Form Lk W-3 - City Of Lakewood Withholding Tax Reconciliation - 2006

ADVERTISEMENT

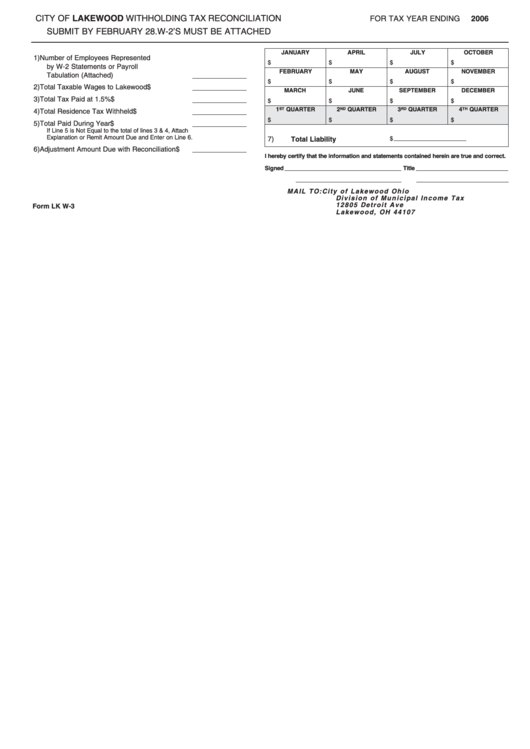

CITY OF LAKEWOOD WITHHOLDING TAX RECONCILIATION

FOR TAX YEAR ENDING

2006

SUBMIT BY FEBRUARY 28. W-2’S MUST BE ATTACHED

JANUARY

APRIL

JULY

OCTOBER

1) Number of Employees Represented

$

$

$

$

by W-2 Statements or Payroll

FEBRUARY

MAY

AUGUST

NOVEMBER

Tabulation (Attached)

$

$

$

$

2) Total Taxable Wages to Lakewood

$

MARCH

JUNE

SEPTEMBER

DECEMBER

3) Total Tax Paid at 1.5%

$

$

$

$

$

1

ST

QUARTER

2

ND

QUARTER

3

RD

QUARTER

4

TH

QUARTER

4) Total Residence Tax Withheld

$

$

$

$

$

5) Total Paid During Year

$

If Line 5 is Not Equal to the total of lines 3 & 4, Attach

Explanation or Remit Amount Due and Enter on Line 6.

7)

Total Liability

$

6) Adjustment Amount Due with Reconciliation

$

I hereby certify that the information and statements contained herein are true and correct.

Signed

Title

Fed. ID No.

Date

M A I L TO :

C i t y o f L a k ewo o d O h i o

D i v i s i o n o f M u n i c i p a l I n c o m e Ta x

1 2 8 0 5 D e t ro i t Av e

Form LK W-3

L a k ewo o d , O H 4 4 1 0 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1