Form K-120ex - Kansas Expensing Deduction Schedule - 2012

ADVERTISEMENT

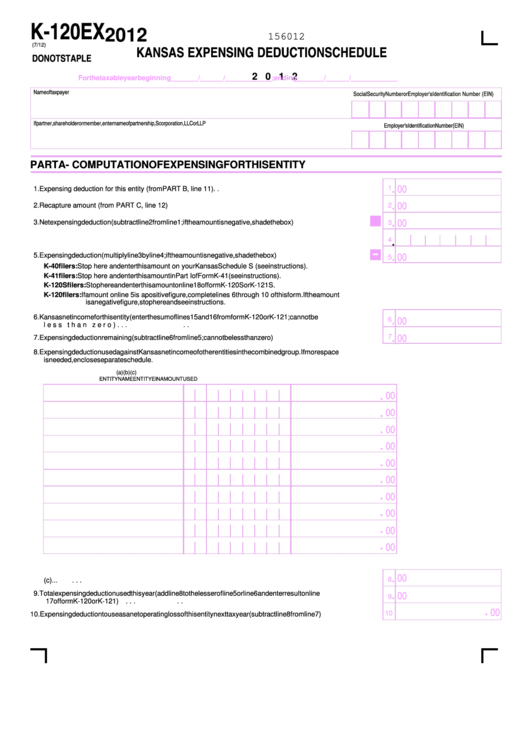

K-120EX

2012

156012

(7/12)

KANSAS EXPENSING DEDUCTION SCHEDULE

DO NOT STAPLE

2 0 1 2

For the taxable year beginning ____ ___ / ___ ___/___ ___ ___ ___ ; ending ____ ___ / ___ ___/___ ___ ___ ___

Name of taxpayer

Social Security Number or Employer's Identification Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer's Identification Number (EIN)

PART A - COMPUTATION OF EXPENSING FOR THIS ENTITY

. 00

1

1. Expensing deduction for this entity (from PART B, line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. 00

2. Recapture amount (from PART C, line 12). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

-

. 00

3. Net expensing deduction (subtract line 2 from line 1; if the amount is negative, shade the box). . . . . . . . .

3

4. Ownership Percentage. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

.

-

. 00

5. Expensing deduction (multiply line 3 by line 4; if the amount is negative, shade the box). . . . . . . . . . . . . .

5

K-40 filers: Stop here and enter this amount on your Kansas Schedule S (see instructions).

K-41 filers: Stop here and enter this amount in Part I of Form K-41 (see instructions).

K-120S filers: Stop here and enter this amount on line 18 of form K-120S or K-121S.

K-120 filers: If amount on line 5 is a positive figure, complete lines 6 through 10 of this form. If the amount

is a negative figure, stop here and see instructions.

6. Kansas net income for this entity (enter the sum of lines 15 and 16 from form K-120 or K-121; cannot be

. 00

6

less than zero). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. 00

7

7. Expensing deduction remaining (subtract line 6 from line 5; cannot be less than zero) . . . . . . . . . . . . . . . . . . .

8. Expensing deduction used against Kansas net income of other entities in the combined group. If more space

is needed, enclose separate schedule.

(a)

(b)

(c)

ENTITY NAME

ENTITY EIN

AMOUNT USED

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

8

Amount used by other entities this year. Enter total of amounts in column (c) . . . . . . . . . . . . . . . . . . . . . . . . . .

. 00

9. Total expensing deduction used this year (add line 8 to the lesser of line 5 or line 6 and enter result on line

9

17 of form K-120 or K-121) . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. 00

10

10. Expensing deduction to use as a net operating loss of this entity next tax year (subtract line 8 from line 7). . . .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2