Form Pt-101.3 - Nontaxable Sales Of Motor Fuel Page 2

ADVERTISEMENT

Page 2 of 3 PT-101.3 (9/06)

Name of distributor

FEIN

Month/year

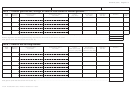

Part 4 — Sales to exempt hospitals and other nontaxable distributions

Section A — Sales to exempt hospitals included in the organizations described in Section 1116(a)(4) of the Tax Law

Date

Mode of

Carrier’s name

Purchaser’s name

Origin

Destination

Purchaser’s

Gallons

Product

sold

delivery

and FEIN

and FEIN

exempt number

code*

(city, state)

(city, state)

Subtotal — Sales to exempt hospitals............................................................................................................................................................................................

Section B — Other nontaxable distributions

Date

Mode of

Carrier’s name

Purchaser’s name

Origin

Destination

Purchaser’s

Gallons

Product

sold

delivery

and FEIN

and FEIN

code*

(city, state)

(city, state)

(city, state)

Subtotal — Other nontaxable distribution ......................................................................................................................................................................................

Total gallons — Add Sections A and B subtotals

.................................................................................................................

(enter here and on Form PT‑101, line 17)

*From Publication 902, Product Codes for Fuels.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3