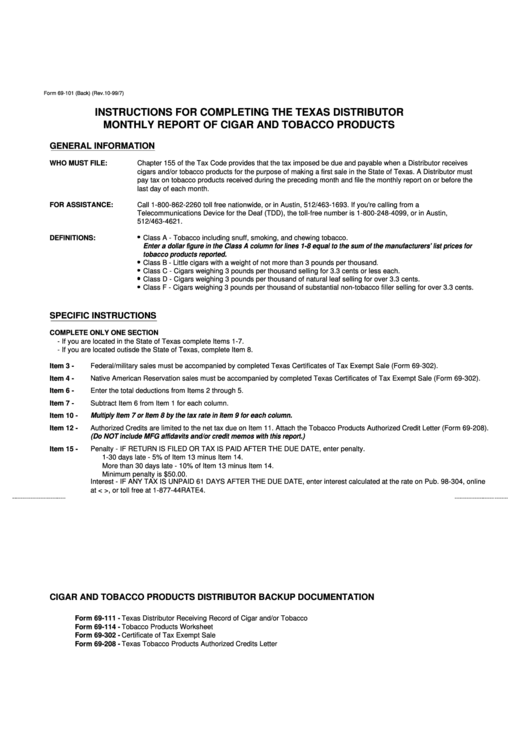

INSTRUCTIONS FOR COMPLETING THE TEXAS DISTRIBUTOR

MONTHLY REPORT OF CIGAR AND TOBACCO PRODUCTS

GENERAL INFORMATION

WHO MUST FILE:

Chapter 155 of the Tax Code provides that the tax imposed be due and payable when a Distributor receives

cigars and/or tobacco products for the purpose of making a first sale in the State of Texas. A Distributor must

pay tax on tobacco products received during the preceding month and file the monthly report on or before the

last day of each month.

FOR ASSISTANCE:

Call 1-800-862-2260 toll free nationwide, or in Austin, 512/463-1693. If you're calling from a

Telecommunications Device for the Deaf (TDD), the toll-free number is 1-800-248-4099, or in Austin,

512/463-4621.

DEFINITIONS:

Class A - Tobacco including snuff, smoking, and chewing tobacco.

Enter a dollar figure in the Class A column for lines 1-8 equal to the sum of the manufacturers' list prices for

tobacco products reported.

Class B - Little cigars with a weight of not more than 3 pounds per thousand.

Class C - Cigars weighing 3 pounds per thousand selling for 3.3 cents or less each.

Class D - Cigars weighing 3 pounds per thousand of natural leaf selling for over 3.3 cents.

Class F - Cigars weighing 3 pounds per thousand of substantial non-tobacco filler selling for over 3.3 cents.

SPECIFIC INSTRUCTIONS

COMPLETE ONLY ONE SECTION

- If you are located in the State of Texas complete Items 1-7.

- If you are located outisde the State of Texas, complete Item 8.

Item 3 -

Federal/military sales must be accompanied by completed Texas Certificates of Tax Exempt Sale (Form 69-302).

Item 4 -

Native American Reservation sales must be accompanied by completed Texas Certificates of Tax Exempt Sale (Form 69-302).

Item 6 -

Enter the total deductions from Items 2 through 5.

Item 7 -

Subtract Item 6 from Item 1 for each column.

Multiply Item 7 or Item 8 by the tax rate in Item 9 for each column.

Item 10 -

Item 12 -

Authorized Credits are limited to the net tax due on Item 11. Attach the Tobacco Products Authorized Credit Letter (Form 69-208).

(Do NOT include MFG affidavits and/or credit memos with this report.)

Item 15 -

Penalty - IF RETURN IS FILED OR TAX IS PAID AFTER THE DUE DATE, enter penalty.

1-30 days late - 5% of Item 13 minus Item 14.

More than 30 days late - 10% of Item 13 minus Item 14.

Minimum penalty is $50.00.

Interest - IF ANY TAX IS UNPAID 61 DAYS AFTER THE DUE DATE, enter interest calculated at the rate on Pub. 98-304, online

at < , or toll free at 1-877-44RATE4.

CIGAR AND TOBACCO PRODUCTS DISTRIBUTOR BACKUP DOCUMENTATION

Form 69-111 -

Texas Distributor Receiving Record of Cigar and/or Tobacco

Form 69-114 -

Tobacco Products Worksheet

Form 69-302 -

Certificate of Tax Exempt Sale

Form 69-208 -

Texas Tobacco Products Authorized Credits Letter

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1