Form E-00 - Combined Report Form - Multnomah County Business Income Tax

ADVERTISEMENT

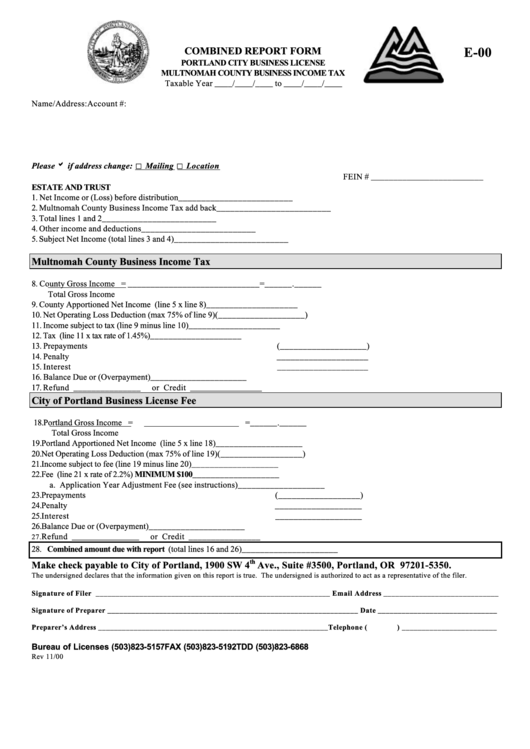

COMBINED REPORT FORM

E-00

PORTLAND CITY BUSINESS LICENSE

MULTNOMAH COUNTY BUSINESS INCOME TAX

Taxable Year ____/____/____ to ____/____/____

Name/Address:

Account #:

Please b if address change: U Mailing U Location

FEIN # _________________________

ESTATE AND TRUST

1.

Net Income or (Loss) before distribution

_________________________

2.

Multnomah County Business Income Tax add back

_________________________

3.

Total lines 1 and 2

_________________________

4.

Other income and deductions

_________________________

5.

Subject Net Income (total lines 3 and 4)

_________________________

Multnomah County Business Income Tax

8.

County Gross Income = _____________________________=______.______

Total Gross Income

9.

County Apportioned Net Income (line 5 x line 8)

____________________

10. Net Operating Loss Deduction (max 75% of line 9)

(___________________)

11. Income subject to tax (line 9 minus line 10)

____________________

12. Tax (line 11 x tax rate of 1.45%)

____________________

13. Prepayments

(___________________)

14. Penalty

____________________

15. Interest

____________________

16. Balance Due or (Overpayment)

_____________________

17. Refund _______________

or Credit ________________

City of Portland Business License Fee

18. Portland Gross Income =

=______.______

Total Gross Income

19. Portland Apportioned Net Income (line 5 x line 18)

___________________

20. Net Operating Loss Deduction (max 75% of line 19)

(__________________)

21. Income subject to fee (line 19 minus line 20)

___________________

22. Fee (line 21 x rate of 2.2%) MINIMUM $100

___________________

a. Application Year Adjustment Fee (see instructions)

___________________

23. Prepayments

(__________________)

24. Penalty

___________________

25. Interest

___________________

26. Balance Due or (Overpayment)

_____________________

Refund _______________

or Credit ________________

27.

28. Combined amount due with report (total lines 16 and 26)

_____________________

th

Make check payable to City of Portland, 1900 SW 4

Ave., Suite #3500, Portland, OR 97201-5350.

The undersigned declares that the information given on this report is true. The undersigned is authorized to act as a representative of the filer.

Signature of Filer ___________________________________________________________ Email Address _____________________________

Signature of Preparer _______________________________________________________________ Date ______________________________

Preparer’s Address __________________________________________________________Telephone (

) ________________________

Bureau of Licenses (503)823-5157

FAX (503)823-5192

TDD (503)823-6868

Rev 11/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1