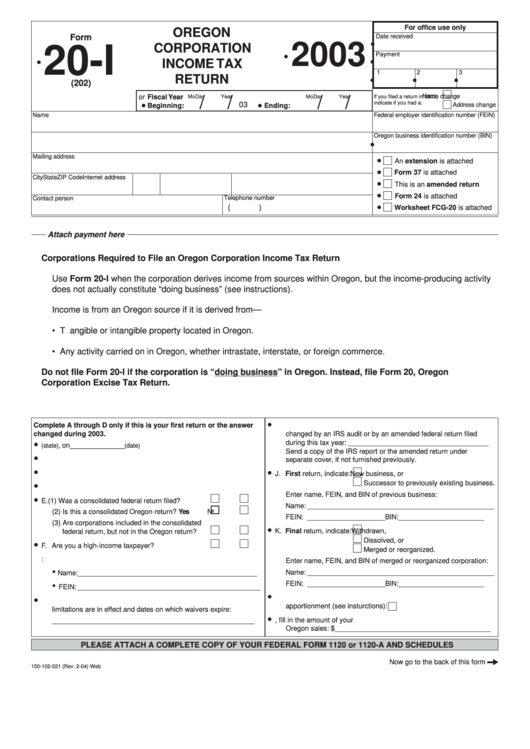

Form 20-I - Oregon Corporation Income Tax Return - 2003

ADVERTISEMENT

For office use only

OREGON

Form

Date received

•

2003

CORPORATION

20-I

•

Payment

•

•

INCOME TAX

1

2

3

RETURN

•

•

•

(202)

Name change

or Fiscal Year

If you filed a return in 2002,

Mo

/

Day

/

Year

Mo

/

Day

/

Year

•

•

indicate if you had a:

03

Address change

Beginning:

Ending:

Name

Federal employer identification number (FEIN)

Oregon business identification number (BIN)

•

Mailing address

•

An extension is attached

•

Form 37 is attached

City

State

ZIP Code

Internet address

•

This is an amended return

•

Form 24 is attached

Telephone number

Contact person

•

(

)

Worksheet FCG-20 is attached

Attach payment here

Corporations Required to File an Oregon Corporation Income Tax Return

Use Form 20-I when the corporation derives income from sources within Oregon, but the income-producing activity

does not actually constitute “doing business” (see instructions).

Income is from an Oregon source if it is derived from—

• Tangible or intangible property located in Oregon.

• Any activity carried on in Oregon, whether intrastate, interstate, or foreign commerce.

Do not file Form 20-I if the corporation is “doing business” in Oregon. Instead, file Form 20, Oregon

Corporation Excise Tax Return.

•

Complete A through D only if this is your first return or the answer

I. List the tax years for which your federal taxable income was

changed during 2003.

changed by an IRS audit or by an amended federal return filed

•

during this tax year: ____________________________________

A. Incorporated in ______________

on ______________

(state),

(date)

Send a copy of the IRS report or the amended return under

•

B. State of commercial domicile ______________________________

separate cover, if not furnished previously.

•

•

C. Date business activity began in Oregon ______________________

J. First return, indicate:

New business, or

Successor to previously existing business.

•

D. Business Activity Code from federal return ___________________

Enter name, FEIN, and BIN of previous business:

•

E. (1) Was a consolidated federal return filed? ............

Yes

No

Name: ________________________________________________

(2) Is this a consolidated Oregon return? ................

Yes

No

FEIN: ____________________ BIN: ______________________

(3) Are corporations included in the consolidated

•

K. Final return, indicate:

Withdrawn,

federal return, but not in the Oregon return? .....

Yes

No

Dissolved, or

•

F. Are you a high-income taxpayer? ...........................

Yes

No

Merged or reorganized.

G. Enter name and FEIN of parent corporation if applicable:

Enter name, FEIN, and BIN of merged or reorganized corporation:

•

Name: ________________________________________________

Name: ______________________________________________

FEIN: ____________________ BIN: ______________________

•

FEIN: _______________________________________________

•

•

L. Utility or telecommunications company electing alternative

H. List the tax years for which federal waivers of the statute of

apportionment (see insturctions):

limitations are in effect and dates on which waivers expire:

•

M. If you did not complete Schedule AP, fill in the amount of your

____________________________________________________

Oregon sales: $ ________________________________________

PLEASE ATTACH A COMPLETE COPY OF YOUR FEDERAL FORM 1120 or 1120-A AND SCHEDULES

Now go to the back of this form

150-102-021 (Rev. 2-04) Web

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4