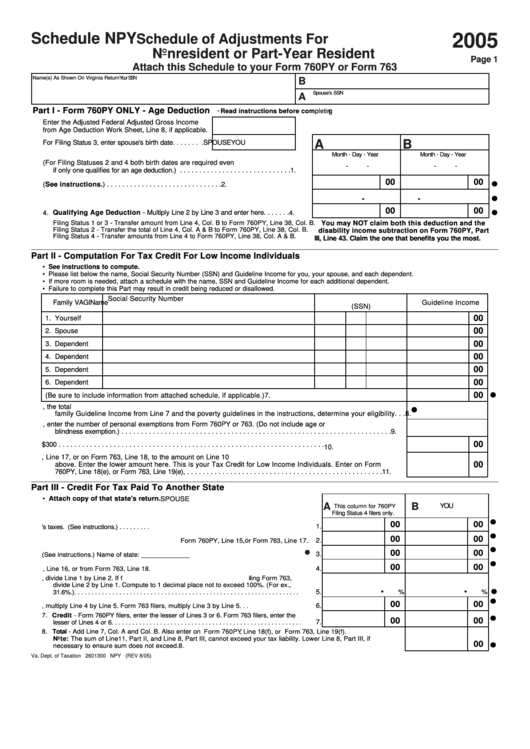

Schedule Npy - Schedule Of Adjustments For Nonresident Or Part-Year Resident - 2005

ADVERTISEMENT

Schedule NPY

2005

Schedule of Adjustments For

Nonresident or Part-Year Resident

Page 1

Attach this Schedule to your Form 760PY or Form 763

Name(s) As Shown On Virginia Return

Your SSN

B

Spouse's SSN

A

Part I - Form 760PY ONLY - Age Deduction -

g

Read instructions before completin

Enter the Adjusted Federal Adjusted Gross Income

from Age Deduction Work Sheet, Line 8, if applicable.

A

B

For Filing Status 3, enter spouse's birth date. . . . . . . .

SPOUSE

YOU

Month - Day - Year

Month - Day - Year

1. Enter birthdate (For Filing Statuses 2 and 4 both birth dates are required even

-

-

-

-

if only one qualifies for an age deduction.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

00

00

v

2. Enter Age Deduction (See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

.

.

v

3. Enter the Ratio Schedule amount for the date you moved into or out of Virginia

3.

00

00

v

4. Qualifying Age Deduction - Multiply Line 2 by Line 3 and enter here. . . . . . .

4.

Filing Status 1 or 3 - Transfer amount from Line 4, Col. B to Form 760PY , Line 38, Col. B.

You may NOT claim both this deduction and the

Filing Status 2 - Transfer the total of Line 4, Col. A & B to Form 760PY , Line 38, Col. B.

disability income subtraction on Form 760PY, Part

Filing Status 4 - Transfer amounts from Line 4 to Form 760PY , Line 38, Col. A & B.

III, Line 43. Claim the one that benefits you the most.

Part II - Computation For Tax Credit For Low Income Individuals

x See instructions to compute.

x Please list below the name, Social Security Number (SSN) and Guideline Income for you, your spouse, and each dependent.

x If more room is needed, attach a schedule with the name, SSN and Guideline Income for each additional dependent.

x Failure to complete this Part may result in credit being reduced or disallowed.

Social Security Number

Family VAGI

Name

Guideline Income

(SSN)

00

1. Yourself

00

2. Spouse

00

3. Dependent

00

4. Dependent

00

5. Dependent

00

6. Dependent

v

00

7. Total Family Guideline Income (Be sure to include information from attached schedule, if applicable.)

7.

8. Enter the total number of exemptions listed above and on any attached schedule. Based on this total, the total

v

family Guideline Income from Line 7 and the poverty guidelines in the instructions, determine your eligibility. . .

8.

9. If eligible, enter the number of personal exemptions from Form 760PY or 763. (Do not include age or

blindness exemption.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

00

10. Multiply Line 9 by $300 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

11. Compare the amount of tax on Form 760PY , Line 17, or on Form 763, Line 18, to the amount on Line 10

00

above. Enter the lower amount here. This is your Tax Credit for Low Income Individuals. Enter on Form

760PY , Line 18(e), or Form 763, Line 19(e), . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

Part III - Credit For Tax Paid To Another State

x Attach copy of that state's return.

SPOUSE

A

B

YOU

This column for 760PY

Filing Status 4 filers only.

v

00

00

1.

1. Enter qualifying taxable income base for other state's taxes. (See instructions.) . . . . . . . . .

v

00

00

o

,

2.

2. Virginia Taxable Income - Enter amount from Form 760PY , Line 15,

r Form 763

Line 17.

v

v

00

00

3.

3. Enter qualifying tax paid to other state. (See instructions.) Name of state: _____________

v

00

00

4.

4. Virginia Income Tax - Enter amount from Form 760PY , Line 16, or from Form 763, Line 18.

5. Income Percentage - If filing Form 760PY , divide Line 1 by Line 2. If f

ling Form 763,

i

divide Line 2 by Line 1. Compute to 1 decimal place not to exceed 100%. (For ex.,

.

.

% v

5.

%

31.6%.). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

v

00

00

6.

6. Form 760PY fi lers, multiply Line 4 by Line 5. Form 763 filers, multiply Line 3 by Line 5. . .

7. Credit - Form 760PY fi lers, enter the lesser of Lines 3 or 6. Form 763 filers, enter the

v

00

00

7.

lesser of Lines 4 or 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Total - Add Line 7, Col. A and Col. B. Also enter on Form 760PY

Line 18(f), or Form 763, Line 19(f).

,

Note: The sum of Line11, Part II, and Line 8, Part III, cannot exceed your tax liability. Lower Line 8, Part III, if

00

v

necessary to ensure sum does not exceed.

8.

Va. Dept. of Taxation 2601300 NPY (REV 8/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2