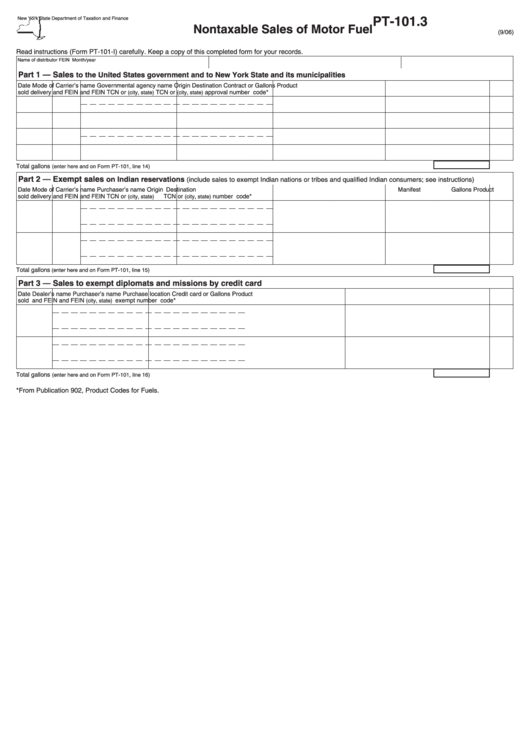

Form Pt-101.3 - Nontaxable Sales Of Motor Fuel

ADVERTISEMENT

PT-101.3

New York State Department of Taxation and Finance

Nontaxable Sales of Motor Fuel

(9/06)

Read instructions (Form PT-101-I) carefully. Keep a copy of this completed form for your records.

Name of distributor

FEIN

Month/year

Part 1 — Sales

to the United States government and to New York State and its municipalities

Date

Mode of

Carrier’s name

Governmental agency name

Origin

Destination

Contract or

Gallons

Product

sold

delivery

and FEIN

and FEIN

TCN or

TCN or

approval number

code*

(city, state)

(city, state)

Total gallons

........................................................................................................................................................................

(enter here and on Form PT‑101, line 14)

Part 2 — Exempt sales

on Indian reservations

(include sales to exempt Indian nations or tribes and qualified Indian consumers; see instructions)

Date

Mode of

Carrier’s name

Purchaser’s name

Origin

Destination

Manifest

Gallons

Product

sold

delivery

and FEIN

and FEIN

TCN or

TCN or

number

code*

(city, state)

(city, state)

Total gallons

........................................................................................................................................................................

(enter here and on Form PT‑101, line 15)

Part 3 — Sales to exempt diplomats and missions by credit card

Date

Dealer’s name

Purchaser’s name

Purchase location

Credit card or

Gallons

Product

sold

and FEIN

and FEIN

exempt number

code*

(city, state)

Total gallons

........................................................................................................................................................................

(enter here and on Form PT‑101, line 16)

*From Publication 902, Product Codes for Fuels.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3