Employer'S Quarterly Return Of License Fee Withheld Under Graves County, Kentucky Ordinance

ADVERTISEMENT

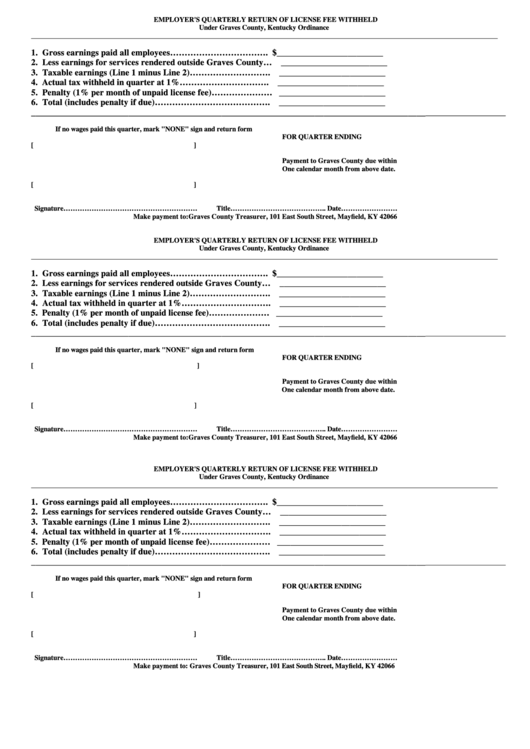

EMPLOYER'S QUARTERLY RETURN OF LICENSE FEE WITHHELD

Under Graves County, Kentucky Ordinance

______________________________________________________________________________________________________________________________________

1. Gross earnings paid all employees……………………………. $________________________

2. Less earnings for services rendered outside Graves County… ________________________

3. Taxable earnings (Line 1 minus Line 2)………………………. ________________________

4. Actual tax withheld in quarter at 1%…………………………. ________________________

5. Penalty (1% per month of unpaid license fee)………………… ________________________

6. Total (includes penalty if due)…………………………………. ________________________

_________________________________________________________________________________________

_______________________

If no wages paid this quarter, mark "NONE" sign and return form

FOR QUARTER ENDING

[

]

Payment to Graves County due within

One calendar month from above date.

[

]

Signature…………………………………………………

Title………………………………….. Date……………………

Make payment to: Graves County Treasurer, 101 East South Street, Mayfield, KY 42066

EMPLOYER'S QUARTERLY RETURN OF LICENSE FEE WITHHELD

Under Graves County, Kentucky Ordinance

______________________________________________________________________________________________________________________________________

1. Gross earnings paid all employees……………………………. $________________________

2. Less earnings for services rendered outside Graves County… ________________________

3. Taxable earnings (Line 1 minus Line 2)………………………. ________________________

4. Actual tax withheld in quarter at 1%…………………………. ________________________

5. Penalty (1% per month of unpaid license fee)………………… ________________________

6. Total (includes penalty if due)…………………………………. ________________________

_________________________________________________________________________________________

_______________________

If no wages paid this quarter, mark "NONE" sign and return form

FOR QUARTER ENDING

[

]

Payment to Graves County due within

One calendar month from above date.

[

]

Signature…………………………………………………

Title………………………………….. Date……………………

Make payment to: Graves County Treasurer, 101 East South Street, Mayfield, KY 42066

EMPLOYER'S QUARTERLY RETURN OF LICENSE FEE WITHHELD

Under Graves County, Kentucky Ordinance

______________________________________________________________________________________________________________________________________

1. Gross earnings paid all employees……………………………. $________________________

2. Less earnings for services rendered outside Graves County… ________________________

3. Taxable earnings (Line 1 minus Line 2)………………………. ________________________

4. Actual tax withheld in quarter at 1%…………………………. ________________________

5. Penalty (1% per month of unpaid license fee)………………… ________________________

6. Total (includes penalty if due)…………………………………. ________________________

_________________________________________________________________________________________

_______________________

If no wages paid this quarter, mark "NONE" sign and return form

FOR QUARTER ENDING

[

]

Payment to Graves County due within

One calendar month from above date.

[

]

Signature…………………………………………………

Title………………………………….. Date……………………

Make payment to: Graves County Treasurer, 101 East South Street, Mayfield, KY 42066

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1