Form Tc140 - Certificate Of Litigation Status - 2000

ADVERTISEMENT

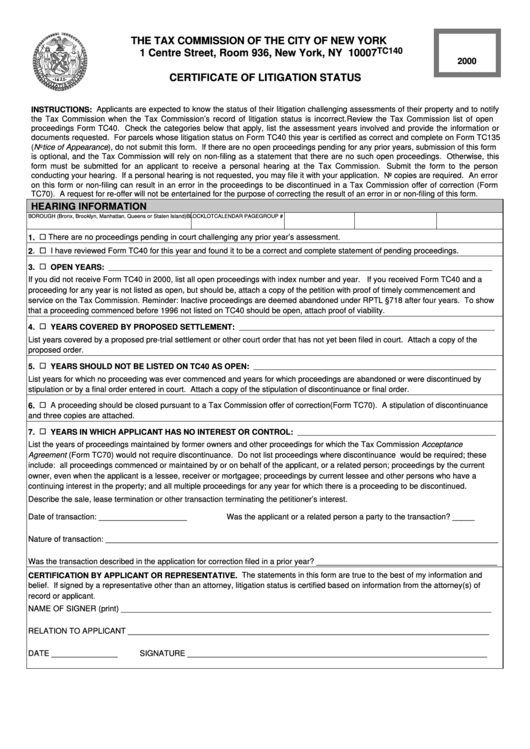

THE TAX COMMISSION OF THE CITY OF NEW YORK

TC140

1 Centre Street, Room 936, New York, NY 10007

2000

CERTIFICATE OF LITIGATION STATUS

INSTRUCTIONS: Applicants are expected to know the status of their litigation challenging assessments of their property and to notify

the Tax Commission when the Tax Commission’s record of litigation status is incorrect. Review the Tax Commission list of open

proceedings Form TC40. Check the categories below that apply, list the assessment years involved and provide the information or

documents requested. For parcels whose litigation status on Form TC40 this year is certified as correct and complete on Form TC135

(Notice of Appearance), do not submit this form. If there are no open proceedings pending for any prior years, submission of this form

is optional, and the Tax Commission will rely on non-filing as a statement that there are no such open proceedings. Otherwise, this

form must be submitted for an applicant to receive a personal hearing at the Tax Commission. Submit the form to the person

conducting your hearing. If a personal hearing is not requested, you may file it with your application. No copies are required. An error

on this form or non-filing can result in an error in the proceedings to be discontinued in a Tax Commission offer of correction (Form

TC70). A request for re-offer will not be entertained for the purpose of correcting the result of an error in or non-filing of this form.

HEARING INFORMATION

BOROUGH (Bronx, Brooklyn, Manhattan, Queens or Staten Island)

BLOCK

LOT

CALENDAR PAGE

GROUP #

1. ! There are no proceedings pending in court challenging any prior year’s assessment.

2 . ! I have reviewed Form TC40 for this year and found it to be a correct and complete statement of pending proceedings.

3. ! OPEN YEARS: _______________________________________________________________________________________

If you did not receive Form TC40 in 2000, list all open proceedings with index number and year. If you received Form TC40 and a

proceeding for any year is not listed as open, but should be, attach a copy of the petition with proof of timely commencement and

service on the Tax Commission. Reminder: Inactive proceedings are deemed abandoned under RPTL §718 after four years. To show

that a proceeding commenced before 1996 not listed on TC40 should be open, attach proof of viability.

4. ! YEARS COVERED BY PROPOSED SETTLEMENT: __________________________________________________________

List years covered by a proposed pre-trial settlement or other court order that has not yet been filed in court. Attach a copy of the

proposed order.

5. ! YEARS SHOULD NOT BE LISTED ON TC40 AS OPEN: _______________________________________________________

List years for which no proceeding was ever commenced and years for which proceedings are abandoned or were discontinued by

stipulation or by a final order entered in court. Attach a copy of the stipulation of discontinuance or final order.

6. ! A proceeding should be closed pursuant to a Tax Commission offer of correction (Form TC70). A stipulation of discontinuance

and three copies are attached.

7. ! YEARS IN WHICH APPLICANT HAS NO INTEREST OR CONTROL: _____________________________________________

List the years of proceedings maintained by former owners and other proceedings for which the Tax Commission Acceptance

Agreement (Form TC70) would not require discontinuance. Do not list proceedings where discontinuance would be required; these

include: all proceedings commenced or maintained by or on behalf of the applicant, or a related person; proceedings by the current

owner, even when the applicant is a lessee, receiver or mortgagee; proceedings by current lessee and other persons who have a

continuing interest in the property; and all multiple proceedings for any year for which there is a proceeding to be discontinued.

Describe the sale, lease termination or other transaction terminating the petitioner’s interest.

Date of transaction: ____________________

Was the applicant or a related person a party to the transaction? _____

Nature of transaction: _________________________________________________________________________________________

Was the transaction described in the application for correction filed in a prior year? _________________________________________

CERTIFICATION BY APPLICANT OR REPRESENTATIVE. The statements in this form are true to the best of my information and

belief. If signed by a representative other than an attorney, litigation status is certified based on information from the attorney(s) of

record or applicant.

NAME OF SIGNER (print) ____________________________________________________________________________________

RELATION TO APPLICANT __________________________________________________________________________________

DATE _______________

SIGNATURE ____________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1