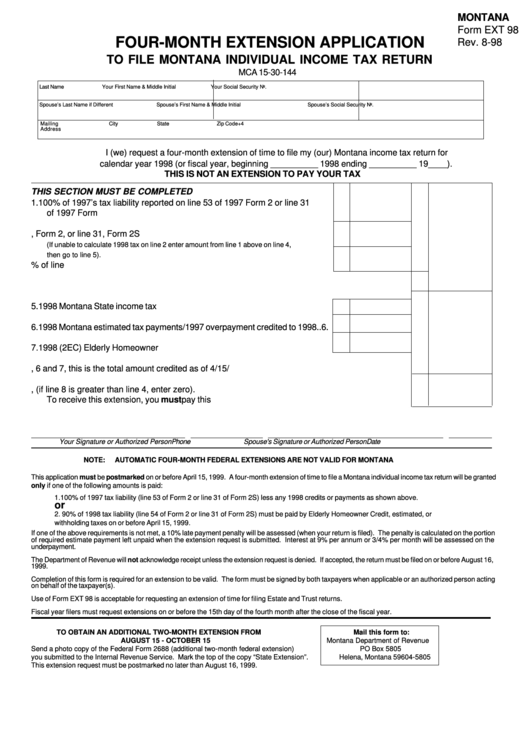

MONTANA

Form EXT 98

FOUR-MONTH EXTENSION APPLICATION

Rev. 8-98

TO FILE MONTANA INDIVIDUAL INCOME TAX RETURN

MCA 15-30-144

Last Name

Your First Name & Middle Initial

Your Social Security No.

Spouse’s Last Name if Different

Spouse’s First Name & Middle Initial

Spouse’s Social Security No.

Mailing

City

State

Zip Code+4

Address

I (we) request a four-month extension of time to file my (our) Montana income tax return for

calendar year 1998 (or fiscal year, beginning __________ 1998 ending __________ 19____).

THIS IS NOT AN EXTENSION TO PAY YOUR TAX

THIS SECTION MUST BE COMPLETED

1. 100% of 1997’s tax liability reported on line 53 of 1997 Form 2 or line 31

of 1997 Form 2S ........................................................................................... 1.

2. Total tax liability for 1998 entered on line 54, Form 2, or line 31, Form 2S ..... 2.

(If unable to calculate 1998 tax on line 2 enter amount from line 1 above on line 4,

then go to line 5).

3. Enter 90% of line 2 ........................................................................................ 3.

4. Enter the lesser of line 1 or 3 ........................................................................................................ 4.

5. 1998 Montana State income tax withheld ....................................................... 5.

6. 1998 Montana estimated tax payments/1997 overpayment credited to 1998 .. 6.

7. 1998 (2EC) Elderly Homeowner Credit .......................................................... 7.

8. Add lines 5, 6 and 7, this is the total amount credited as of 4/15/99 .............................................. 8.

9. Subtract line 8 from line 4, (if line 8 is greater than line 4, enter zero).

To receive this extension, you must pay this amount ..................................................................... 9.

Your Signature or Authorized Person

Phone

Spouse's Signature or Authorized Person

Date

NOTE:

AUTOMATIC FOUR-MONTH FEDERAL EXTENSIONS ARE NOT VALID FOR MONTANA

This application must be postmarked on or before April 15, 1999. A four-month extension of time to file a Montana individual income tax return will be granted

only if one of the following amounts is paid:

1. 100% of 1997 tax liability (line 53 of Form 2 or line 31 of Form 2S) less any 1998 credits or payments as shown above.

or

2. 90% of 1998 tax liability (line 54 of Form 2 or line 31 of Form 2S) must be paid by Elderly Homeowner Credit, estimated, or

withholding taxes on or before April 15, 1999.

If one of the above requirements is not met, a 10% late payment penalty will be assessed (when your return is filed). The penalty is calculated on the portion

of required estimate payment left unpaid when the extension request is submitted. Interest at 9% per annum or 3/4% per month will be assessed on the

underpayment.

The Department of Revenue will not acknowledge receipt unless the extension request is denied. If accepted, the return must be filed on or before August 16,

1999.

Completion of this form is required for an extension to be valid. The form must be signed by both taxpayers when applicable or an authorized person acting

on behalf of the taxpayer(s).

Use of Form EXT 98 is acceptable for requesting an extension of time for filing Estate and Trust returns.

Fiscal year filers must request extensions on or before the 15th day of the fourth month after the close of the fiscal year.

TO OBTAIN AN ADDITIONAL TWO-MONTH EXTENSION FROM

Mail this form to:

AUGUST 15 - OCTOBER 15

Montana Department of Revenue

Send a photo copy of the Federal Form 2688 (additional two-month federal extension)

PO Box 5805

you submitted to the Internal Revenue Service. Mark the top of the copy “State Extension”.

Helena, Montana 59604-5805

This extension request must be postmarked no later than August 16, 1999.

1

1