Print

Clear

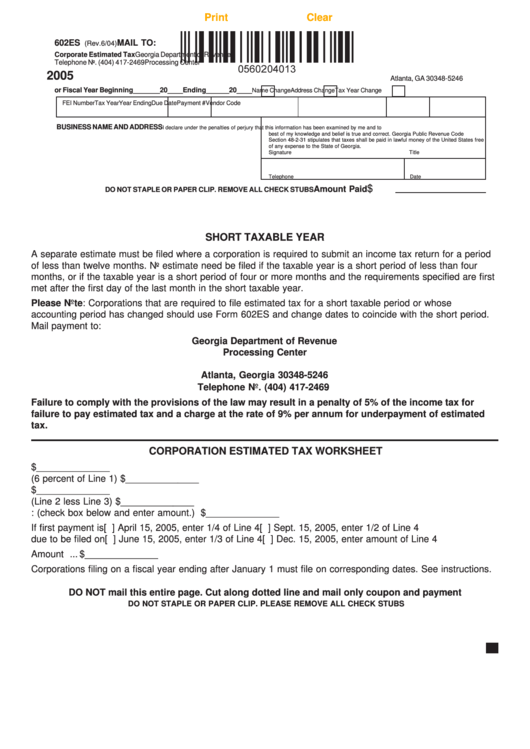

602ES

MAIL TO:

(Rev.6/04)

Corporate Estimated Tax

Georgia Department of Revenue

Telephone No. (404) 417-2469

Processing Center

P.O. Box 105246

2005

Atlanta, GA 30348-5246

or Fiscal Year Beginning_______20____Ending______20____

Name Change

Address Change

Tax Year Change

FEI Number

Tax Year

Year Ending

Due Date

Payment #

Vendor Code

BUSINESS NAME AND ADDRESS

I declare under the penalties of perjury that this information has been examined by me and to

best of my knowledge and belief is true and correct. Georgia Public Revenue Code

Section 48-2-31 stipulates that taxes shall be paid in lawful money of the United States free

of any expense to the State of Georgia.

Signature

Title

Telephone

Date

$

Amount Paid

DO NOT STAPLE OR PAPER CLIP. REMOVE ALL CHECK STUBS

SHORT TAXABLE YEAR

A separate estimate must be filed where a corporation is required to submit an income tax return for a period

of less than twelve months. No estimate need be filed if the taxable year is a short period of less than four

months, or if the taxable year is a short period of four or more months and the requirements specified are first

met after the first day of the last month in the short taxable year.

Please Note: Corporations that are required to file estimated tax for a short taxable period or whose

accounting period has changed should use Form 602ES and change dates to coincide with the short period.

Mail payment to:

Georgia Department of Revenue

Processing Center

P.O. Box 105246

Atlanta, Georgia 30348-5246

Telephone No. (404) 417-2469

Failure to comply with the provisions of the law may result in a penalty of 5% of the income tax for

failure to pay estimated tax and a charge at the rate of 9% per annum for underpayment of estimated

tax.

CORPORATION ESTIMATED TAX WORKSHEET

1. Amount of taxable income expected during the current year ........................................ $ ______________

2. Estimated Tax (6 percent of Line 1) ............................................................................... $ ______________

3. Less Credit for 2004 overpayment if credit was elected on Form 600 .......................... $ ______________

4. Unpaid balance (Line 2 less Line 3)............................................................................... $ ______________

5. Computation of installment: (check box below and enter amount.) .............................. $ ______________

If first payment is

[ ] April 15, 2005, enter 1/4 of Line 4

[ ] Sept. 15, 2005, enter 1/2 of Line 4

due to be filed on

[ ] June 15, 2005, enter 1/3 of Line 4

[ ] Dec. 15, 2005, enter amount of Line 4

Amount Due ........................................................................................................................ $ ______________

Corporations filing on a fiscal year ending after January 1 must file on corresponding dates. See instructions.

DO NOT mail this entire page. Cut along dotted line and mail only coupon and payment

DO NOT STAPLE OR PAPER CLIP. PLEASE REMOVE ALL CHECK STUBS

1

1