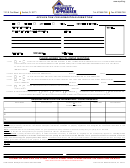

Form Mcpa-204 - Monroe County Property Appraiser Page 2

ADVERTISEMENT

S

P. R

, CFA

COTT

USSELL

MCPA-203

M

C

P

A

ONROE

OUNTY

ROPERTY

PPRAISER

Rev 4/13

C

C

OUNTY

OURTHOUSE

P.O. B

1176

OX

K

W

, FLORIDA 33041

EY

EST

(305) 292-3420

FAX: (305) 292-3431

PHONE

IMPORTANT NOTICE

Pursuant to Florida Statute 197.192 the property appraiser’s office will not split or combine parcels until all taxes due or

delinquent have been paid to the Tax Collector. It should also be noted that a parcel split / combination by the Property Appraiser is

for taxation purposes only and does not imply legality of the land division being requested, the legality for such parcel to be conveyed via

land title, nor the suitability for such parcel to be developed. No rights are being granted by this action that is reserved to any regulatory

agency. Contact the appropriate land development, zoning, and/or planning department of your jurisdiction for questions concerning

property development.

PLEASE NOTE: The Splitting of Parcels May Increase Your Property Assessment, Possibly Resulting in Higher Taxes.

HOMESTEAD PROPERTIES CURRENTLY AFFECTED BY AMENDMENT 10, SAVE OUR HOMES:

The land division (split) of a homestead property will result in the removal of the Save Our Homes 3% assessment limitation (cap)

from the newly created (split-out) parcel. The new (split-out) parcel will be assessed at market value generally resulting in an

increase in taxable value. If at a future date the property owner desires to re-combine the property, the new (split-out) parcel will be

combined back with the homestead parcel at its current market value. The Save Our Homes cap will not be restored to its former

level. When combining any parcel with a homesteaded parcel, the full market value of the non-homesteaded parcel will be added to

the assessed value of the homesteaded parcel for the current tax roll. In subsequent tax years, that value shall be protected by the

Save Our Homes assessment cap.

NON-HOMESTEAD PROPERTIES AFFECTED BY AMENDMENT 1, ASSESSMENT LIMITATION:

Per Florida Statute 193.1554(7) and 193.1555(7) the land division (split) or combination of non-homestead property will result in the

removal of the 10% assessment limitation (cap) and the assessment of the parcel(s) at full market value in the following tax year.

Property Owner(s) initials: Please note that by initialing this box you are stating that you have read and understand the above

statement.

___________ Property Owner initials

____________ Property Owner/Spouse initials

__________Property Owner/Spouse initials

Property Appraiser to Be Held Harmless:

It is the responsibility of the owner to ensure that any and all prior or currently due tax amounts on any parcels being split or aggregated

with any other parcels are paid in full to the Tax Collector. This agency is not responsible for any delinquent taxes, penalties, or interest

that could occur and accrue due to negligence on the part of the property owner, the owner’s representatives, or other parties when

requesting parcel splits or combinations. This action does not nullify or alleviate any existing liens or encumbrances on the property.

Furthermore, if the property is encumbered by a mortgage, it is the owner’s responsibility to seek prior approval from the mortgage

company for any changes to the property involving a split or combination. You agree by submitting this application that the Monroe County

Property Appraiser is neither responsible nor liable for any problems or complications resulting from this request.

By signing below, whether by the owner or the owner’s representative, the owner acknowledges they have read and understand the

aforementioned and availed themselves of the opportunity to ask any questions, seek clarification, or obtain additional information prior to

this action being requested.

Name of Owner of Record: _____________________________________________________________________________

Address: ___________________________________________________________________________________________

Telephone: _____________________________________ E-Mail: ______________________________________________

Signature: ______________________________________________________ Date: ________________________________

For Office Use Only

This split/combination will be effective for the 20___ tax year.

Approved By: ____________________________________________________ Date: ________________________________

Monroe County Property Appraiser’s Office

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3