Employer'S Quarterly Return Of License Fee Withheld Ordinance No. 453 (Form G-1) - City Of Goodwater

ADVERTISEMENT

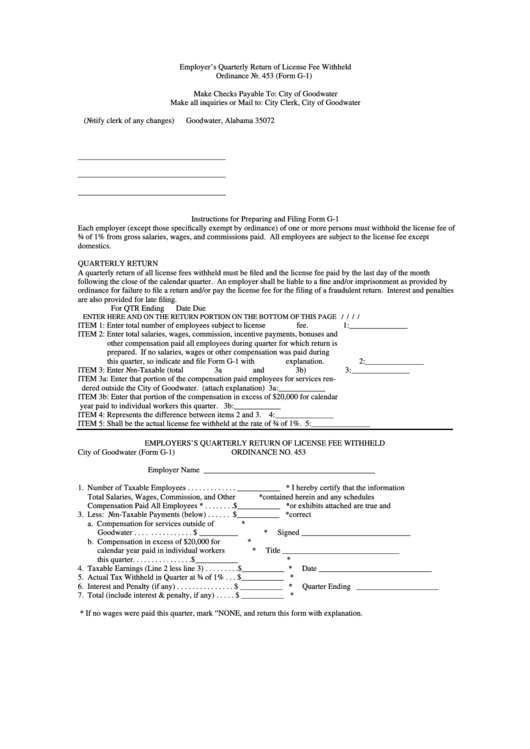

Employer’s Quarterly Return of License Fee Withheld

Ordinance No. 453 (Form G-1)

Make Checks Payable To: City of Goodwater

Make all inquiries or Mail to: City Clerk, City of Goodwater

P.O. Box 45

(Notify clerk of any changes)

Goodwater, Alabama 35072

______________________________________

______________________________________

______________________________________

Instructions for Preparing and Filing Form G-1

Each employer (except those specifically exempt by ordinance) of one or more persons must withhold the license fee of

¾ of 1% from gross salaries, wages, and commissions paid. All employees are subject to the license fee except

domestics.

QUARTERLY RETURN

A quarterly return of all license fees withheld must be filed and the license fee paid by the last day of the month

following the close of the calendar quarter. An employer shall be liable to a fine and/or imprisonment as provided by

ordinance for failure to file a return and/or pay the license fee for the filing of a fraudulent return. Interest and penalties

are also provided for late filing.

For QTR Ending

Date Due

ENTER HERE AND ON THE RETURN PORTION ON THE BOTTOM OF THIS PAGE

/ /

/ /

ITEM 1: Enter total number of employees subject to license fee.

1:_______________

ITEM 2: Enter total salaries, wages, commission, incentive payments, bonuses and

other compensation paid all employees during quarter for which return is

prepared. If no salaries, wages or other compensation was paid during

this quarter, so indicate and file Form G-1 with explanation.

2:_______________

ITEM 3: Enter Non-Taxable (total 3a and 3b)

3:_______________

ITEM 3a: Enter that portion of the compensation paid employees for services ren-

dered outside the City of Goodwater. (attach explanation)

3a:____________

ITEM 3b: Enter that portion of the compensation in excess of $20,000 for calendar

year paid to individual workers this quarter.

3b:____________

ITEM 4: Represents the difference between items 2 and 3.

4:_______________

ITEM 5: Shall be the actual license fee withheld at the rate of ¾ of 1%.

5:_______________

EMPLOYERS’S QUARTERLY RETURN OF LICENSE FEE WITHHELD

City of Goodwater (Form G-1)

ORDINANCE NO. 453

Employer Name

____________________________________________

1. Number of Taxable Employees . . . . . . . . . . . . . ___________ * I hereby certify that the information

Total Salaries, Wages, Commission, and Other

*contained herein and any schedules

Compensation Paid All Employees * . . . . . . . .$___________ *or exhibits attached are true and

3. Less: Non-Taxable Payments (below) . . . . . . $___________ *correct

a. Compensation for services outside of

*

Goodwater . . . . . . . . . . . . . . . $ __________

*

Signed ____________________________

b. Compensation in excess of $20,000 for

*

calendar year paid in individual workers

*

Title ______________________________

this quarter. . . . . . . . . . . . . . . .$___________

*

4. Taxable Earnings (Line 2 less line 3) . . . . . . . . .$___________ *

Date _____________________________

5. Actual Tax Withheld in Quarter at ¾ of 1% . . . $___________ *

6. Interest and Penalty (if any) . . . . . . . . . . . . . . . $ ___________ *

Quarter Ending _____________________

7. Total (include interest & penalty, if any) . . . . . $ ___________ *

* If no wages were paid this quarter, mark “NONE, and return this form with explanation.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1