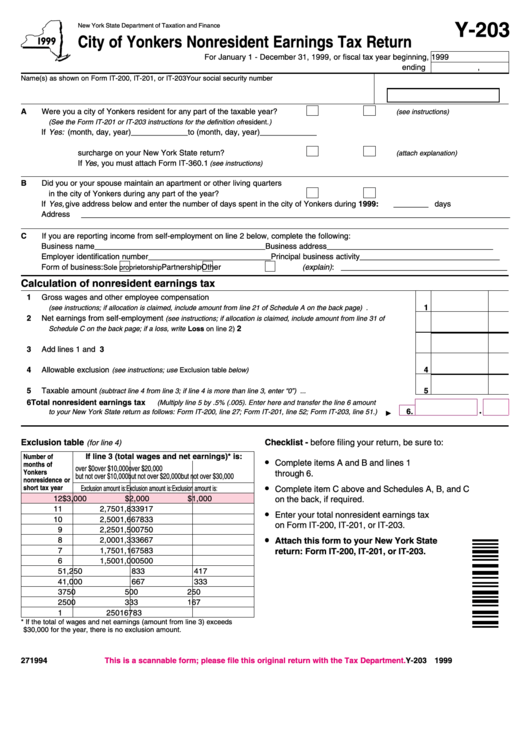

Y-203

New York State Department of Taxation and Finance

City of Yonkers Nonresident Earnings Tax Return

For January 1 - December 31, 1999, or fiscal tax year beginning

, 1999

ending

,

Name(s) as shown on Form IT-200, IT-201, or IT-203

Your social security number

A

Were you a city of Yonkers resident for any part of the taxable year? ...........

Yes

No

(see instructions)

(See the Form IT-201 or IT-203 instructions for the definition of resident. )

If Yes: 1. Give period of city of Yonkers residence. From (month, day, year) _____________ to (month, day, year)

_____________

2. Are you reporting the city of Yonkers resident income tax

surcharge on your New York State return? ...................................

Yes

No

(attach explanation)

If Yes , you must attach Form IT-360.1

(see instructions)

B

Did you or your spouse maintain an apartment or other living quarters

in the city of Yonkers during any part of the year? ......................................

Yes

No

If Yes, give address below and enter the number of days spent in the city of Yonkers during 1999:

________ days

Address

__________________________________________________________________________________________________

C

If you are reporting income from self-employment on line 2 below, complete the following:

Business name _______________________________________ Business address ______________________________________

Employer identification number ____________________________ Principal business activity ________________________________

Form of business:

Partnership

Other (explain) : ______________________________________

Sole proprietorship

Calculation of nonresident earnings tax

1

Gross wages and other employee compensation

1

(see instructions; if allocation is claimed, include amount from line 21 of Schedule A on the back page) ........................

2

Net earnings from self-employment

(see instructions; if allocation is claimed, include amount from line 31 of

2

Schedule C on the back page; if a loss, write Loss on line 2) ............................................................................................

3

Add lines 1 and 2 .............................................................................................................................................

3

4

Allowable exclusion

4

(see instructions; use Exclusion table below) ....................................................................................

5

Taxable amount

5

(subtract line 4 from line 3; if line 4 is more than line 3, enter “0”) ...........................................................

6

Total nonresident earnings tax

(Multiply line 5 by .5% (.005). Enter here and transfer the line 6 amount

6.

to your New York State return as follows: Form IT-200, line 27; Form IT-201, line 52; Form IT-203, line 51.) ....

Exclusion table

Checklist - before filing your return, be sure to:

(for line 4)

If line 3 (total wages and net earnings)* is:

Number of

Complete items A and B and lines 1

months of

over $0

over $10,000

over $20,000

Yonkers

through 6.

but not over $10,000 but not over $20,000

but not over $30,000

nonresidence or

short tax year

Exclusion amount is:

Exclusion amount is:

Exclusion amount is:

Complete item C above and Schedules A, B, and C

12

$3,000

$2,000

$1,000

on the back, if required.

11

2,750

1,833

917

Enter your total nonresident earnings tax

10

2,500

1,667

833

on Form IT-200, IT-201, or IT-203.

9

2,250

1,500

750

8

2,000

1,333

667

Attach this form to your New York State

7

1,750

1,167

583

return: Form IT-200, IT-201, or IT-203.

6

1,500

1,000

500

5

1,250

833

417

4

1,000

667

333

3

750

500

250

2

500

333

167

1

250

167

83

* If the total of wages and net earnings (amount from line 3) exceeds

$30,000 for the year, there is no exclusion amount.

271994

This is a scannable form; please file this original return with the Tax Department.

Y-203 1999

1

1 2

2