Form C51a - Alternate Wage Levy Disclosure

ADVERTISEMENT

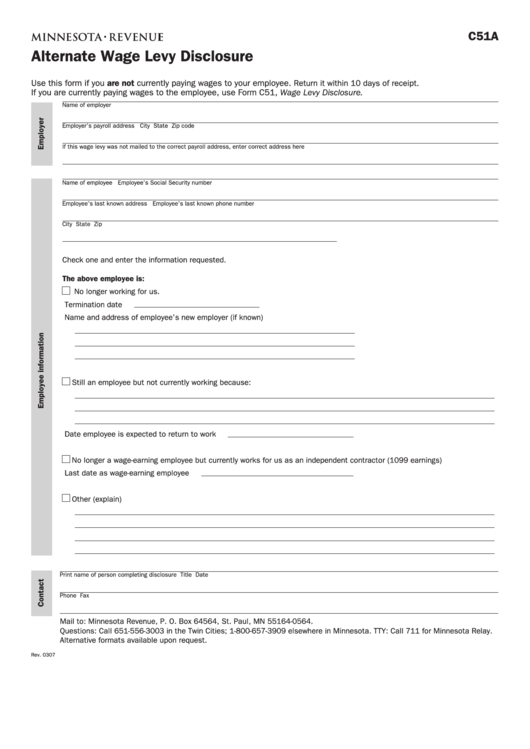

C51A

Alternate Wage Levy Disclosure

Use this form if you are not currently paying wages to your employee. Return it within 10 days of receipt.

If you are currently paying wages to the employee, use Form C51, Wage Levy Disclosure.

Name of employer

Employer’s payroll address

City

State

Zip code

If this wage levy was not mailed to the correct payroll address, enter correct address here

Name of employee

Employee’s Social Security number

Employee’s last known address

Employee’s last known phone number

City

State

Zip

Check one and enter the information requested.

The above employee is:

No longer working for us.

Termination date

Name and address of employee’s new employer (if known)

Still an employee but not currently working because:

Date employee is expected to return to work

No longer a wage-earning employee but currently works for us as an independent contractor (1099 earnings)

Last date as wage-earning employee

Other (explain)

Print name of person completing disclosure

Title

Date

Phone

Fax

Mail to: Minnesota Revenue, P . O. Box 64564, St. Paul, MN 55164-0564.

Questions: Call 651-556-3003 in the Twin Cities; 1-800-657-3909 elsewhere in Minnesota. TTY: Call 711 for Minnesota Relay.

Alternative formats available upon request.

Rev. 0307

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1