Instructions For Filing Schedule M1mtc - Alternative Minimum Tax Credit - 2002

ADVERTISEMENT

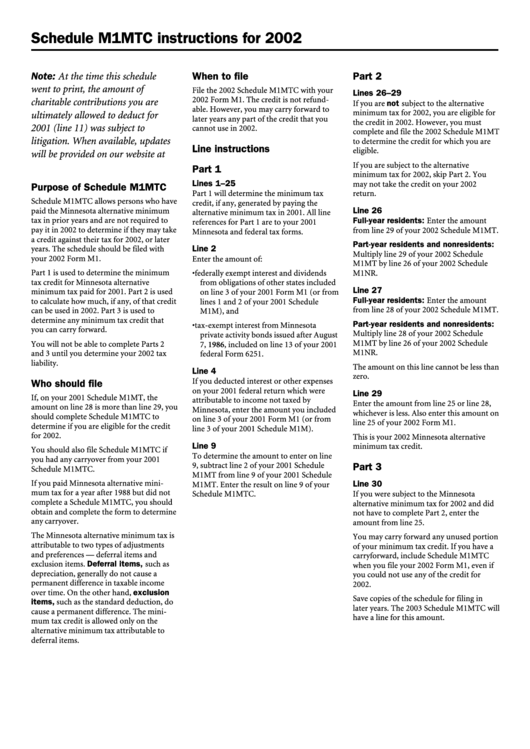

Schedule M1MTC instructions for 2002

Note: At the time this schedule

When to file

Part 2

went to print, the amount of

File the 2002 Schedule M1MTC with your

Lines 26–29

2002 Form M1. The credit is not refund-

charitable contributions you are

If you are not subject to the alternative

able. However, you may carry forward to

minimum tax for 2002, you are eligible for

ultimately allowed to deduct for

later years any part of the credit that you

the credit in 2002. However, you must

2001 (line 11) was subject to

cannot use in 2002.

complete and file the 2002 Schedule M1MT

litigation. When available, updates

to determine the credit for which you are

Line instructions

eligible.

will be provided on our website at

If you are subject to the alternative

Part 1

minimum tax for 2002, skip Part 2. You

Lines 1–25

may not take the credit on your 2002

Purpose of Schedule M1MTC

Part 1 will determine the minimum tax

return.

Schedule M1MTC allows persons who have

credit, if any, generated by paying the

paid the Minnesota alternative minimum

Line 26

alternative minimum tax in 2001. All line

tax in prior years and are not required to

Full-year residents: Enter the amount

references for Part 1 are to your 2001

pay it in 2002 to determine if they may take

from line 29 of your 2002 Schedule M1MT.

Minnesota and federal tax forms.

a credit against their tax for 2002, or later

Part-year residents and nonresidents:

years. The schedule should be filed with

Line 2

Multiply line 29 of your 2002 Schedule

your 2002 Form M1.

Enter the amount of:

M1MT by line 26 of your 2002 Schedule

Part 1 is used to determine the minimum

• federally exempt interest and dividends

M1NR.

tax credit for Minnesota alternative

from obligations of other states included

Line 27

minimum tax paid for 2001. Part 2 is used

on line 3 of your 2001 Form M1 (or from

Full-year residents: Enter the amount

to calculate how much, if any, of that credit

lines 1 and 2 of your 2001 Schedule

from line 28 of your 2002 Schedule M1MT.

can be used in 2002. Part 3 is used to

M1M), and

determine any minimum tax credit that

Part-year residents and nonresidents:

• tax-exempt interest from Minnesota

you can carry forward.

Multiply line 28 of your 2002 Schedule

private activity bonds issued after August

M1MT by line 26 of your 2002 Schedule

You will not be able to complete Parts 2

7, 1986, included on line 13 of your 2001

M1NR.

and 3 until you determine your 2002 tax

federal Form 6251.

liability.

The amount on this line cannot be less than

Line 4

zero.

If you deducted interest or other expenses

Who should file

on your 2001 federal return which were

Line 29

If, on your 2001 Schedule M1MT, the

attributable to income not taxed by

Enter the amount from line 25 or line 28,

amount on line 28 is more than line 29, you

Minnesota, enter the amount you included

whichever is less. Also enter this amount on

should complete Schedule M1MTC to

on line 3 of your 2001 Form M1 (or from

line 25 of your 2002 Form M1.

determine if you are eligible for the credit

line 3 of your 2001 Schedule M1M).

for 2002.

This is your 2002 Minnesota alternative

Line 9

minimum tax credit.

You should also file Schedule M1MTC if

To determine the amount to enter on line

you had any carryover from your 2001

9, subtract line 2 of your 2001 Schedule

Part 3

Schedule M1MTC.

M1MT from line 9 of your 2001 Schedule

If you paid Minnesota alternative mini-

Line 30

M1MT. Enter the result on line 9 of your

mum tax for a year after 1988 but did not

Schedule M1MTC.

If you were subject to the Minnesota

complete a Schedule M1MTC, you should

alternative minimum tax for 2002 and did

obtain and complete the form to determine

not have to complete Part 2, enter the

any carryover.

amount from line 25.

The Minnesota alternative minimum tax is

You may carry forward any unused portion

attributable to two types of adjustments

of your minimum tax credit. If you have a

and preferences — deferral items and

carryforward, include Schedule M1MTC

exclusion items. Deferral items, such as

when you file your 2002 Form M1, even if

depreciation, generally do not cause a

you could not use any of the credit for

permanent difference in taxable income

2002.

over time. On the other hand, exclusion

Save copies of the schedule for filing in

items, such as the standard deduction, do

later years. The 2003 Schedule M1MTC will

cause a permanent difference. The mini-

have a line for this amount.

mum tax credit is allowed only on the

alternative minimum tax attributable to

deferral items.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1