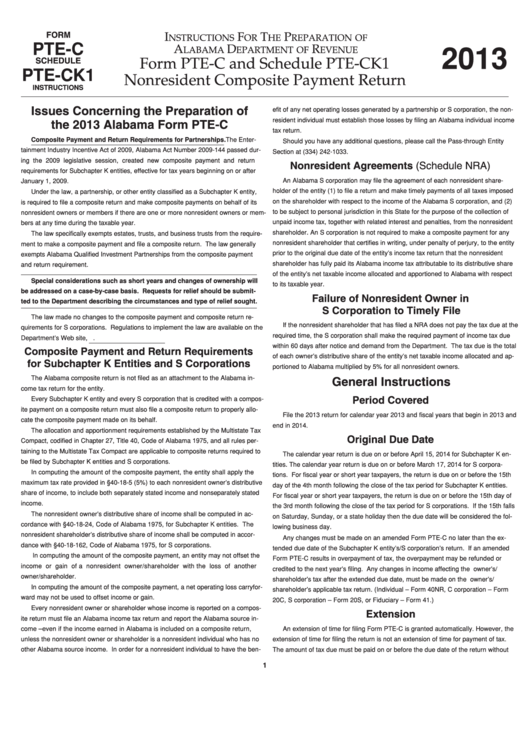

Form Pte-C Schedule Pte-Ck1 - Instructions For Nonresident Composite Payment Return Form - 2013

ADVERTISEMENT

FORM

I

F

T

P

NSTRUCTIONS

OR

HE

REPARATION OF

PTE-C

2013

A

D

R

LABAMA

EPARTMENT OF

EVENUE

Form PTE-C and Schedule PTE-CK1

SCHEDULE

PTE-CK1

Nonresident Composite Payment Return

INSTRUCTIONS

Issues Concerning the Preparation of

efit of any net operating losses generated by a partnership or S corporation, the non-

resident individual must establish those losses by filing an Alabama individual income

the 2013 Alabama Form PTE-C

tax return.

Composite Payment and Return Requirements for Partnerships. The Enter-

Should you have any additional questions, please call the Pass-through Entity

tainment Industry Incentive Act of 2009, Alabama Act Number 2009-144 passed dur-

Section at (334) 242-1033.

ing the 2009 legislative session, created new composite payment and return

Nonresident Agreements (Schedule NRA)

requirements for Subchapter K entities, effective for tax years beginning on or after

An Alabama S corporation may file the agreement of each nonresident share-

January 1, 2009.

holder of the entity (1) to file a return and make timely payments of all taxes imposed

Under the law, a partnership, or other entity classified as a Subchapter K entity,

on the shareholder with respect to the income of the Alabama S corporation, and (2)

is required to file a composite return and make composite payments on behalf of its

to be subject to personal jurisdiction in this State for the purpose of the collection of

nonresident owners or members if there are one or more nonresident owners or mem-

unpaid income tax, together with related interest and penalties, from the nonresident

bers at any time during the taxable year.

shareholder. An S corporation is not required to make a composite payment for any

The law specifically exempts estates, trusts, and business trusts from the require-

nonresident shareholder that certifies in writing, under penalty of perjury, to the entity

ment to make a composite payment and file a composite return. The law generally

prior to the original due date of the entity’s income tax return that the nonresident

exempts Alabama Qualified Investment Partnerships from the composite payment

shareholder has fully paid its Alabama income tax attributable to its distributive share

and return requirement.

of the entity’s net taxable income allocated and apportioned to Alabama with respect

Special considerations such as short years and changes of ownership will

to its taxable year.

be addressed on a case-by-case basis. Requests for relief should be submit-

Failure of Nonresident Owner in

ted to the Department describing the circumstances and type of relief sought.

S Corporation to Timely File

The law made no changes to the composite payment and composite return re-

If the nonresident shareholder that has filed a NRA does not pay the tax due at the

quirements for S corporations. Regulations to implement the law are available on the

required time, the S corporation shall make the required payment of income tax due

Department’s Web site, alabama.gov.

within 60 days after notice and demand from the Department. The tax due is the total

Composite Payment and Return Requirements

of each owner’s distributive share of the entity’s net taxable income allocated and ap-

for Subchapter K Entities and S Corporations

portioned to Alabama multiplied by 5% for all nonresident owners.

The Alabama composite return is not filed as an attachment to the Alabama in-

General Instructions

come tax return for the entity.

Every Subchapter K entity and every S corporation that is credited with a compos-

Period Covered

ite payment on a composite return must also file a composite return to properly allo-

File the 2013 return for calendar year 2013 and fiscal years that begin in 2013 and

cate the composite payment made on its behalf.

end in 2014.

The allocation and apportionment requirements established by the Multistate Tax

Original Due Date

Compact, codified in Chapter 27, Title 40, Code of Alabama 1975, and all rules per-

taining to the Multistate Tax Compact are applicable to composite returns required to

The calendar year return is due on or before April 15, 2014 for Subchapter K en-

be filed by Subchapter K entities and S corporations.

tities. The calendar year return is due on or before March 17, 2014 for S corpora-

In computing the amount of the composite payment, the entity shall apply the

tions. For fiscal year or short year taxpayers, the return is due on or before the 15th

maximum tax rate provided in §40-18-5 (5%) to each nonresident owner’s distributive

day of the 4th month following the close of the tax period for Subchapter K entities.

share of income, to include both separately stated income and nonseparately stated

For fiscal year or short year taxpayers, the return is due on or before the 15th day of

income.

the 3rd month following the close of the tax period for S corporations. If the 15th falls

The nonresident owner’s distributive share of income shall be computed in ac-

on Saturday, Sunday, or a state holiday then the due date will be considered the fol-

cordance with §40-18-24, Code of Alabama 1975, for Subchapter K entities. The

lowing business day.

nonresident shareholder’s distributive share of income shall be computed in accor-

Any changes must be made on an amended Form PTE-C no later than the ex-

dance with §40-18-162, Code of Alabama 1975, for S corporations.

tended due date of the Subchapter K entity’s/S corporation’s return. If an amended

In computing the amount of the composite payment, an entity may not offset the

Form PTE-C results in overpayment of tax, the overpayment may be refunded or

income or gain of a nonresident owner/shareholder with the loss of another

credited to the next year’s filing. Any changes in income affecting the owner’s/

owner/shareholder.

shareholder’s tax after the extended due date, must be made on the owner’s/

In computing the amount of the composite payment, a net operating loss carryfor-

shareholder’s applicable tax return. (Individual – Form 40NR, C corporation – Form

ward may not be used to offset income or gain.

20C, S corporation – Form 20S, or Fiduciary – Form 41.)

Every nonresident owner or shareholder whose income is reported on a compos-

Extension

ite return must file an Alabama income tax return and report the Alabama source in-

come – even if the income earned in Alabama is included on a composite return,

An extension of time for filing Form PTE-C is granted automatically. However, the

unless the nonresident owner or shareholder is a nonresident individual who has no

extension of time for filing the return is not an extension of time for payment of tax.

other Alabama source income. In order for a nonresident individual to have the ben-

The amount of tax due must be paid on or before the due date of the return without

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2