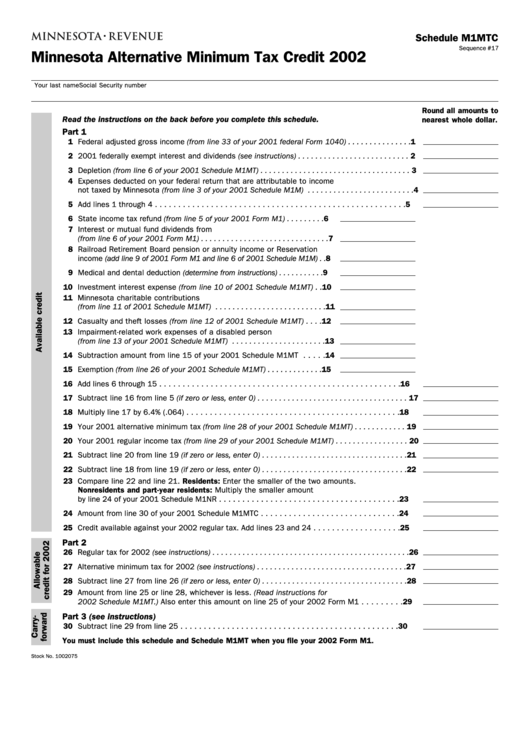

Schedule M1mtc - Minnesota Alternative Minimum Tax Credit - 2002

ADVERTISEMENT

Schedule M1MTC

Sequence #17

Minnesota Alternative Minimum Tax Credit 2002

Your last name

Social Security number

Round all amounts to

Read the instructions on the back before you complete this schedule.

nearest whole dollar.

Part 1

1 Federal adjusted gross income (from line 33 of your 2001 federal Form 1040) . . . . . . . . . . . . . . . 1

2 2001 federally exempt interest and dividends (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Depletion (from line 6 of your 2001 Schedule M1MT) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Expenses deducted on your federal return that are attributable to income

not taxed by Minnesota (from line 3 of your 2001 Schedule M1M) . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 State income tax refund (from line 5 of your 2001 Form M1) . . . . . . . . . 6

7 Interest or mutual fund dividends from U.S. bonds

(from line 6 of your 2001 Form M1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Railroad Retirement Board pension or annuity income or Reservation

income (add line 9 of 2001 Form M1 and line 6 of 2001 Schedule M1M) . . 8

9 Medical and dental deduction (determine from instructions) . . . . . . . . . . . 9

10 Investment interest expense (from line 10 of 2001 Schedule M1MT) . . 10

11 Minnesota charitable contributions

(from line 11 of 2001 Schedule M1MT) . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Casualty and theft losses (from line 12 of 2001 Schedule M1MT) . . . . 12

13 Impairment-related work expenses of a disabled person

(from line 13 of your 2001 Schedule M1MT) . . . . . . . . . . . . . . . . . . . . . . 13

14 Subtraction amount from line 15 of your 2001 Schedule M1MT . . . . . 14

15 Exemption (from line 26 of your 2001 Schedule M1MT) . . . . . . . . . . . . . 15

16 Add lines 6 through 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Subtract line 16 from line 5 (if zero or less, enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Multiply line 17 by 6.4% (.064) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Your 2001 alternative minimum tax (from line 28 of your 2001 Schedule M1MT) . . . . . . . . . . . . 19

20 Your 2001 regular income tax (from line 29 of your 2001 Schedule M1MT) . . . . . . . . . . . . . . . . . 20

21 Subtract line 20 from line 19 (if zero or less, enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Subtract line 18 from line 19 (if zero or less, enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Compare line 22 and line 21. Residents: Enter the smaller of the two amounts.

Nonresidents and part-year residents: Multiply the smaller amount

by line 24 of your 2001 Schedule M1NR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Amount from line 30 of your 2001 Schedule M1MTC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 Credit available against your 2002 regular tax. Add lines 23 and 24 . . . . . . . . . . . . . . . . . . . 25

Part 2

26 Regular tax for 2002 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27 Alternative minimum tax for 2002 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 Subtract line 27 from line 26 (if zero or less, enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

29 Amount from line 25 or line 28, whichever is less. (Read instructions for

2002 Schedule M1MT.) Also enter this amount on line 25 of your 2002 Form M1 . . . . . . . . . 29

Part 3 (see instructions)

30 Subtract line 29 from line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

You must include this schedule and Schedule M1MT when you file your 2002 Form M1.

Stock No. 1002075

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1