Reset Form

Michigan Department of Treasury

Issued under authority of Public Act 281 of 1967, as amended.

4642 (Rev. 06-16)

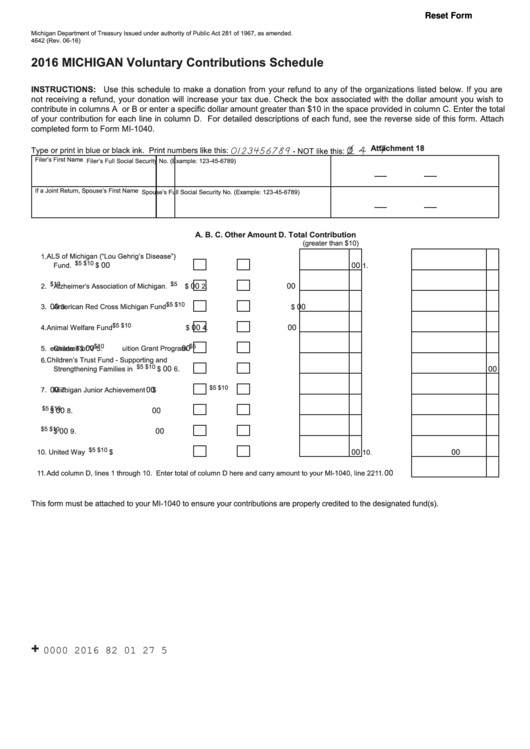

2016 MICHIGAN Voluntary Contributions Schedule

INSTRUCTIONS: Use this schedule to make a donation from your refund to any of the organizations listed below. If you are

not receiving a refund, your donation will increase your tax due. Check the box associated with the dollar amount you wish to

contribute in columns A or B or enter a specific dollar amount greater than $10 in the space provided in column C. Enter the total

of your contribution for each line in column D. For detailed descriptions of each fund, see the reverse side of this form. Attach

completed form to Form MI-1040.

1 4

Attachment 18

Type or print in blue or black ink. Print numbers like this:

0123456789

- NOT like this:

Filer’s First Name

M.I.

Last Name

Filer’s Full Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

Spouse’s Full Social Security No. (Example: 123-45-6789)

A.

B.

C. Other Amount

D. Total Contribution

(greater than $10)

1. ALS of Michigan (“Lou Gehrig’s Disease”)

$5

$10

00

00

Fund. ..........................................................

$

1.

................

$5

$10

00

00

2. Alzheimer’

s Association of Michigan. ........

$

2.

................

$5

$10

00

00

3. American Red Cross Michigan Fund ..........

$

3.

.................

$5

$10

00

00

4. Animal Welfare Fund ..................................

$

4.

.................

$5

$10

00

00

5.

Children of V

eterans T

uition Grant Program

$

5.

.................

6. Children’s Trust Fund - Supporting and

$5

$10

00

00

Strengthening Families in Michigan............

$

6.

.................

$5

$10

00

00

7.

Michigan Junior Achievement Fund............

$

7.

.................

$5

$10

00

00

8. Military Family Relief Fund .........................

$

8.

.................

$5

$10

00

00

9. Special Olympics Michigan.........................

$

9.

.................

$5

$10

00

00

10. United Way Fund ........................................

$

10.

.................

00

11. Add column D, lines 1 through 10. Enter total of column D here and carry amount to your MI-1040, line 22......

11.

This form must be attached to your MI-1040 to ensure your contributions are properly credited to the designated fund(s).

+

0000 2016 82 01 27 5

1

1 2

2